|

| 20 August 2025 Institutions keep buying the dips |

| LMAX Digital performance |

|

LMAX Digital volumes were solid again on Tuesday. Total notional volume for Tuesday came in at $779 million, 30% above 30-day average volume. Bitcoin volume printed $325 million, 30% above 30-day average volume. Ether volume came in at $303 million, 48% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,575 and average position size for ether at $3,515. Bitcoin volatility continues to track just off yearly low levels. ETH volatility has been trending up since bottoming in May, at its highest levels since February. We’re looking at average daily ranges in bitcoin and ether of $2,833 and $221 respectively. |

| Latest industry news |

|

There is no denying Bitcoin has softened in the aftermath of some hotter US inflation data souring the rate cut outlook, and ahead of Fed Chair Powell’s Jackson Hole speech. The pullback also reflects profit-taking following last week’s push to a fresh record high. Ethereum has followed a similar corrective path. Despite this, the institutional thesis remains broadly intact—robust ETF inflows and growing treasury interest continue to underpin confidence in its sustained utility and adoption momentum. As a testament to this fact, the ETHBTC ratio sits just off a recent yearly high. Markets are fixated on the Fed narrative unfolding at Jackson Hole, with policy signals poised to steer cross-asset flows. Adding to the evolving backdrop, Fed Governor Michelle Bowman urged banks and regulators to embrace new technologies—specifically blockchain and digital assets—or risk irrelevance. Her direct call for a cultural shift toward innovation adds a policy nuance to the upside case for crypto. Overall, while short-term pricing is adjusting to macro drivers, the structural outlook for crypto remains balanced, anchored by policy developments and institutional engagement, yet sensitive to macroeconomic data and central bank direction. |

| LMAX Digital metrics | ||||

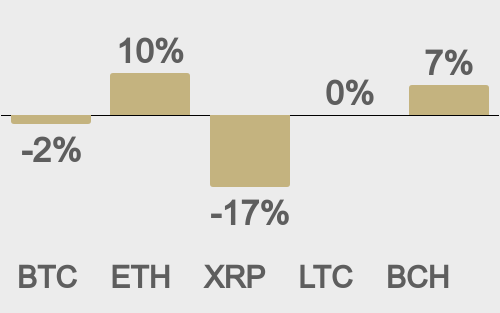

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

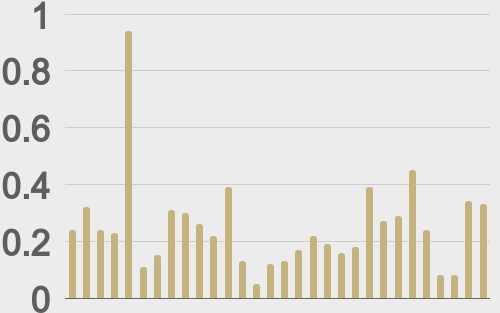

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||