| ||

| 4th June 2025 | view in browser | ||

| Fed urges patience as trade war clouds economic outlook | ||

| Recent Federal Reserve commentary emphasizes patience in monetary policy amid uncertainties from an escalating trade war, which is dampening the global economic outlook. | ||

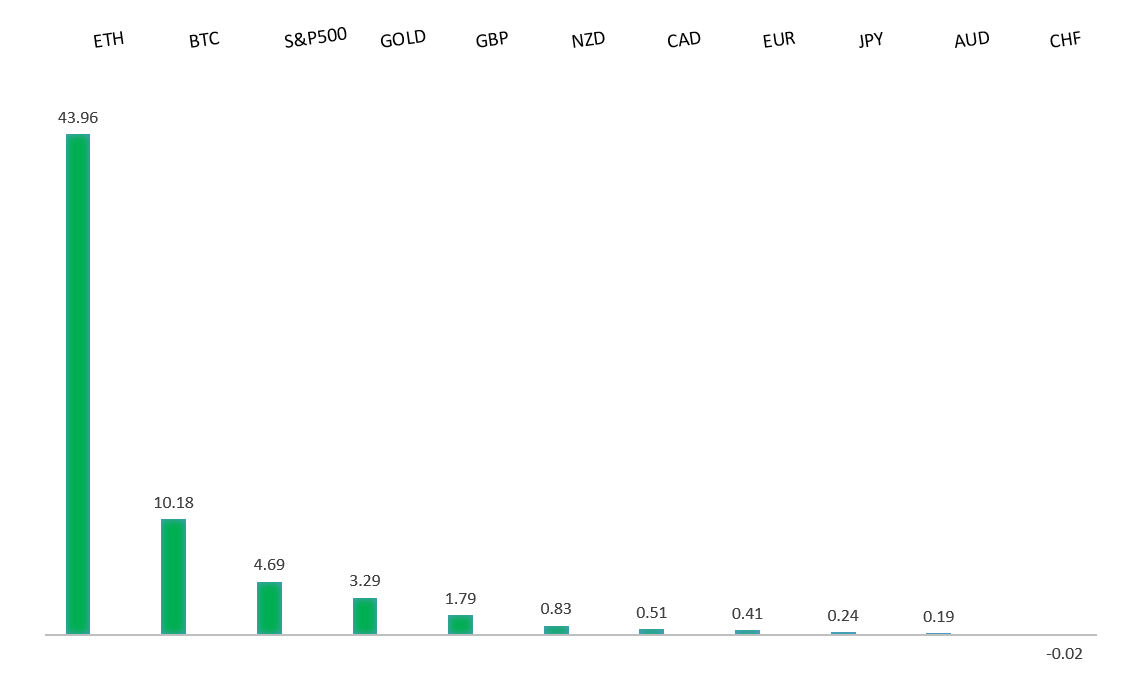

| Performance chart 30day v. USD (%) | ||

| ||

| Technical & fundamental highlights | ||

| EURUSD: technical overview | ||

| The Euro has finally broken out from a multi-month consolidation off a critical longer-term low. This latest push through the 2023 high lends further support to the case for a meaningful bottom, setting the stage for a bullish structural shift and the next major upside extension targeting the 2021 high at 1.2350. Setbacks should be exceptionally well supported below 1.1000. | ||

| ||

| R2 1.1474 - 11 April high - Medium R1 1.1455 - 3 June high - Medium S1 1.1210 - 29 May low - Medium S2 1.1065 - 12 May low - Strong | ||

| EURUSD: fundamental overview | ||

| Eurozone inflation fell to 1.9% in May, below the expected 2.0% and down from 2.2% in April, driven by a significant drop in services inflation from 4% to 3.2%. Core inflation also eased to 2.3%, supporting expectations of an ECB deposit rate cut to 2% at its next meeting, with another potential cut later this year. Despite these cuts, the euro’s strength against the dollar is likely to persist due to factors like de-dollarization and U.S. fiscal concerns. | ||

