|

| 22 October 2025 Bitcoin eyes gold’s overbought gap |

| LMAX Digital performance |

|

LMAX Digital volumes bested Monday levels and were healthy overall. Total notional volume for Tuesday came in at $791 million, 12% above 30-day average volume. Bitcoin volume printed $482 million, 47% above 30-day average volume. Ether volume came in at $140 million, 33% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,740 and average position size for ether at $3,258. Bitcoin and ETH volatility is consolidating in the aftermath of the latest surge. We’re looking at average daily ranges in bitcoin and ether of $3,890 and $237 respectively. |

| Latest industry news |

|

Cryptocurrency markets are currently subdued, with Bitcoin and Ether edging lower amid cautious sentiment in risk assets, driven by rising U.S. yields and a stronger dollar. Traders are scaling back positions ahead of key macroeconomic events, though Bitcoin and Ether remain within familiar ranges, maintaining a constructive long-term outlook. Recent pressure stems from Federal Reserve officials signaling a slower pace of rate cuts, yet the broader expectation of eventual easing supports a view of this pullback as a healthy consolidation, presenting opportunities for investors. Notably, Bitcoin appears attractive compared to an overbought gold market, which is showing technical exhaustion, while crypto’s correction from earlier highs seems complete. On-chain data reinforces this resilience, with long-term holders accumulating and exchange balances declining, reflecting strong conviction. Ether has slightly underperformed against bitcoin as investors favor safer crypto assets, though stable developer activity and protocol revenues suggest its softness is macro-driven rather than fundamental. Geopolitical tensions, including U.S.-China trade rhetoric and mixed global growth signals, contribute to defensive positioning. However, moderating inflation, easing U.S. bank stress, and anticipated policy support into year-end bolster a positive medium-term outlook for digital assets. As a reminder, historically, October and Q4 have been strong for crypto, leaving plenty of room for a rally before the month ends and a continuation of strength into year end. |

| LMAX Digital metrics | ||||

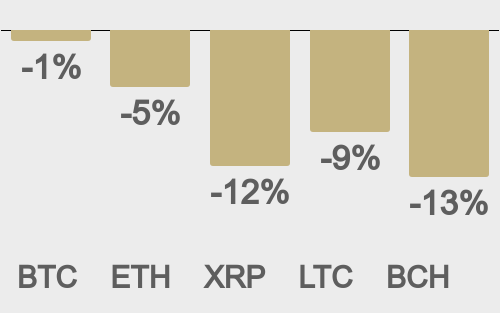

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

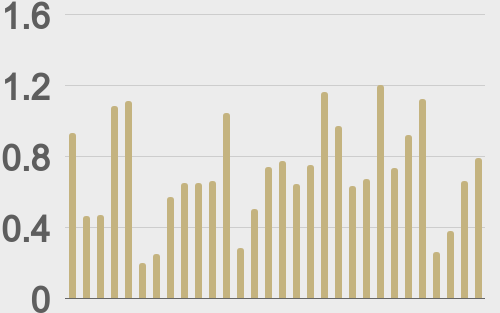

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

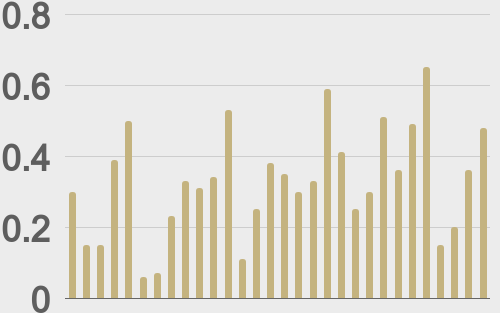

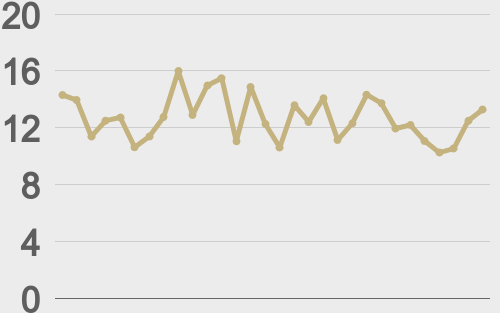

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

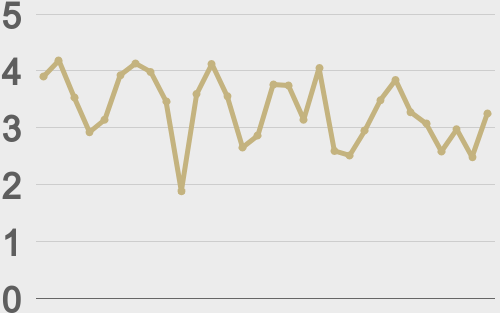

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||