Next 24 hours: Yield differentials keep slanting towards the Dollar

Today’s report: Back to higher for longer

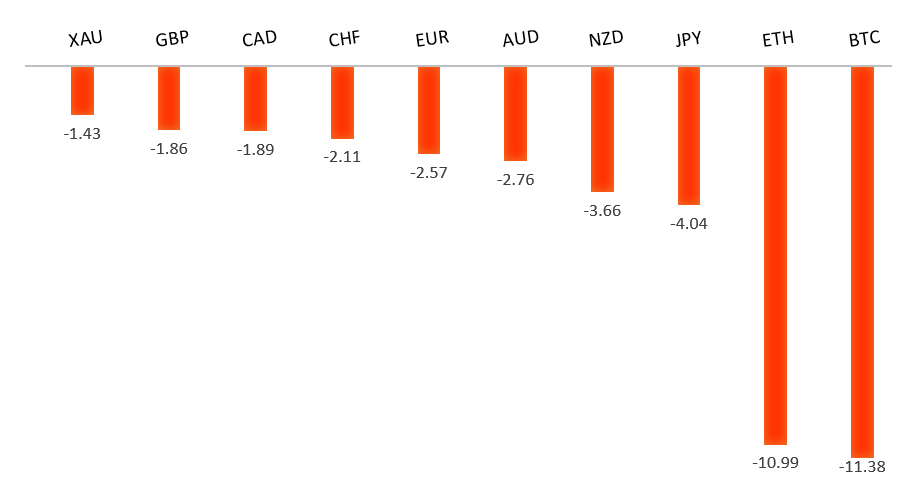

US rates rose for a third consecutive day, while US economic data continued to outperform other regions. All of this resulted in more broad demand for the US Dollar and more risk off flow in equities.

Wake-up call

- bank stocks

- BOE officials

- BOJ Takata

- Aussie GDP

- rate hold

- PM Hipkins

- Messy combination

- Dealers report

Peformance chart: 30 Day Performance vs. US dollar (%)

Suggested reading

- This Is the China New Normal. Get Used to It, J. Authers, Bloomberg (September 6, 2023)

- Why UK Labour Rejects a Wealth Tax, R. Shrimsley, FT (September 5, 2023)

Chart talk: Technical & fundamental highlights

Choose pair:

EURUSD – technical overview

The Euro remains well supported on dips following a run to the topside through 1.1000. Any additional setbacks should be well supported ahead of 1.0500 in favor of a bullish continuation. Ultimately, only a monthly close back below 1.0500 would give reason for concern. Next key resistance comes in the form of the 2023 high at 1.1276.EURUSD – fundamental overview

Another discouraging round of economic data kept the Euro weighed down on Wednesday. Meanwhile, European bank stocks fell for the fifth session. Key standouts on Thursday’s calendar come from German industrial production, Eurozone GDO, Eurozone employment, Canada building permits, US initial jobless claims, Canada Ivey PMIs, and some Fed speak.EURUSD - Technical charts in detail

GBPUSD – technical overview

Signs have emerged of the market wanting to put in a longer-term base after collapsing to a record low in September 2022. The November 2022 monthly close back above 1.2000 strengthens this prospect. Any setbacks should now be well supported ahead of 1.2500. Next key resistance comes in at 1.3143.GBPUSD – fundamental overview

The Pound was an underperformer on Wednesday after BOE officials predicted an inflation decline. BOE Bailey said the fall in inflation was to be marked, while BOE Dhingra said current policy was sufficiently restrictive. On the data side, UK construction PMIs edged lower. Key standouts on Thursday’s calendar come from German industrial production, Eurozone GDO, Eurozone employment, Canada building permits, US initial jobless claims, Canada Ivey PMIs, and some Fed speak.USDJPY – technical overview

At this stage, it looks like the market is wanting to resume the bigger picture uptrend and head back towards a retest of that multi-year high from October 2022 up at 151.95. Look for any weakness to continue to be well supported on dips.USDJPY – fundamental overview

