|

|

| Big names dipping into NFTs |

| LMAX Digital performance |

|

Volumes at LMAX Digital were mostly stable on Tuesday, but remained healthy overall, continuing to reflect the healthy uptrend we’ve been seeing since July. Total notional volume for Tuesday came in at $1.2 billion, just 4% below 30-day average volume. Total notional volume for the past 30 days comes in at $37.1 billion. Bitcoin actually held 3% above 30-day average volume on Tuesday, coming in at $724 million, despite the dip from what we had seen on Monday. Ether volume was the one that took a bit of hit, coming in at $262 million on Tuesday, 14% below 30-day average volume. Average position size for bitcoin over the past 30 days comes in at $9,874. Average position for ether over the past 30 days comes in at $4,560. Interestingly enough, despite the flat to slightly lower volume on Tuesday, market participants were happy to be taking bigger position sizes. On Tuesday, bitcoin and ether trading sizes were 22% and 12% above their 30-day averages. |

| Latest industry news |

|

We’ve been seeing a mild round of selling in the price of bitcoin, which has translated to some mild selling across the board. Overall however, price action has been positive and could just be about the market wanting to pause for a breather ahead of the next big push though $50,000. Fundamentally, recent updates have been encouraging. According to a Reuters report, volume at exchanges have ramped up quite significantly around the globe, and over in India, we’re seeing interest in crypto extending beyond just bitcoin and into other assets. Other updates include reports Citi is awaiting regulatory approval to begin trading bitcoin futures contracts on the CME, and news of corporates adopting NFTs. This week alone we’ve heard about Visa buying a CryptoPunk and Budweiser dipping into the Tom Sachs’ Rocket Factory project. Of course, we also recommend proceeding with caution right now given the severe overextension in the US equities market and potential that a capitulation here could trigger a bout of risk off flow that weighs on crypto – at least over the short-term. |

