|

| 12 January 2026 Critical levels in view as week gets going |

| LMAX Digital performance |

|

Total notional volume from last Monday to Friday came in at $1.8 billion, up 70% from the prior week, as market conditions returned to normal. Breaking it down per coin, bitcoin volume came in at $998 million, 53% higher than the previous week. Ether volume came in at $431 million, 119% higher than the week earlier. Total notional volume over the past 30 days comes in at $6.7 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,465 and average position size for ether at $1,565. Bitcoin and ETH volatility have come off substantially over the past several weeks. We’re looking at average daily ranges in bitcoin and ether of $2,300 and $106 respectively. |

| Latest industry news |

|

We’re seeing a fresh wave of demand as the new week gets going, which keeps alive the prospect of a breakout that we’ve flagged in recent updates. Price action since the November lows has largely been defined by consolidation, but bitcoin’s $95k level remains the key technical marker for confirming an end to this range and a resumption of the broader uptrend toward a retest of the record high. For ETH, the equivalent trigger sits at $3,500, with a clear break above required to re-ignite bullish momentum. While both assets remain some distance from these levels, the tone at the start of the week is constructive and points to a potential test in the sessions ahead. Within crypto, flows have improved modestly, with renewed interest in spot ETFs and a pickup in perpetual futures positioning suggesting traders are cautiously leaning back into risk. On-chain activity remains steady, with long-term holders largely sitting tight and exchange balances continuing to grind lower, reinforcing the view that structural supply remains constrained. ETH has also seen improved sentiment on the back of steady staking inflows and growing anticipation around the next wave of network upgrades. From a broader macro perspective, traditional markets are providing a supportive backdrop. The US dollar has softened following political pressure on the Federal Reserve, while gold has surged to fresh record highs, reinforcing demand for alternative stores of value. Risk assets are being buoyed by a resilient US economy and strong earnings momentum, while expectations of eventual rate cuts later in the year continue to underpin appetite. Geopolitics is also playing into the narrative, with renewed instability in the Middle East driving oil prices higher and keeping investors focused on hedges against macro and political uncertainty. At the same time, China’s growing influence in global trade and technology is reinforcing longer-term diversification trends that continue to benefit digital assets as part of a broader alternative allocation mix. Looking ahead, volatility risks remain elevated. Key US inflation data, a heavy slate of earnings from major banks, and further commentary from Fed officials will shape near-term risk sentiment, while any escalation in geopolitical tensions could quickly spill over into crypto via moves in the dollar and real yields. Against this backdrop, bitcoin’s $95k level and ETH’s $3,500 marker remain the critical signposts for whether this consolidation phase is finally ready to give way to the next leg higher. |

| LMAX Digital metrics | ||||

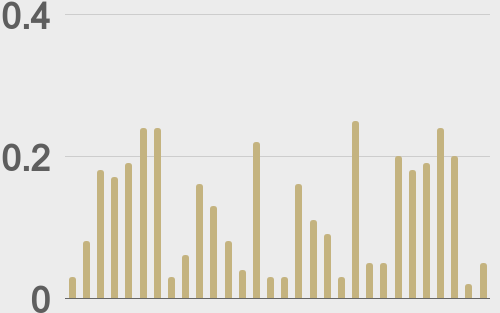

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

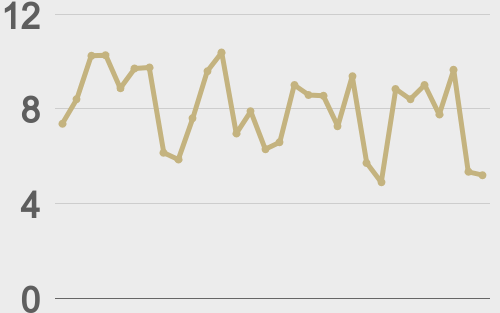

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

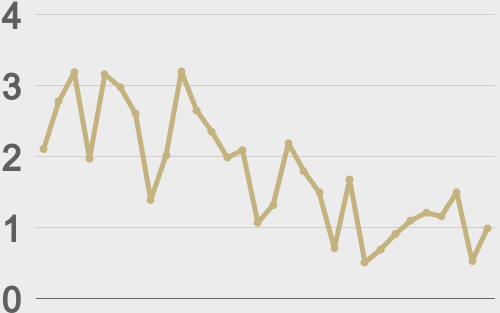

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||