More Yen weakness after BOJ Takata said it was too early to exit negative interest rate policy. At the same time, Yen setbacks were perhaps mitigated on warnings from Japan FX Chief Kanda, who said there would be no hesitation to stamp out speculative activity against the Yen. Key standouts on Thursday’s calendar come from German industrial production, Eurozone GDO, Eurozone employment, Canada building permits, US initial jobless claims, Canada Ivey PMIs, and some Fed speak.AUDUSD – technical overview

There are signs of the potential formation of a longer-term base with the market trading down into a meaningful longer-term support zone. Only a monthly close below 0.6400 would give reason for rethink. Back above 0.6523 will take the immediate pressure off the downside and strengthen case for a bottom.AUDUSD – fundamental overview

The Australian Dollar held up on Wednesday, mostly on the back of a steady Australia GDP read. However, risk off flow was front and center, which kept the Australian Dollar from making any meaningful moves to the topside. Key standouts on Thursday’s calendar come from Aussie trade, Aussie building permits, German industrial production, Eurozone GDO, Eurozone employment, Canada building permits, US initial jobless claims, Canada Ivey PMIs, and some Fed speak.USDCAD – technical overview

Above 1.3000 signals an end to a period of longer-term bearish consolidation and suggests the market is in the process of carving out a more significant longer-term base. Next key resistance now comes in up into the 1.4000 area. Setbacks should be very well supported down into the 1.3000 area.USDCAD – fundamental overview

The Bank of Canada left rates on hold as widely expected, but did remain concerned about sticky inflation. As such, the central bank was unwilling to rule out the possibility for additional rate hikes. On the data front, the Canada trade gap narrowed, while Canada labor productivity declined. Key standouts on Thursday’s calendar come from German industrial production, Eurozone GDO, Eurozone employment, Canada building permits, US initial jobless claims, Canada Ivey PMIs, and some Fed speak.NZDUSD – technical overview

Overall pressure remains on the downside with the market once again stalling out on a run up into the 0.6500 area. Ultimately, a break back above 0.6015 would be required to take the immediate pressure off the downside. A monthly close below 0.6000 would intensify bearish price action.NZDUSD – fundamental overview

The New Zealand Dollar was unimpressed with PM Hipkins pep talk on the economy, instead remaining weighed down on broader risk off flow in global markets. Key standouts on Thursday’s calendar come from German industrial production, Eurozone GDO, Eurozone employment, Canada building permits, US initial jobless claims, Canada Ivey PMIs, and some Fed speak.US SPX 500 – technical overview

Longer-term technical studies are in the process of unwinding from extended readings off record highs. Look for rallies to be well capped in favor of lower tops and lower lows. A monthly close back above 4600 will be required to take the immediate pressure off the downside. Next key support comes in at 4328.US SPX 500 – fundamental overview

We've finally reached a point in the cycle where the Fed recognizes unanchored inflation expectations pose a greater downside risk than over-tightening. This is significant, as it means less investor friendly monetary policy, even in the face of a less certain growth outlook. Overall, we expect inflation to continue to be a problem in 2023 that results in downside pressure into rallies despite market expectations that would argue otherwise.GOLD (SPOT) – technical overview

The 2019 breakout above the 2016 high at 1375 was a significant development, opening the door for fresh record highs. Setbacks should now be well supported above 1600 on a monthly close basis ahead of the next major upside extension. Next major resistance comes in at 2100, above which opens the next extension towards 2500.GOLD (SPOT) – fundamental overview

The yellow metal continues to be well supported on dips with solid demand from medium and longer-term accounts. These players are more concerned about inflation risk and a less upbeat global growth outlook. All of this should keep the commodity well supported, with many market participants also fleeing to the hard asset as the grand dichotomy of record high equities and record low yields comes to an unnerving climax.