|

| 29 June 2022 Balance of risk points to more downside |

| LMAX Digital performance |

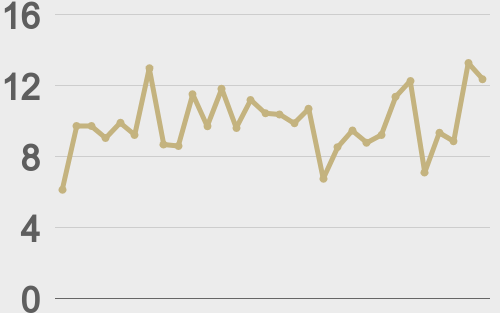

LMAX Digital volumes have been thin this week. Total notional volume for Tuesday came in at $492 million, 21% off 30-day average volume. Bitcoin volume printed $342 million on Tuesday, 19% below 30-day average volume. Ether volume came in at $108 million, 21% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,981 and average position size for ether at 2,508. Volatility continues to hold at yearly low levels. We’re looking at average daily ranges in bitcoin and ether of $1,579 and $125 respectively. |

| Latest industry news |

It looks like crypto could be on the verge of rolling over again, with setbacks at risk of extending to fresh yearly lows. To this point, there has been quite a bit of support for bitcoin and ether around $20,000 and $1,000 respectively. But with those correlations to traditional market sentiment still very much alive and well, all things point to more pain. Technically speaking, we continue to highlight risk for bitcoin to fall back towards $14,000, previous resistance turned support in the form of the 2019 high. As far as ether goes, we would use bitcoin levels as a proxy for indications of any potential trend shift. Of course, all of the fallout within crypto in recent months relating to the implosion of projects and funds, has invited additional scrutiny of the space from regulatory authorities, which hasn’t helped matters. But here, it’s important to make the distinction between bitcoin and the rest of the crypto market. Whereas Ethereum projects and related blockchain projects are exposed to a higher degree of scrutiny around the subject of regulation with respect to being classified as securities, bitcoin has less to worry about here as it is clearly not under the classification of a security. We continue to highlight the importance of understanding why bitcoin should be in better demand during periods of risk off, given its attractive properties as a flight to safety, store of value asset. And ultimately, once we start seeing demand from medium and longer-term players on these merits, we anticipate it will also help to prop up the rest of the space. |

| LMAX Digital metrics | ||||

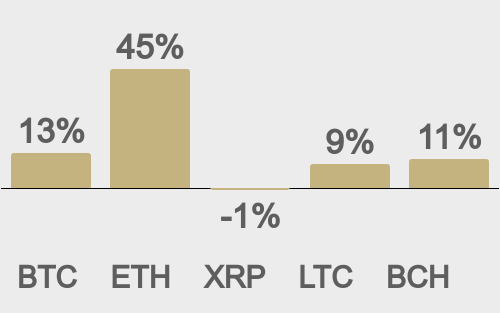

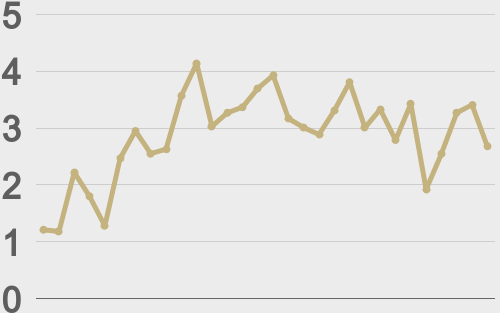

| Price performance last 30 days avg. vs USD (%) | ||||

| ||||

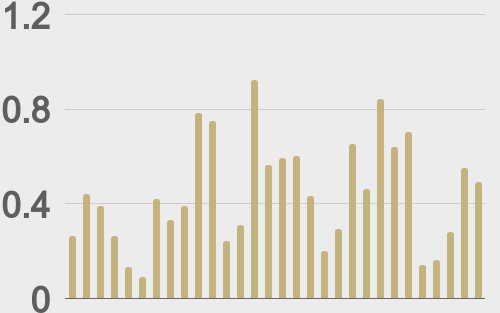

| Total volumes last 30 days ($bn) | ||||

| ||||

| BTCUSD volumes last 30 days ($bn) | ||||

| ||||

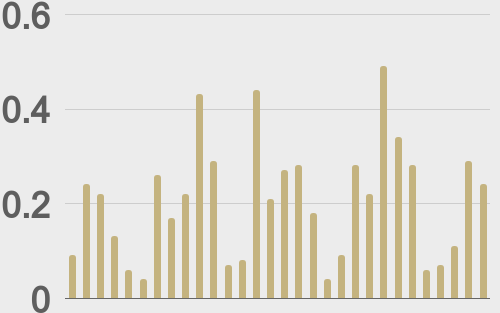

| BTCUSD avg. trade size last 30 days ($k) | ||||

| ||||

| ETHUSD avg. trade size last 30 days ($k) | ||||

| ||||

| Average daily range | ||||

| ||||

| ||||

@wealth | ||||

@TheBlock__ | ||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||