|

|

23 November 2023 Another day of impressive volume |

| LMAX Digital performance |

|

LMAX Digital volumes came in strong again on Wednesday, following up robust Monday and Tuesday performances. Total notional volume for Wednesday came in at $716 million, 60% above 30-day average volume. Bitcoin volume printed $510 million on Wednesday, 77% above 30-day average volume. Ether volume came in at $152 million, 36% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $10,864 and average position size for ether at $3,316. Volatility has been surging since bottoming in August, with both bitcoin and ether closing in on yearly high levels. We’re looking at average daily ranges in bitcoin and ether of $1,286 and $83 respectively. |

| Latest industry news |

|

Market conditions are expected to thin out quite a bit from now into the end of the week on account of the Thanksgiving holiday in the US. But as we head into the end of the week, things are looking up, with the crypto market taking the latest headwinds in stride. The big news this week has come by way of the Binance settlement with the US Department of Justice. The market has also been contending with yet another SEC complaint against Kraken. As far as the Binance settlement goes, the takeaway has been mostly positive, as many market participants believe this removes what had been systemic risk within the system and now allows for a clearer path forward. And with respect to the SEC’s complaint against Kraken, the market is seemingly less bothered given a court of public opinion that is increasingly supportive of crypto, and a US court system which has been decidedly more crypto friendly in 2023. Indeed, the delay of the SEC approval of the bitcoin ETF applications has been somewhat discouraging. But overall, the broad consensus is that the approvals will happen, most likely in early 2024. Technically speaking, dips have been exceptionally well supported and bitcoin looks to be readying for a push to fresh yearly highs and towards a test of next key resistance in the form of the $40k barrier. |

| LMAX Digital metrics | ||||

|

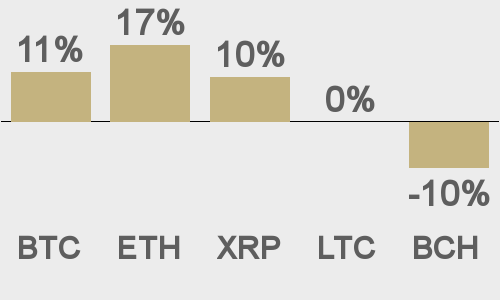

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

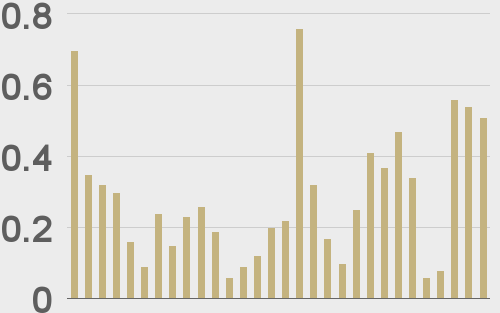

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

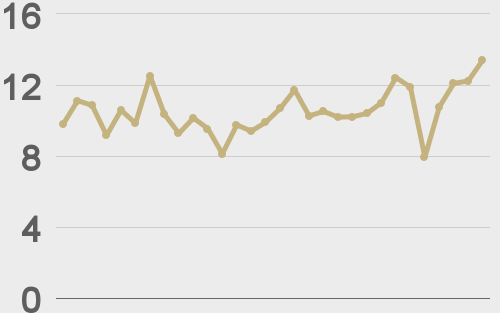

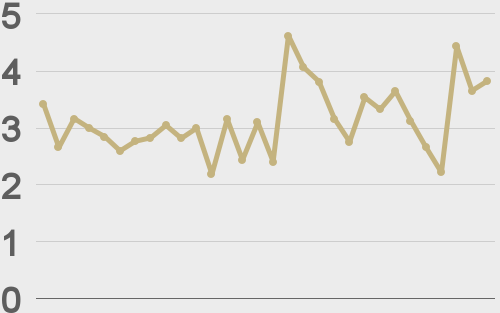

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||