|

|

13 February 2023 A closer look at the retreat in crypto prices |

| LMAX Digital performance |

|

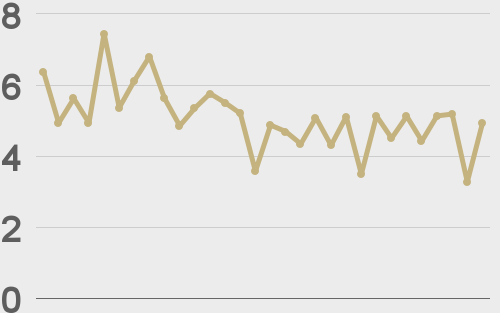

Total notional volume at LMAX Digital lightened up in the previous week. Total notional volume from last Monday through Friday came in at $1.7 billion, 11.7% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $765 million in the previous week, down 18% from a week earlier. Ether volume however turned up just a bit, coming in at $562 million, 1.4% higher than the week earlier. Total notional volume over the past 30 days comes in at $10.7 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,271 and average position size for ether at $3,041. Volatility is finally showing signs of turning up from multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $695 and $69 respectively. |

| Latest industry news |

|

It’s been a tough go for crypto assets in recent days. We’ve seen the market taking a hit on a combination of factors both macro and within the asset class itself. On a macro level, it’s become clear, investors aren’t going to get what they want. There has been a repricing of expectations in which the pivot bet has come off the table and an extended tightening cycle is now seen as more likely. This has weighed on global sentiment given the implication of higher rates and less investor friendly monetary policy, which has weighed on crypto prices by extension. And in the world of crypto, there’s also been quite a bit to be feeling uneasy about. The regulatory crackdown in the space has ramped up, and the SEC has been out giving many firms headaches. Last week, Kraken was forced to close its retail staking operation in a settlement agreement with the SEC. And already this week, headlines are making the wires that the SEC will be suing Paxos over its offering of unregistered security in the form of BUSD. Ultimately, we don’t believe any of this will have more than a short-term negative impact on the space. Historically, regulatory crackdowns haven’t done much at all to dissuade crypto investors and we believe there is too much good going on within the space for regulators to stifle innovation and take away competitive advantage. Another possible factor behind this latest crypto slide is technical. After all, we saw a rocket-ship run higher in the month of January, with bitcoin running +40% on the month. And so, it shouldn’t come as much of a surprise to see some form of a consolidation and correction kicking in. |

| LMAX Digital metrics | ||||

|

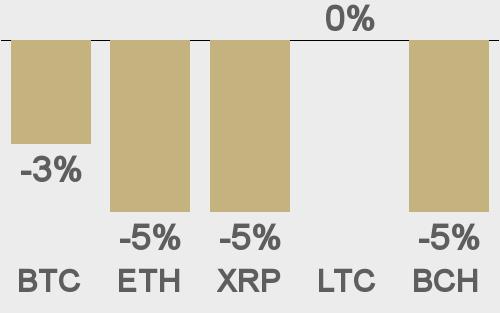

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

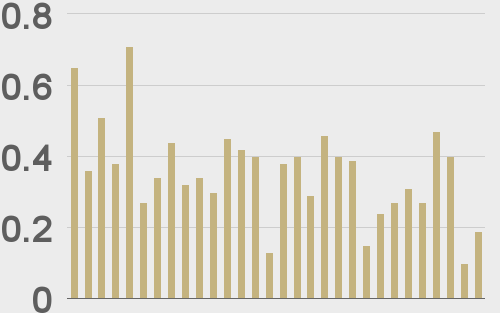

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||