|

|

17 August 2023 About volatility and forward returns |

| LMAX Digital performance |

|

LMAX Digital volume has improved steadily throughout the week but still tracks well below 30-day average volume. Total notional volume for Wednesday came in at $139 million, 30% below 30-day average volume. Bitcoin volume printed $81 million on Wednesday, 29% below 30-day average volume. Ether volume printed $27 million, 47% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,526 and average position size for ether at $3,315. Volatility continues to track at critical, multi-month lows as per the daily average true range indicator. We’re looking at average daily ranges in bitcoin and ether of $538 and $34 respectively. |

| Latest industry news |

|

Thinner liquidity conditions and low volatility have been a big story in the crypto market in recent months. At the same time, historical analysis is encouraging with respect to forward returns when volatility sinks to depressed levels. As per our Wednesday note, all of this has also happened with crypto assets standing out as a clear outperformer relative to traditional assets in 2023. We’ve simply arrived at a point where the market is locked in a kind of holding pattern. We’ve also highlighted the fact that crypto assets have proven to be more resilient in the face of equity market weakness as they have in the past. This is encouraging as it reflects maturity within the space. Of course, with court rulings and SEC decisions hanging in the balance, it’s been harder for the crypto market to ignore price action in global markets. On Wednesday, investors were disappointed with a more hawkish leaning FOMC Minutes, which triggered a wave of risk off flow and broad demand for the US Dollar. We believe the crypto market was not immune to this flow, coming under pressure as a consequence. As far as crypto specific stories go, there have been positive updates this week. Jacobi Asset Management made history after listing the first spot BTC ETF in Europe on Euronext Amsterdam. Meanwhile, Coinbase finally gained approval to list crypto futures in the US. It will also be worth keeping an eye on Grayscale’s lawsuit against the SEC. Grayscale is looking to convert its bitcoin trust into an ETF. A positive outcome for Grayscale could invite a fresh wave of demand for bitcoin and other crypto assets. |

| LMAX Digital metrics | ||||

|

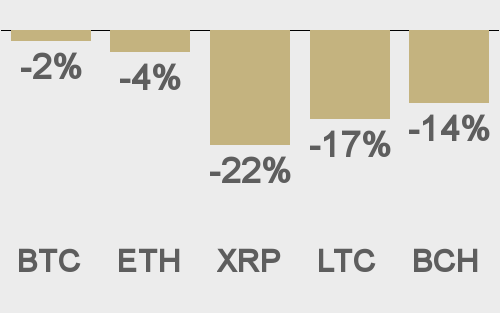

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

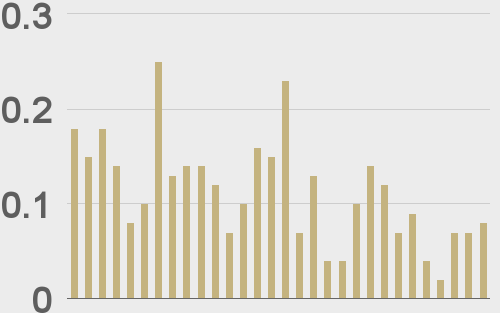

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

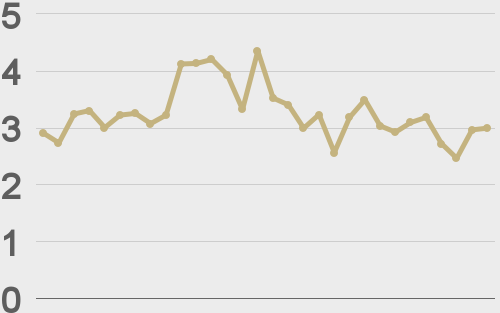

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@MessariCrypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||