|

|

31 January 2022 Another tough month for crypto |

| LMAX Digital performance |

|

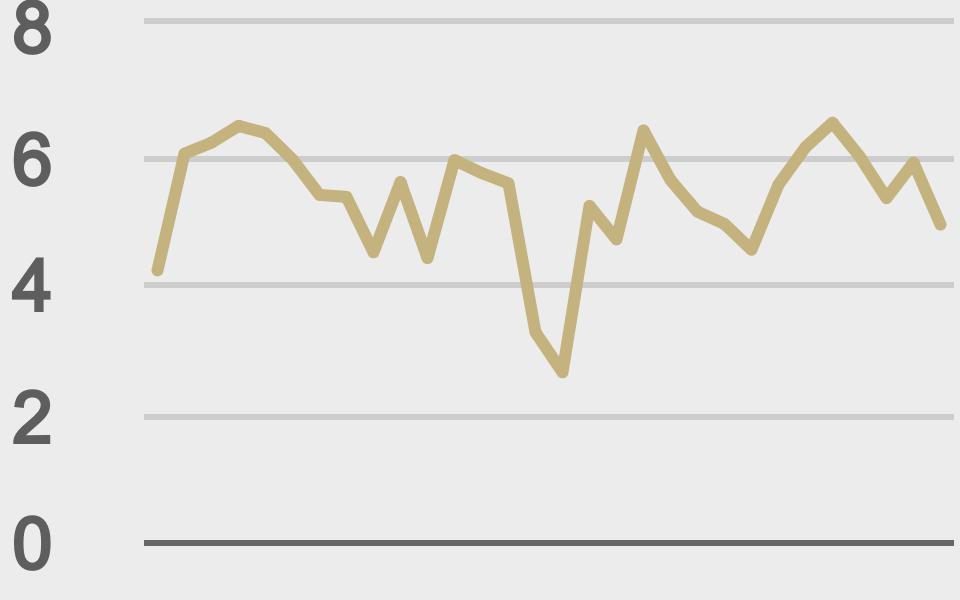

Total notional volume at LMAX Digital was up big in the previous week. Total notional volume from Monday through Friday came in at $5.8 billion, up 49% from a week earlier. Breaking it down per coin, Bitcoin volume came in at $2.7 billion in the previous week, up 34% from the week earlier. Ether volume came in at $2.4 billion, up 69% from the week earlier. Total notional volume over the past 30 days comes in at $22 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,498 and average position size for ether at $5,308. Volatility has cooled off in recent weeks after topping out in December. We’re now looking at average daily ranges in bitcoin and ether of $2,132 and $214 respectively. |

| Latest industry news |

|

January was another hard month for crypto assets. Bitcoin put in a third consecutive bearish monthly close, while ether put in a second consecutive bearish monthly close. But ether weakness in January was more pronounced, with the cryptocurrency down +30% as compared to bitcoin, down around 20%. The primary driver of the weakness was not crypto specific, rather a reaction to a very clear shift in Federal Reserve policy. Rising inflationary pressures have made it impossible for the Fed to ignore, which has resulted in a move towards more restrictive, less investor friendly policy. For now, the correlation of risk off in traditional markets and downward pressure in crypto assets is very much alive, with many market participants perceiving crypto to be a risk correlated play given the fact that the asset class is still a young, maturing, emerging asset class. At the same time, we think this correlation is one that won’t be holding up much longer and we see this breakdown playing out over the coming months. Our core view is that there will be a surge in demand from medium and longer-term players into this dip, on the understanding of the highly compelling longer-term value proposition of the crypto asset class. Bitcoin will be highly attractive as a store of value play given its decentralised, deflationary, limited supply economics. Ether will be highly attractive on its deflationary economics as well, along with all of the wonderful promises that it is expected to deliver on when it comes to web 3 technology. As far as how much lower we should expect to go before these markets bottom out goes, we think it would be wise to consider the possibility of another drop that takes bitcoin down into the $25,000 area and ether into the $1800 area before these markets finally look to turn back up, eventually retesting and breaking the 2021 record highs. |

| LMAX Digital metrics | ||||

|

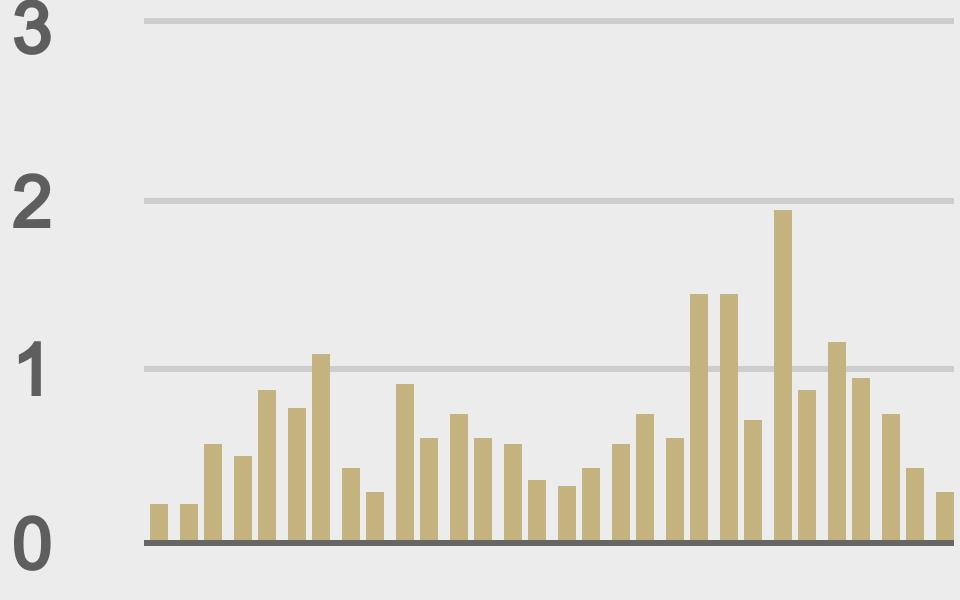

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||