|

| 25 September 2025 September profit taking ahead of seasonal tailwinds |

| LMAX Digital performance |

|

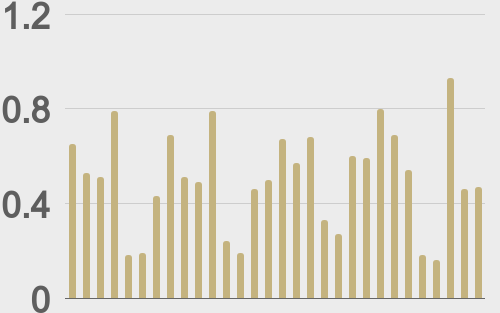

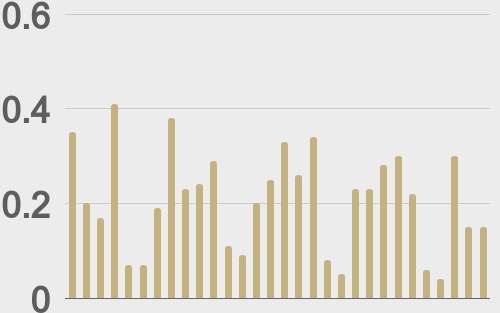

LMAX Digital volumes came in on the softer side on Wednesday. Total notional volume for the day came in at $474 million, 6% below 30-day average volume. Bitcoin volume printed $145 million, 30% below 30-day average volume. Ether volume came in at $145 million, 19% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,118 and average position size for ether at $3,731. Bitcoin volatility is attempting to turn up off the lowest levels of the year. ETH volatility is also looking to turn up after a period of cool down off multi-month highs. We’re looking at average daily ranges in bitcoin and ether of $2,284 and $175 respectively. |

| Latest industry news |

|

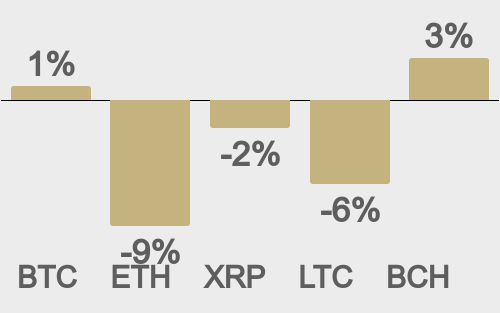

Over the past 24 hours, bitcoin has drifted modestly lower and ETH has come under slightly greater pressure, as markets wrestle with renewed dollar strength and a broad shift into defensive assets. The tilt toward risk-off sentiment has been driven in part by Fed Chair Powell’s remarks—he emphasized that policy remains “modestly restrictive,” flagged upside inflation risks, and warned there is “no risk-free path” forward. That language has undercut hopes for an aggressive pivot to easing, reinforcing demand for the dollar and exerting downward pressure on crypto. Compounding the macro headwinds, there is also natural profit taking place. After a relatively strong run in September, some participants are locking in gains in what is historically a softer month for crypto returns. That cautious trimming is especially visible in larger assets like bitcoin and ETH, where long-position holders are more sensitive to shifts in sentiment. These moves exacerbate, rather than initiate, downward pressure when risk appetite wanes. Within the altcoin space, a handful of small- and mid-cap names are still showing bursts of volatility and relative strength, as traders hunt for high beta plays. But the broader pattern is consistent with consolidation: gains earlier in the month being defended, and downside capped by buyer interest near key technical levels. Meanwhile, traditional markets have felt similar tension as equity indices struggle under interest rate uncertainty and Treasury yields remain volatile. Looking ahead, any further weakness in crypto is likely to be met with sharper reflex bounce, in our view. Historical seasonality and structural rotation into the fourth quarter tend to favor crypto outperformance at year end. As long as the dollar’s upside is constrained and the Fed does not aggressively lean hawkish, oversold conditions in bitcoin and ETH may quickly become attractive entry points for momentum and longer-term flow. |

| LMAX Digital metrics | ||||

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

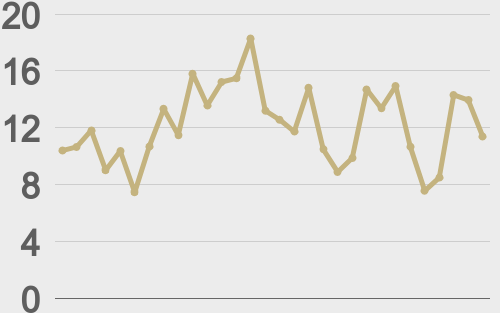

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

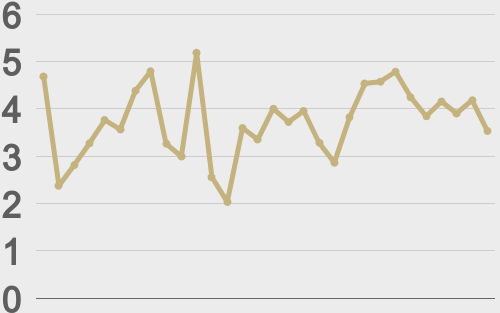

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||