|

|

6 December 2023 Bitcoin daily volume back above a yard |

| LMAX Digital performance |

|

LMAX Digital volumes continue to trend higher into the end of the year. In fact, total notional volume for Tuesday was the highest since November 2022, coming in at $1.4 billion, 165% above 30-day average volume. Bitcoin volume printed just over $1.1 billion on Tuesday, 218% above 30-day average volume. This was the highest daily volume for bitcoin since November 2022. Ether volume came in at $174 million, 51% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,481 and average position size for ether at $3,441. Volatility is trending higher overall in recent months, with bitcoin volatility trading back to yearly high levels from March. We’re looking at average daily ranges in bitcoin and ether of $1,352 and $78 respectively. |

| Latest industry news |

|

Earlier this week, we talked about bitcoin’s bullish break through $40k and highlighted the fact that the move should now open an acceleration towards next key resistance in the $48k to $53k area. We’ve left our technical update in place from earlier this week as the chart shows how there is very little in the way of any meaningful resistance until $48k. And true to form, the acceleration has already taken the price more than halfway to test $45k. The fact that the upward move in price has also been accompanied by the highest volume in over 12 months is also extremely encouraging and sets the stage for what should be a big year for crypto assets in 2024. All of the stars look to be aligning. We are inching closer to a big catalyst for institutional and mainstream adoption by way of the SEC approval of the bitcoin spot ETF applications. We are also coming into a year which features the next bitcoin halving event, an event that has correlated well with bullish price action. The fact that bitcoin has outperformed on a risk adjusted return basis, while also proving to be an uncorrelated asset, has only made the lure of investing in crypto assets that much more appealing into 2024. Looking ahead, it’s possible traditional markets could play a part in volatility into the end of the week. There is plenty of economic data on the global calendar for Wednesday, and the market will also be waiting to see what comes of Friday’s US jobs report. |

| LMAX Digital metrics | ||||

|

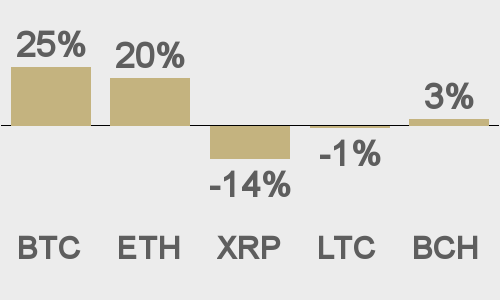

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

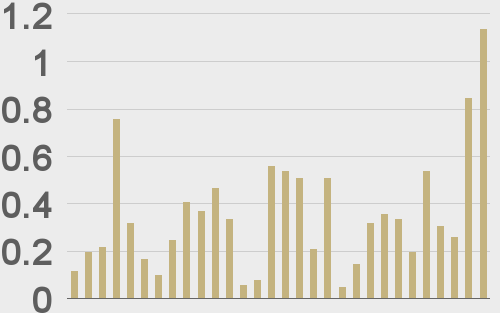

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

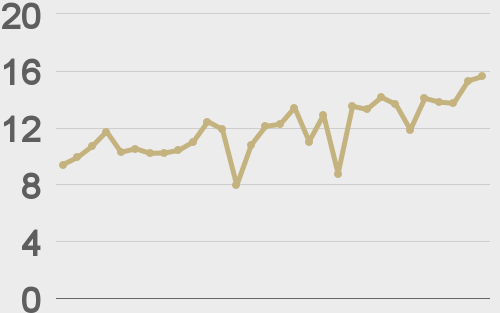

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||