|

|

13 March 2024 Another day another record high |

| LMAX Digital performance |

|

LMAX Digital volumes for Tuesday were impressive, outpacing Monday levels. Total notional volume for Tuesday came in at $1.1 billion, 41% above 30-day average volume. Bitcoin volume printed $699 million on Tuesday, 37% above 30-day average volume. Ether volume came in at $279 million, 34% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $14,416 and average position size for ether at $4,130. Market volatility is tracking at its highest levels since 2022. We’re looking at average daily ranges in bitcoin and ether of $3,086 and $190 respectively. |

| Latest industry news |

|

Bitcoin setbacks continue to be exceptionally well supported into even the most shallow of dips. Already on Wednesday, we’ve seen the market pushing up to yet another record high. The news of bitcoin passing silver in terms of total market capitalization, and the news of the FCA saying it wouldn’t object to investment exchanges creating a UK listed market segment for crypto ETNs has helped to keep the momentum going. At this stage, we wonder if the bitcoin run will have more of an excuse to extend with the price of ether yet to push through its record high from 2021. That level comes in just shy of $4,900. It almost feels like ether also needs to push a fresh record in the current run up. Later today, Ethereum will finally get that much anticipated Dencun upgrade, expected to bring about some notable changes, including cheaper fees and the allowance for participating networks to store large amounts of data. As far as developments on the macro front go, we were surprised to see the market turn a blind eye to Tuesday’s US inflation data. On balance, the data should point towards less investor friendly monetary policy than what is being priced. And yet, US equities continue to trade at record high levels. Crypto has been less correlated to stocks in recent months, though any delayed risk off reaction to the inflation data, could open some profit taking on crypto longs, especially with the market already not needing much of an excuse to correct from extended levels. |

| LMAX Digital metrics | ||||

|

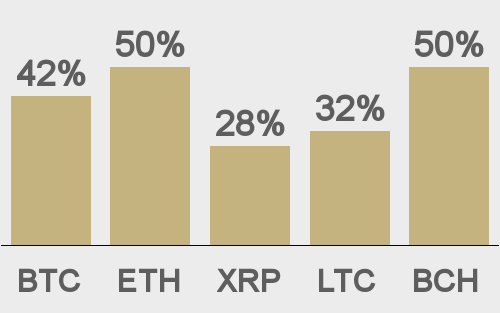

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

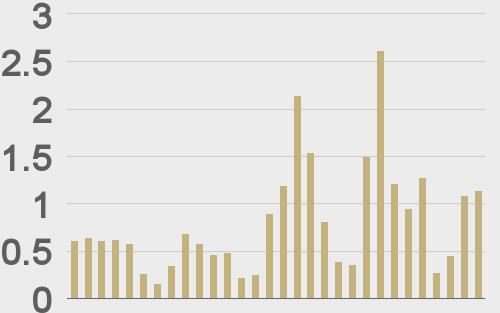

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

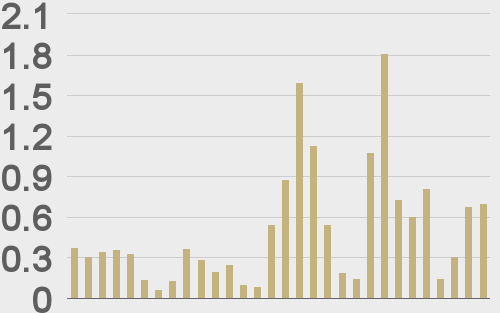

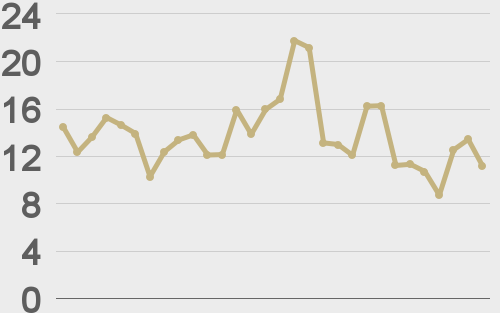

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

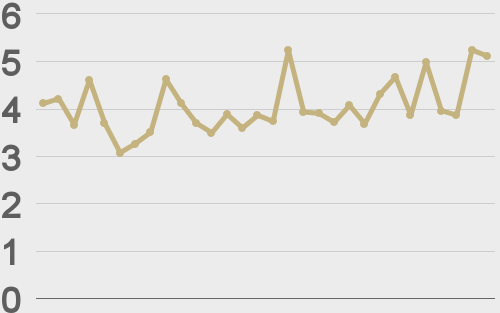

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@woonomic |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||