This year at LMAX Exchange we asked our world leading Liquidity Providers to create an even tighter top of the book stream for our brokerage clients.

Averaging 0.14 this month our spreads are the tightest they’ve ever been and arguably the most competitive on the street.

BUT – we also agree with those that say – Tight Spreads – so what?

Spread is just one of the metrics you need to assess when choosing your liquidity as a client and particularly a brokerage client:

You also need to know:

Fill rates – using market orders as most brokers do, you’ll achieve a perfect 100% fill rate on LMAX Exchange – something you won’t see with ‘Last Look’ liquidity

- Zero cost of hold time – opportunity cost

- Zero cost of rejection – estimated at an average of $25/m if you are held for 100ms with last look

- Up to $300/m of price improvement but averaging $10/m in 2016

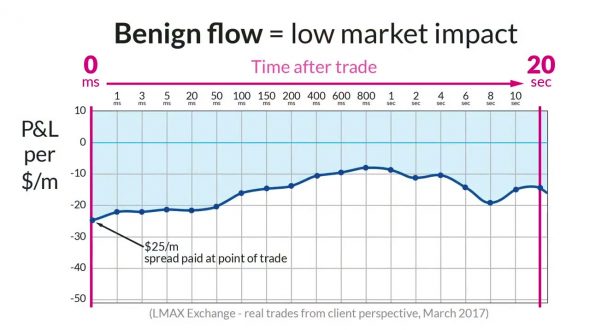

- Finally you should look at your market impact post trade but frankly when your flow looks like THIS

The typical broker flow, there is very little market impact and you should expect only the tightest spreads

So… in summary – Spread is important – that’s why we’ve brought you better prices this year, BUT you need to be able to measure your Total Cost of Trading.

We are confident your total cost of trading will be lower on firm, LMAX Exchange limit order liquidity.

And with the upcoming Global Code of Conduct about to launch with an underlying message of greater transparency, you NEED to have firm liquidity in your armoury, to show your customers that you provide them with access to only the best and fairest liquidity in the marketplace.

If you are still not convinced please feel free to ask us directly email [email protected]