|

| 18 September 2025 Bitcoin extends multi-session highs post Fed |

| LMAX Digital performance |

|

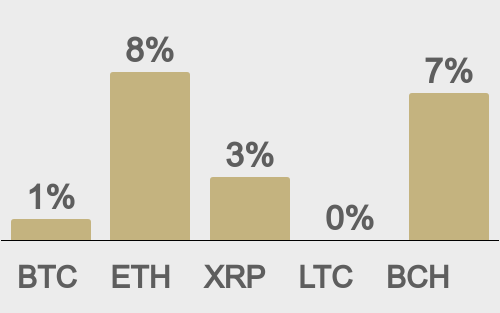

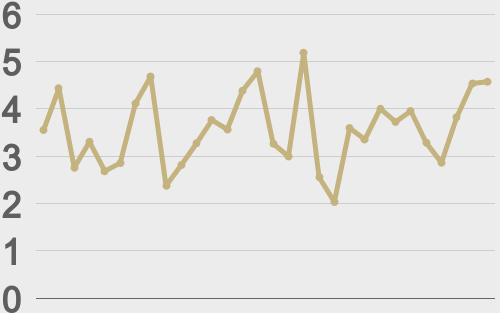

LMAX Digital volumes picked up cross the board on Wednesday. Total notional volume for the day came in at $796 million, 50% above 30-day average volume. Bitcoin volume printed $281 million, 21% above 30-day average volume. Ether volume came in at $319 million, 73% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,710 and average position size for ether at $3,534. Bitcoin volatility has sunk to its lowest levels of the year. ETH volatility has been in cool down mode since mid-August when it traded to its highest level since December 2021. We’re looking at average daily ranges in bitcoin and ether of $2,419 and $180 respectively. |

| Latest industry news |

|

The crypto market held firm over the past 24 hours, with total capitalization steady above USD 4 trillion and trading volumes remaining robust. Bitcoin continues to anchor sentiment, extending to multi-session highs as institutional dip-buying offsets light profit-taking. Ethereum likewise remains well supported, with sustained ETF inflows, its yield-generating characteristics, and ongoing Layer-2 network growth keeping demand resilient even through modest intraday pullbacks. Markets are digesting the Federal Reserve’s latest rate cut, which was delivered alongside less-dovish guidance than anticipated. While the cut itself was broadly expected, Chair Powell’s tone pointed to a more measured path for future easing and a continued emphasis on incoming data. Normally, such a stance would pressure risk assets. Yet crypto has so far absorbed the shift with surprising composure, suggesting that positioning and the depth of recent liquidity inflows have left the market well prepared. For bitcoin, this resilience underscores its evolving role as both a risk-sensitive asset and a long-term macro hedge. The fact that prices have held firm despite a modestly stronger dollar speaks to the strength of institutional demand and ongoing structural adoption. Ethereum’s steady bid reflects similar dynamics, as capital continues to flow toward staking and Layer-2 scaling plays that reinforce its utility narrative. Global factors add further context. Middle East geopolitical risks remain on the radar but have not sparked broad de-risking, while concerns about the long-term stability of the U.S. fiscal outlook and the declining share of dollar assets in central-bank reserves continue to support alternative stores of value. In this environment, crypto’s aggregate market capitalization—now approximately 10 percent of combined M1 money supply across major economies—underscores its growing macro relevance. It’s worth noting that we are now well past the midpoint of a September that has historically been one of the weakest months for crypto performance. This resilience adds another layer of encouragement as we look ahead to the fourth quarter, which has consistently been the strongest period on record for the asset class. |

| LMAX Digital metrics | ||||

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||