|

|

9 October 2023 Bitcoin holding up well in the face of geopolitical risk |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was impressive in the previous week. Total notional volume from last Monday through Friday came in at $1.5 billion, 34% higher than the week earlier. Breaking it down per coin, bitcoin volume came in at $950 million in the previous week, 30% higher than the week earlier. Ether volume came in at $431 million, 44% higher than the week earlier. Total notional volume over the past 30 days comes in at $6.3 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,714 and average position size for ether at $2,415. Volatility is moderately higher after recovering from cycle lows in August. We’re looking at average daily ranges in bitcoin and ether of $648 and $42 respectively. |

| Latest industry news |

|

The weekend events have unsettled investors around the globe. As a consequence, we’ve been seeing a fresh wave of risk off flow in traditional markets. Though bitcoin has not been immune to the fallout, the cryptocurrency continues to hold up exceptionally well on a relative basis. US equity futures are down closer to 1% on the day, while bitcoin is down only 0.35% as of the time of this update around the Monday European markets open. We believe this continues to reflect a market that is becoming increasingly turned on to bitcoin’s attraction as a store of value asset. Even ahead of the weekend, bitcoin was holding up well despite a US jobs report that argued for yield differentials to move back in the Buck’s favor as odds for a Fed November rate hike moved up. Looking ahead, the market will continue to monitor risk associated with the escalation of geopolitical tension and how this could shape direction in the days and weeks ahead. It’s worth noting, US markets will be a lot thinner on account of the Monday holiday, while China markets have returned from the Golden Week holiday break. |

| LMAX Digital metrics | ||||

|

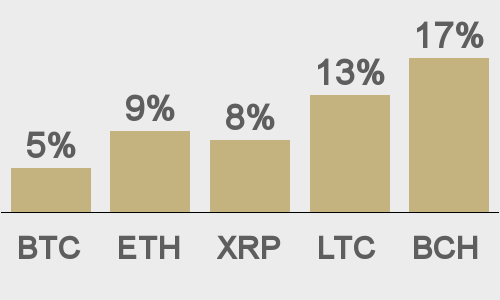

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

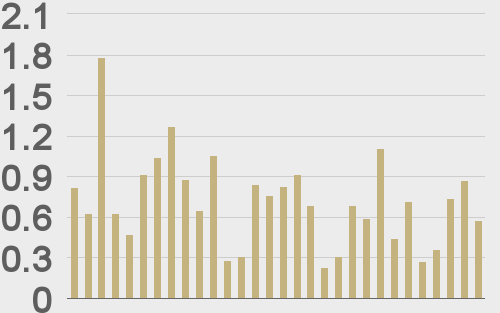

Total volumes last 30 days ($bn) |

||||

|

||||

|

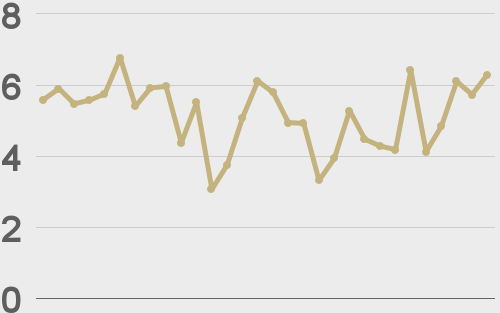

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||