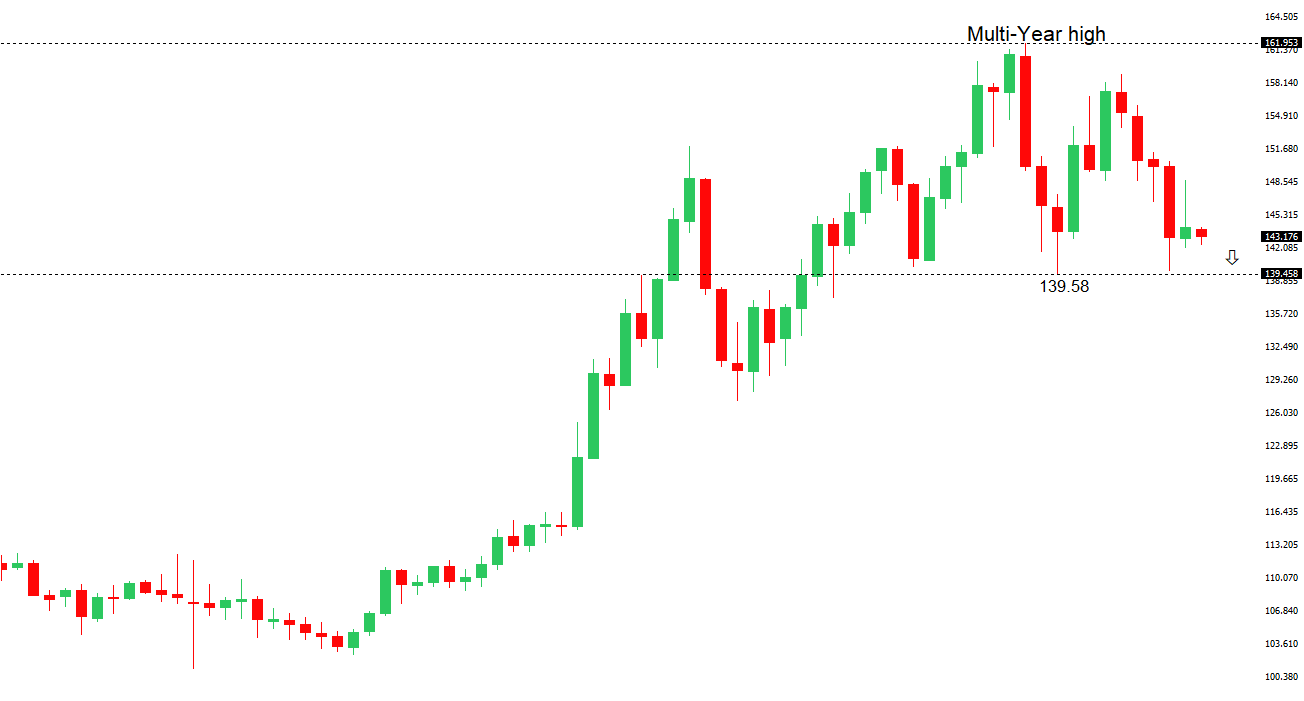

| USDJPY: technical overview | ||

| There are signs of a meaningful top in place after the market put in a multi-year high in 2024. At this point, the door is now open for a deeper setback below the 2024 low at 139.58 over the coming sessions exposing a retest of the 2023 low. Rallies should be well capped below 150.00. | ||

| ||

| R2 148.65 - 12 May high - Medium R1 146.29 - 29 May high - Medium S1 142.11 - 27 May low - Medium S2 141.97 - 29 April low - Medium | ||

| USDJPY: fundamental overview | ||

| Japan’s Chief Cabinet Secretary Yoshimasa Hayashi noted that no reminder letter was received from the U.S. Trade Representative, suggesting possible U.S. satisfaction with Japan’s stance, as Japan holds firm for a comprehensive tariff deal ahead of elections. The Bank of Japan has increased provisions for bond transaction losses to 100%, signaling expectations of higher interest rates and a shift from ultra-loose monetary policy, which could strengthen the yen. However, BOJ Governor Ueda and former board member Sakurai indicated that rising JGB yields and trade uncertainties, particularly from U.S. tariffs, may delay rate hikes until late 2025, with the BOJ likely to pause bond purchase reductions if yields surge. Recent data shows Japan’s PMI Composite and Services indices revised upward to 50.2 and 51.0, respectively, for May. | ||

| AUDUSD: technical overview | ||

| There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.5500 would give reason for rethink. A monthly close back above 0.7000 will take the big picture pressure off the downside and strengthen case for a bottom. | ||

| ||

| R2 0.6550 - 25 November 2024 high - Strong R1 0.6538 - 26 May/2025 high - Medium S1 0.6344 - 24 April low - Medium S1 0.6275 - 14 April low - Strong | ||

| AUDUSD: fundamental overview | ||

| The Australian dollar is attempting to hold gains above its 200-day moving average amid broad U.S. dollar weakness, but caution prevails due to China’s Caixin Manufacturing PMI slipping into contraction and dovish RBA minutes suggesting a potential 50bps rate cut as a safeguard against global trade risks. Australia’s Q1 GDP grew by just 0.2% quarter-on-quarter, below the expected 0.4%, signaling vulnerability to global trade tensions and geopolitical risks. The OECD warns of a potential global economic stall due to U.S. tariff hikes, increasing speculation that the RBA may cut rates at its July meeting. | ||

| Suggested reading | ||

| Petrobras: fuelling the future or stuck in the past?, G. Bobillot, Financial Times (June 4, 2025) The Only Way To Get Paid Trading, C. Reilly, RiskHedge (June 2, 2025) | ||