|

|

29 September 2021 30 day volume crosses $40 billion |

| LMAX Digital performance |

|

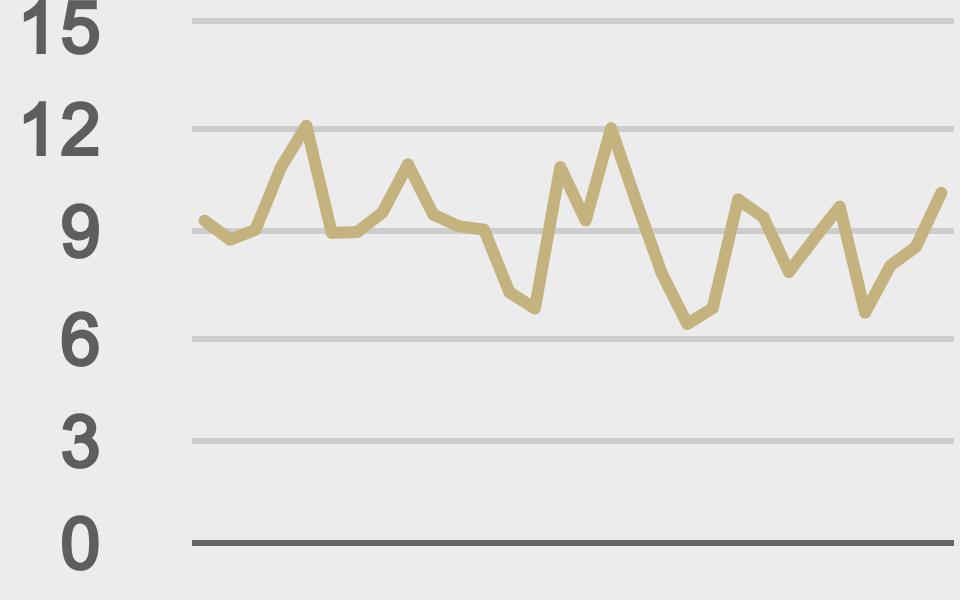

The healthy run of volume continues at LMAX Digital, with volume over the past 30 days exceeding $40 billion. Total notional volume has also been north of $1 billion over the past 11 weekday sessions. On Tuesday, total notional volume pushed up from Monday, coming in at $1.26 billion, and just 6% off 30-day average volume. Bitcoin and ether volumes ticked up as well on Tuesday, though bitcoin volume of $618 million was off 8% from 30-day average volume. Ether volume was more impressive on a relative basis, up on Tuesday at $460 million, up 11% from 30-day average volume. Average position sizes for bitcoin and ether over the past 30 days come in at $9,038 and $4,767 respectively. |

| Latest industry news |

|

We’re seeing some demand into Wednesday, though the bias overall this week has been bearish. Market participants have been taking their lead from the push higher in US treasury yields as prospects for tighter monetary policy in the US turn up. Still, demand into dips is to be expected from medium and longer-term players looking to take advantage of bitcoin’s store of value and hedge against inflation proposition. Looking out over the coming sessions, the price of bitcoin does remain vulnerable to further negative headlines out of China, with the latest downgrade to Evergrande not helping matters. Crypto overall also remains vulnerable to updates from the US infrastructure bill vote. Last week, our own Jenna Wright, Managing Director of LMAX Digital sat down on a call to discuss the intersection of crypto and finance. We recommend taking a listen in to see what Jenna had to say. |

| LMAX Digital metrics | ||||

|

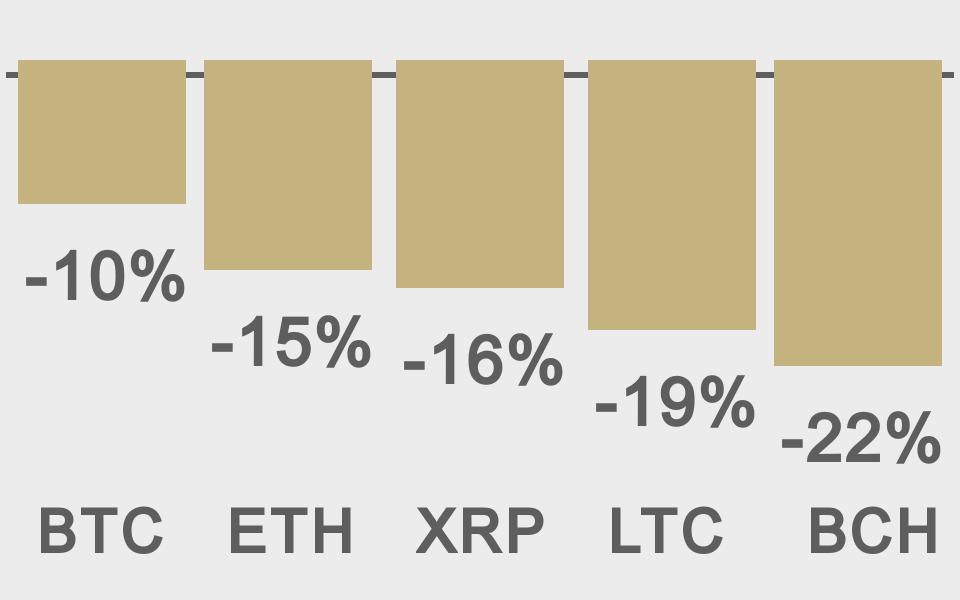

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@Bitcoin |

||||

|

@KaikoData |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||