|

| 2 July 2025 Demand sticks into crypto dips |

| LMAX Digital performance |

|

LMAX Digital volumes cooled off on Tuesday. Total notional volume for Tuesday came in at $378 million, 12% below 30-day average volume. Bitcoin volume printed $201 million, on par with 30-day average volume. Ether volume came in at $73 million, 31% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,906 and average position size for ether at $2,834. Bitcoin volatility is tracking at its lowest levels of the year, while ETH volatility has been contained since bottoming in May. We’re looking at average daily ranges in bitcoin and ether of $2,615 and $125 respectively. |

| Latest industry news |

|

Bitcoin hasn’t really gone anywhere of late, continuing to consolidate below the May record high. We did see a modest, brief pullback this week, driven by a short wave of broader risk-off sentiment. But in the end, the bitcoin dip was well supported, helped along by an ongoing insatiable appetite for ETFs. ETH is also doing a good job finding demand into dips. Ethereum ETFs have turned positive for a second consecutive week, staking activity has risen, and exchange balances continue to fall—underscoring accumulation trends. Corporate treasury programs have also been a supportive theme in recent months, with firms like Strategy and Metaplanet continuing to add to their holdings, and more firms jumping on board to adopt similar strategies. This includes some corporate strategies built around ETH accumulation. Macro and political developments continue to provide critical context for market direction. The Federal Reserve’s decision to hold rates steady, combined with falling Treasury yields, has supported risk appetite. Meanwhile, a weaker U.S. dollar—down roughly 10% year to date—has added to the tailwinds for crypto assets. Investor sentiment has also been buoyed by expectations of U.S. policy changes, including potential leadership turnover at the Fed and upcoming Senate action on the GENIUS Act for stablecoin regulation. Looking ahead, we maintain a constructive outlook. Historical seasonality supports this view—Bitcoin has gained an average of 11.2% in July since 2016, making it one of its strongest calendar months. |

| LMAX Digital metrics | ||||

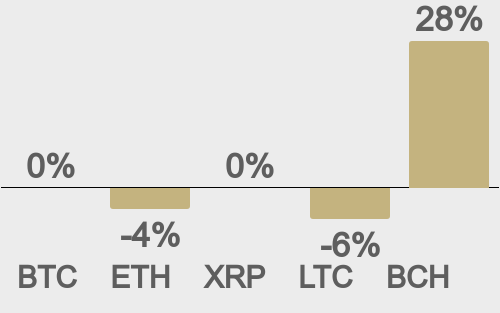

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

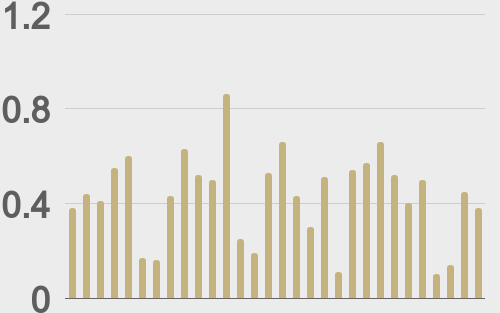

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

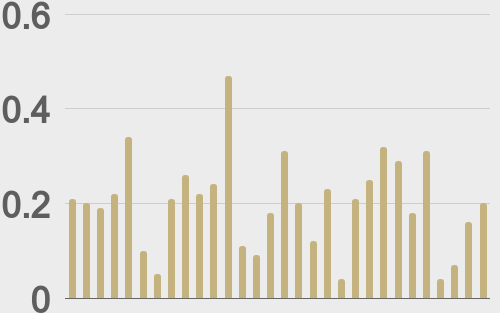

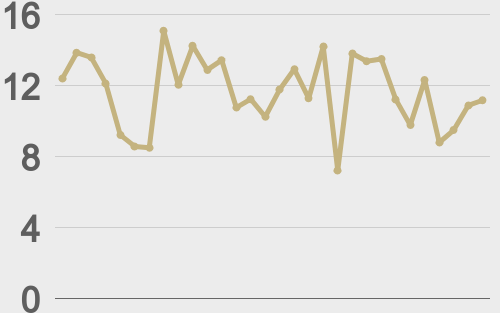

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

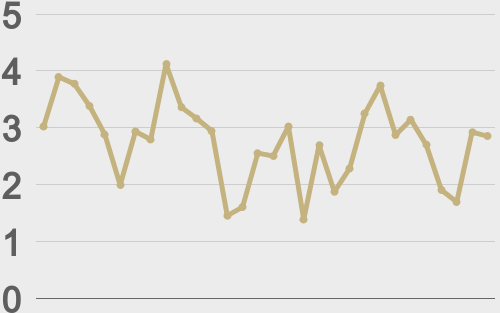

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||