|

| 27 May 2025 Healthy demand despite macro turbulence |

| LMAX Digital performance |

|

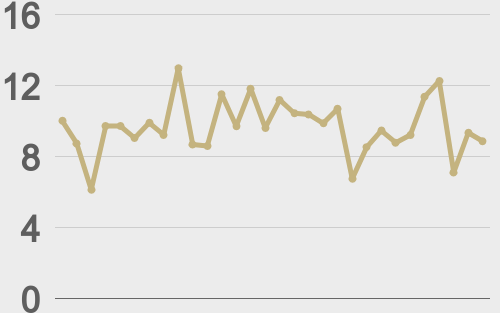

LMAX Digital volumes were thin as the week got going on account of holiday trade. Total notional volume for Monday came in at $284 million, 34% below 30-day average volume. Bitcoin volume printed $114 million, 43% below 30-day average volume. Ether volume came in at $76 million, 28% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,868 and average position size for ether at $2,697. Bitcoin volatility continues to be rather subdued, just off recent yearly low levels, while ETH volatility has picked up since bottoming out earlier this month. We’re looking at average daily ranges in bitcoin and ether of $2,942 and $141 respectively. |

| Latest industry news |

|

Trading conditions have been rather subdued in the early portion of the week, though overall, the crypto market remains exceptionally well supported, fueled by strong institutional inflows and surging on-chain activity. Institutional interest remains a key driver for bitcoin as reflected through sizable ETF demand, while Ethereum benefits from a spike in smart contract deployments reminiscent of 2021 DeFi peaks. The US dollar’s drop to its lowest level since December 2023, driven by worries over Trump’s tax policies and ballooning US debt, has further bolstered crypto’s appeal as a hedge against fiat uncertainty. Meanwhile, a projected 7.9% decline in US April Durable Goods Orders signaling economic caution could nudge investors even more toward digital assets, especially at a time when bitcoin has proven to be resilient, even in the face of struggles in traditional markets. Regulatory optimism, particularly around US crypto legislation like the GENIUS Act, continues to fuel bullish sentiment as well. As per our recent technical insights, the recent break to a fresh record high beyond $110,00 has opened the door for a bitcoin run towards the next measured move extension target at $145,000. |

| LMAX Digital metrics | ||||

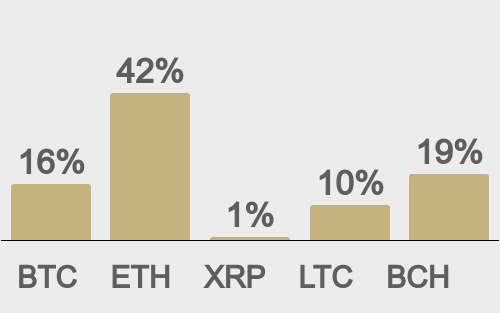

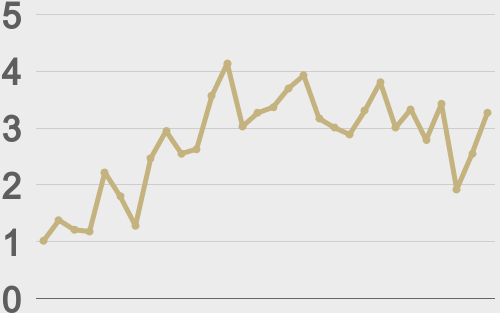

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

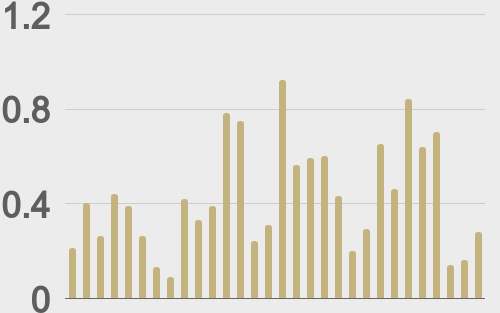

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

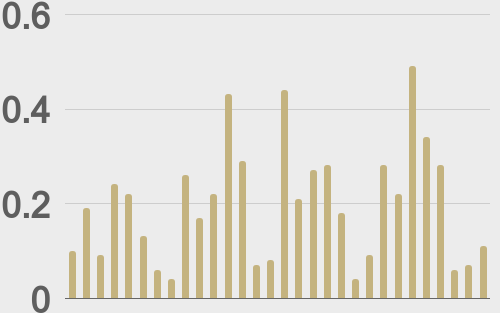

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||