|

| 6 January 2026 Bitcoin firms into key resistance |

| LMAX Digital performance |

LMAX Digital volumes got off to a solid start this week as market participants returned to desks. Total notional volume for Monday came in at $385 million, 62% above 30-day average volume. Bitcoin volume printed $202 million, 52% above 30-day average volume. Ether volume came in at $61 million, 20% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,808 and average position size for ether at $1,932. Bitcoin and ETH volatility have been trending sharply lower over the past several weeks. We’re looking at average daily ranges in bitcoin and ether of $2,396 and $110 respectively. |

| Latest industry news |

Crypto markets are trading with a constructive tone into Tuesday, extending the bullish momentum that has characterized the start of the year. Bitcoin continues to act as the primary barometer for risk appetite, holding firm after January’s sharp rebound, while Ethereum remains a relative outperformer as investors selectively lean back into higher-beta exposure. Price action is orderly and volatility remains contained, reinforcing the sense that this move is being driven more by positioning and confidence than by speculative excess. The upbeat start to the year reflects a confluence of supportive factors. Improved macro sentiment, expectations of easier financial conditions later in the year, and a recovery in global risk assets have all helped reset investor psychology after a challenging Q4 2025. Within crypto, steady institutional participation, resilient ETF flows, and the absence of new regulatory shocks have allowed markets to focus on upside narratives rather than downside risks. Ethereum’s relative strength continues to underscore renewed interest in on-chain activity, staking yield, and the broader application layer, while Bitcoin benefits from its role as the cleanest expression of crypto beta. The broader complex appears increasingly comfortable treating digital assets as part of the risk allocation rather than a standalone hedge, with correlations to equities and tech remaining supportive in the current environment. That said, some near-term caution is warranted. Bitcoin is trading into a technically significant zone near the December highs, and the market still needs to establish itself convincingly above the $95k level to signal that upside momentum is re-accelerating. Positioning looks healthier than late last year, but a period of consolidation or shallow pullbacks would not be inconsistent with a market digesting strong gains. Stepping back, the broader tone remains encouraging. After a difficult end to 2025, sentiment across crypto has clearly improved, with renewed optimism, better liquidity conditions, and growing confidence in the medium-term outlook. While near-term resistance bears watching, markets look fundamentally better positioned, and the balance of risks appears skewed toward further upside as the year progresses. |

| LMAX Digital metrics | ||||

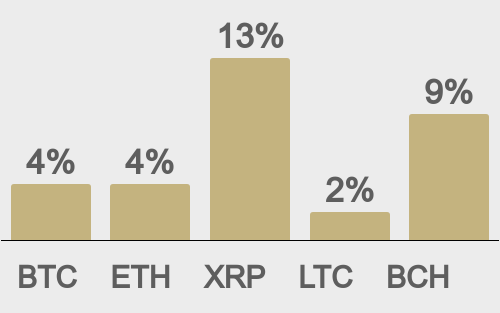

| Price performance last 30 days avg. vs USD (%) | ||||

| ||||

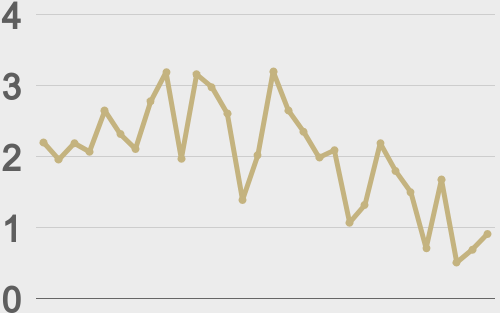

| Total volumes last 30 days ($bn) | ||||

| ||||

| BTCUSD volumes last 30 days ($bn) | ||||

| ||||

| BTCUSD avg. trade size last 30 days ($k) | ||||

| ||||

| ETHUSD avg. trade size last 30 days ($k) | ||||

| ||||

| Average daily range | ||||

| ||||

| ||||

@TheBlock__ | ||||

@TheBlock__ | ||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||