|

LMAX Digital metrics |

||||

|

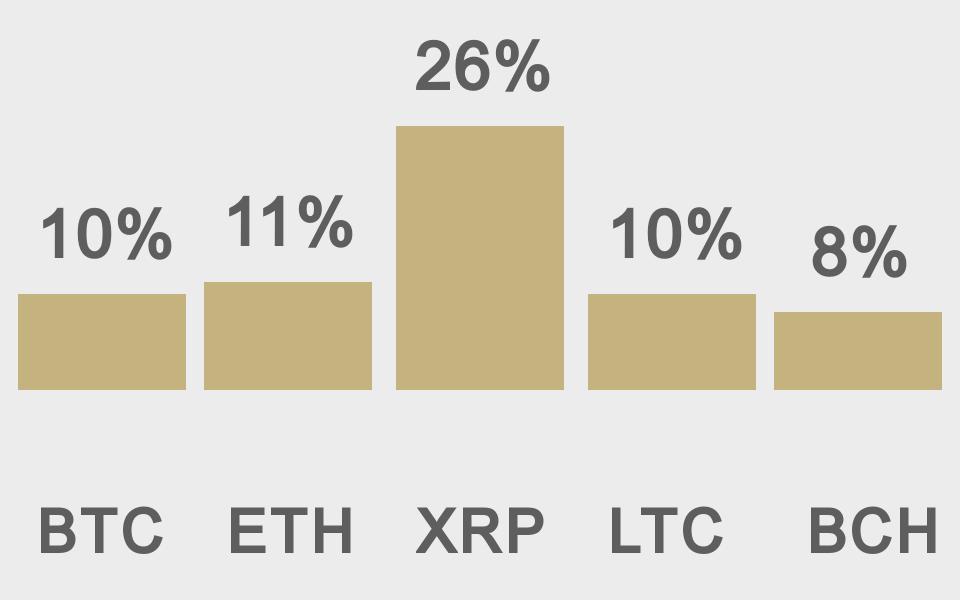

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

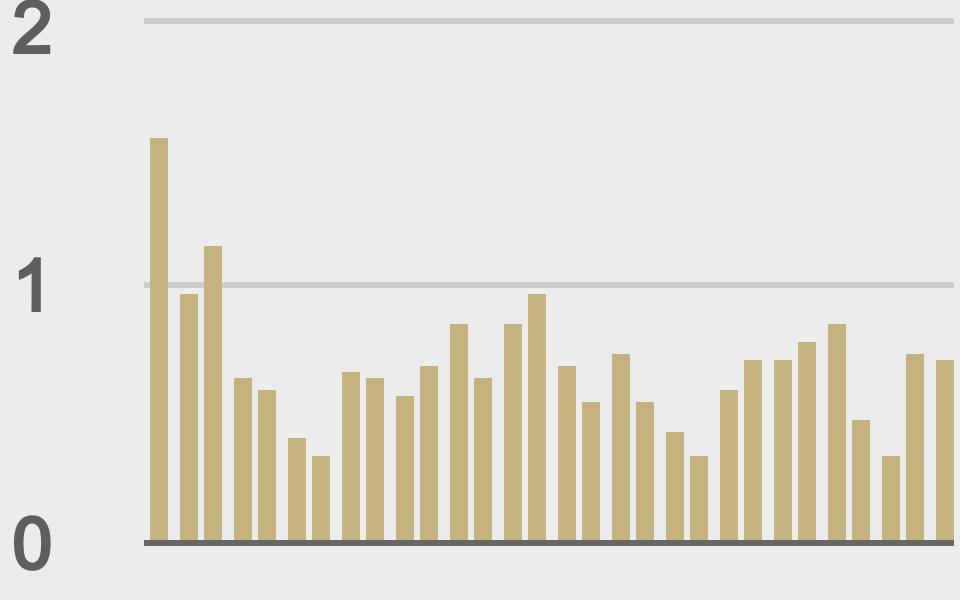

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

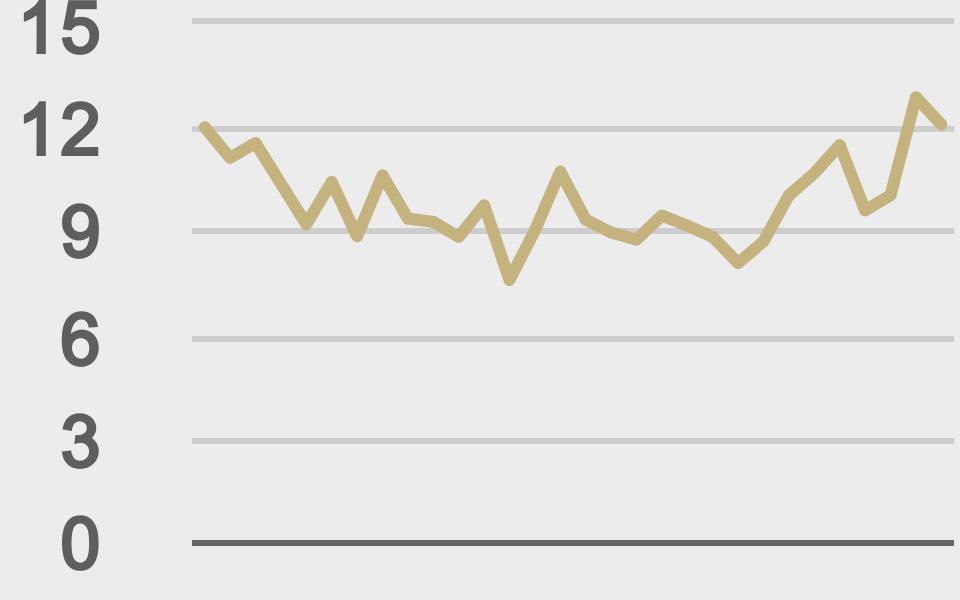

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@DocumentingBTC |

||||

|

@gregisenberg |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||