|

| 23 October 2025 Macro headwinds slow momentum, not conviction |

| LMAX Digital performance |

|

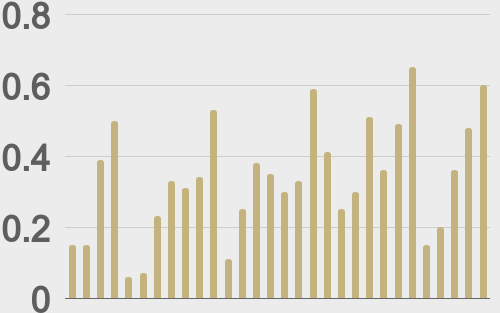

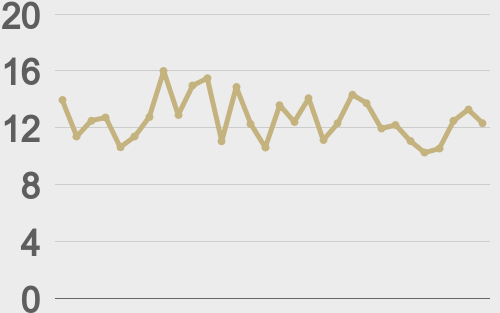

LMAX Digital volumes continue to trend higher this week. Total notional volume for Wednesday came in at $905 million, 28% above 30-day average volume. Bitcoin volume printed $595 million, 76% above 30-day average volume. Ether volume came in at $171 million, 15% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,674 and average position size for ether at $3,223. Bitcoin and ETH volatility is consolidating in the aftermath of the latest surge. We’re looking at average daily ranges in bitcoin and ether of $3,830 and $231 respectively. |

| Latest industry news |

|

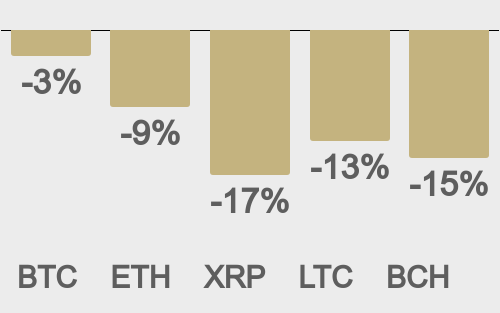

Most of the immediate pressure on crypto has been driven by a rebound in U.S. Treasury yields and a firmer dollar, which tend to weigh on assets that are sensitive to funding and discount-rate regimes. Compounding the weakness are mixed signals from the Federal Reserve, where recent commentary suggests a more cautious approach to stimulus than markets had hoped for. The timing of this recalibration has created a temporary lull in momentum across digital assets. Yet despite the recent slowdown, on-chain metrics still show accumulation among long-term holders, which provides a counter-balance to the more nervous active trading base. ETH is underperforming bitcoin modestly as rotational pressures favour the perceived safety of bitcoin during pauses in broader crypto activity. However, underlying network activity and adoption metrics remain stable, underscoring the structural resilience that continues to support the market beneath the surface. Globally, trade dynamics and geopolitics are also contributing to the cautious tone. Trade tensions between the U.S. and China have flared slightly, nudging some capital toward safe havens. Yet beyond the near-term volatility, the medium-term script remains intact: policy support still looms, bank-system stress has eased, and digital assets continue to trade within a larger constructive framework. In our view, the recent softness looks more like a period of consolidation within what has already been a highly constructive year for digital assets. We continue to take confidence from seasonal trends, which historically point to renewed strength and rising demand as the market moves through the final months of the year. |

| LMAX Digital metrics | ||||

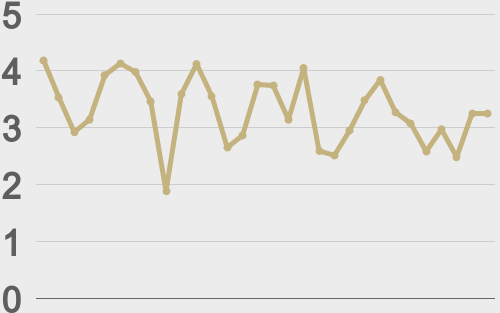

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||