|

|

15 August 2024 About the relative weakness |

| LMAX Digital performance |

|

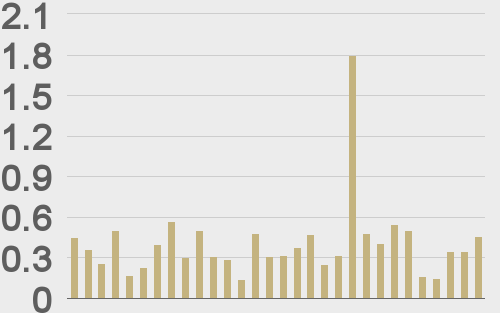

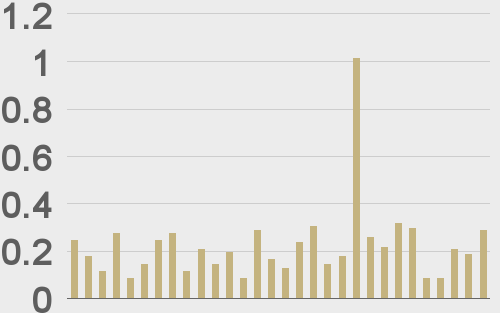

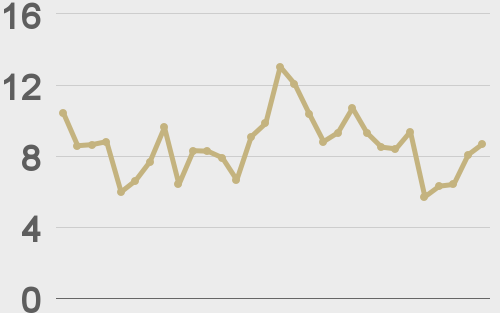

LMAX Digital volumes turned up overall on Wednesday, helped along by a more active economic calendar. Total notional volume for Wednesday came in at $461 million, 13% above 30-day average volume. Bitcoin volume printed $294 million on Wednesday, 28% above 30-day average volume. Ether volume came in at $103 million, 9% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,809 and average position size for ether at $3,469. Market volatility has been trending higher since bottoming at the end of June and early July. We’re back to about halfway between yearly high and low levels. Average daily ranges in bitcoin and ether are $3,114 and $179 respectively. |

| Latest industry news |

|

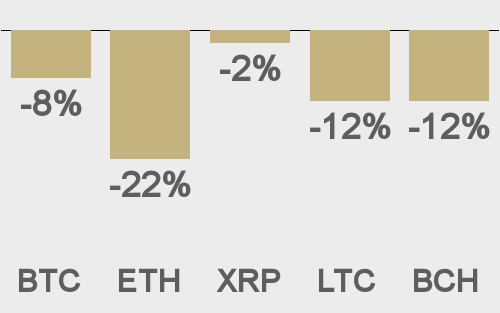

It’s difficult to reconcile relative weakness in crypto assets over the past 24 hours. Any familiar correlations have fallen by the wayside. The US Dollar remains under pressure and US equities have extended their recovery. And yet, crypto assets have stumbled. At the same time, it’s important to take the price action with a grain of salt. One only needs to look at the daily charts to see the weakness is really nothing more than choppy consolidation within a well supported crypto market. If we are to try and assign some sense to the weakness it’s possible an end to a streak of ETF inflows has rattled things a bit, with the selling from these traditional market participants weighing on crypto assets. There are others sources that cite a recent $1.7 billion shift of dormant bitcoin, which could suggest this bitcoin will soon be converted to stables or fiat. However, onchain analytics show nearly 50% of the bitcoin supply remaining unmoved over the past six months, a metric that should invite plenty of confidence in the outlook. We’ve also heard about bitcoin exposure disclosures from giants like Goldman Sachs and Morgan Stanley, which should only encourage further confidence in the path forward. Ultimately, it looks like the relative weakness is nothing more than a blip within some thinner August trade and we suspect there will continue to be plenty of demand on dips into recent range consolidation support. Technically speaking, so long as bitcoin holds up above $57,500 on a daily close basis, the recovery out from last Monday’s panic low remains well intact. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@WatcherGuru |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||