|

||

| 15th April 2025 | view in browser | ||

| Safe-haven currencies gain in uncertain trade landscape | ||

|

Financial markets continue to navigate a complex landscape shaped by evolving US trade policies and global economic dynamics. US Dollar weakness is at the center of everything as investors reconsider the Buck’s safe-haven status in a world of trade wars. |

||

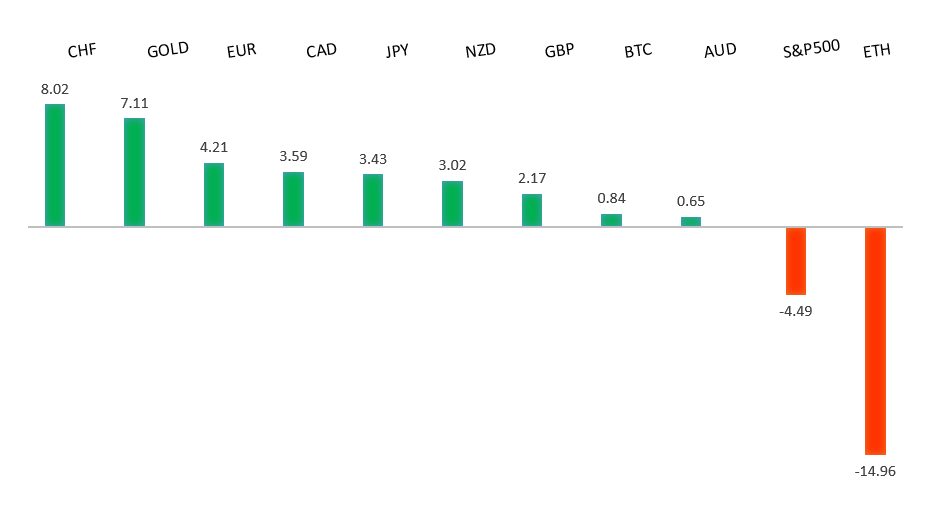

| Performance chart 30day v. USD (%) | ||

|

||

| Technical & fundamental highlights | ||

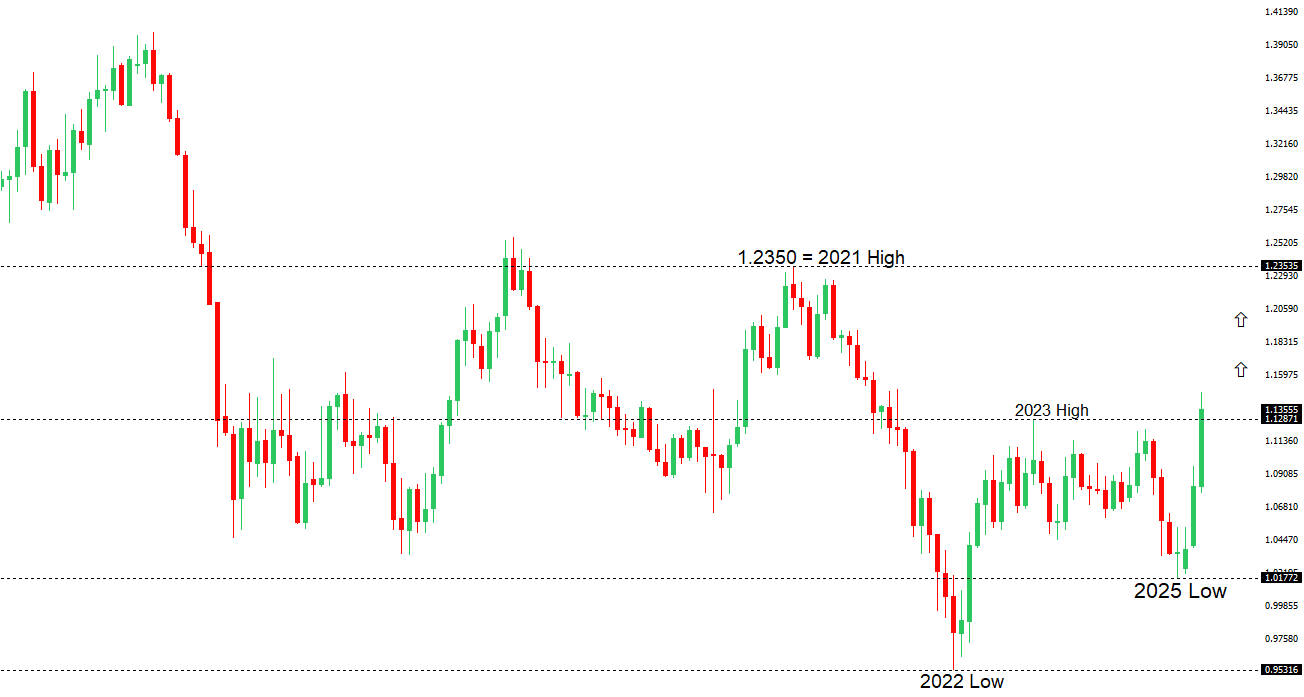

| EURUSD: technical overview | ||

|

The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. |

||

|

||

|

R2 1.1496

- 2022 high - Strong

R1 1.1474 - 11 April/2025 high - Strong S1 1.1181 - 11 April low - Medium S2 1.1000 - Psychological - Strong |

||

| EURUSD: fundamental overview | ||

|

German 10-year yields have softened since their March peak of 2.93%, despite expectations of increased fiscal spending, as investors shift from US assets to safe-haven options like the Euro and German bunds, amid a weakening US Dollar treated like an emerging market currency. The ECB is expected to cut rates by 25bps on April 17 due to US tariffs impacting Eurozone demand, with markets pricing in 79 basis points of cuts for 2025, while the EU seeks to diversify trade partnerships to counter long-term US policy shifts. Euro Area growth is forecasted at 0.8% for 2025, with a 40% recession risk, and upcoming data like the April ZEW Survey and February Industrial Production may signal further economic challenges. Key standouts on today’s calendar come from German wholesale prices, UK employment, Eurozone industrial production, German and Eurozone ZEW reads, Canada inflation, US import and export prices, Empire manufacturing, and Fed speak.

|

||

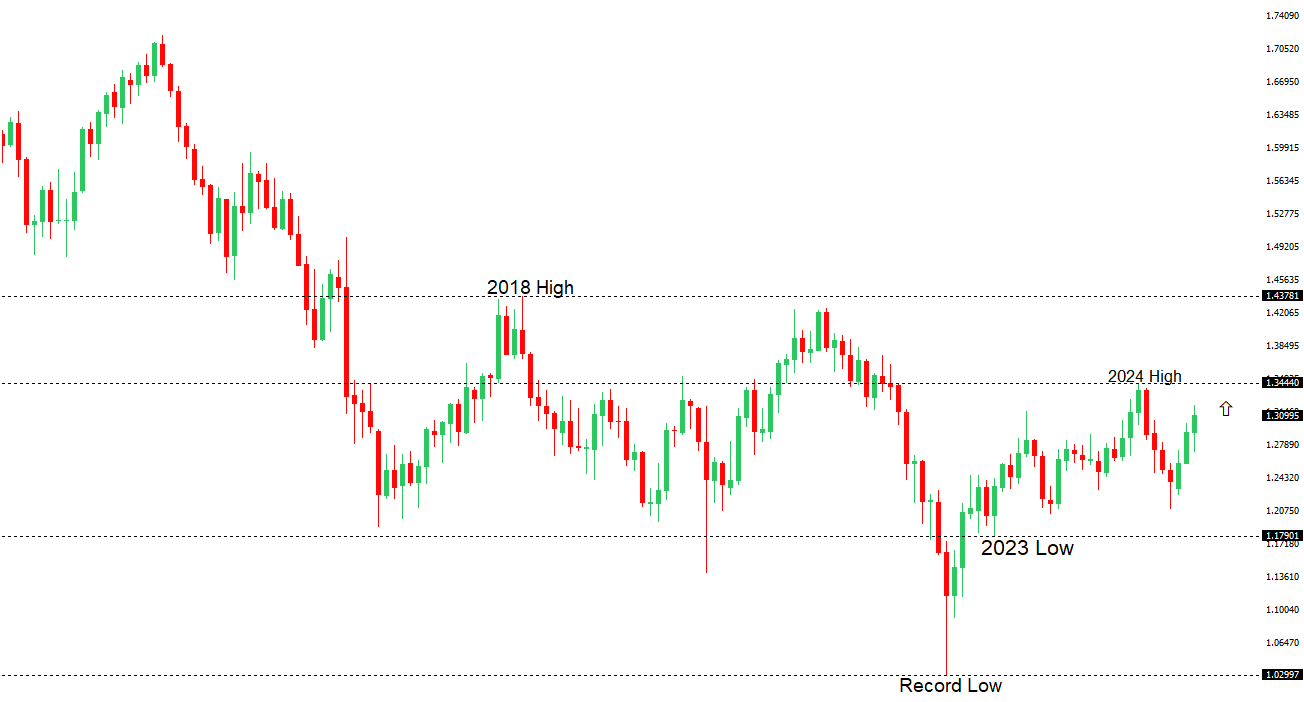

| GBPUSD: technical overview | ||

|

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The door is now open for the next major upside extension towards the 2018 high at 1.4377. Setbacks should be well supported above 1.2000 on a monthly close basis. |

||

|

||

|

R2 1.3266

- 27 August high - Strong

R1 1.3218 - 15 April high - Medium S1 1.3063 - 14 April low - Medium S2 1.2965 - 11 April low - Medium |

||

| GBPUSD: fundamental overview | ||

|

The Pound has been bolstered against the US Dollar in the past 24 hours, trading to a fresh yearly high, primarily on the back of uncertainties surrounding US trade policies, particularly President Trump’s temporary exemption of tariffs on certain Chinese goods. Robust UK economic indicators have also supported the Pound’s rise, as investors view it as a hedge amid US market volatility. Additionally, the Bank of England’s monetary policy stance continues to influence the UK currency, with market expectations leaning toward potential rate stability or hikes in late 2025. Key standouts on today’s calendar come from German wholesale prices, UK employment, Eurozone industrial production, German and Eurozone ZEW reads, Canada inflation, US import and export prices, Empire manufacturing, and Fed speak.

|

||

| USDJPY: technical overview | ||

|

There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback towards the 140 area over the coming sessions. |

||

|

||

|

R2 146.54

- 11 March low - Strong

R1 144.58 - 11 April high - Medium S1 142.06 - 11 April/2025 low - Medium S2 141.64 - 30 September low - Medium |

||

| USDJPY: fundamental overview | ||

|

Then Yen continues to be a beneficiary of US-China trade tensions. Japan’s Prime Minister Ishiba highlighted the disruptive potential of US tariffs, signaling readiness for economic measures like a possible supplementary budget, while upcoming US-Japan trade talks on April 17 could pressure the Bank of Japan to raise rates if linked to Yen weakness and trade imbalances. Speculative JPY long positions have spiked, and a favorable deal for Japan could spark a risk asset rally, while narrowing US-Japan yield differentials may further strengthen the Yen if the Federal Reserve cuts rates. Key standouts on today’s calendar come from German wholesale prices, UK employment, Eurozone industrial production, German and Eurozone ZEW reads, Canada inflation, US import and export prices, Empire manufacturing, and Fed speak.

|

||

| AUDUSD: technical overview | ||

|

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. |

||

|

||

|

R2 0.6409

- 21 February/2025 high - Strong

R1 0.6389 - 3 April high - Medium S1 0.6181 - 11 April low - Medium S1 0.6115 - 10 April low - Medium |

||

| AUDUSD: fundamental overview | ||

|

The Australian Dollar has been propped up by China’s stable yuan fixing, as it helps to build on expectations for a moderate weakening rather than a sharp devaluation. Despite market anticipation of an RBA rate cut in May, driven by economic growth concerns outweighing inflation risks, some strategists see the Australian Dollar bottoming out, supported by China’s expected economic shielding measures and a broader shift away from US Dollar assets. Key standouts on today’s calendar come from German wholesale prices, UK employment, Eurozone industrial production, German and Eurozone ZEW reads, Canada inflation, US import and export prices, Empire manufacturing, and Fed speak.

|

||

| Suggested reading | ||

|

No Such Thing As ‘Adjusting’ The Gold Price To ‘Inflation’, J. Tamny, Forbes (April 13, 2025) On Treasurys’ Post-Tariff Ride, Fisher Investments (April 11, 2025) |

||