|

|

17 October 2023 Bitcoin holds up well despite fake news |

| LMAX Digital performance |

|

LMAX Digital volumes surged as the week got going. Total notional volume for Monday came in at $758 million, 251% above 30-day average volume. Bitcoin volume printed $558 million on Monday, 300% above 30-day average volume. Ether volume came in at $155 million, 166% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,767 and average position size for ether at $2,446. Volatility has picked up in recent sessions but overall, continues to consolidate off the August low levels. We’re looking at average daily ranges in bitcoin and ether of $738 and $42 respectively. |

| Latest industry news |

|

We’re coming off a day of wild price action in the world of crypto. Bitcoin led the surge higher to fresh multi-day highs after a report came out that BlackRock’s bitcoin spot ETF application had been approved. However, the news was quickly denied and a sharp pullback ensued in the aftermath. Nevertheless, it does appear we are ultimately headed in the direction of spot ETFs getting approved and price action has reflected this anticipation. Even with the pullback from the Monday spike high on the fake news, bitcoin managed to close out the day up about 5%. We’ve since seen the market hold up and consolidate around Monday closing levels. Technically speaking, the price action is notable as the push higher from Monday, beyond a previous high at $28,615, confirms the next higher low in place at $26,520 (11 October low) and opens the door for a retest of the yearly high. It’s worth reminding that seasonality metrics are quite favorable in the month of October, which stands out as one of the strongest months of performance. On the macro front, we’ve also seen added demand for bitcoin at a time where investors have been looking for store of value assets. Bitcoin’s recent run higher coincides with an aggressive move higher in the price of gold. Looking ahead, Monday’s economic calendar is quite active, with some notable first tier data due out of the US in the form of retail sales, industrial production, and business inventories. |

| LMAX Digital metrics | ||||

|

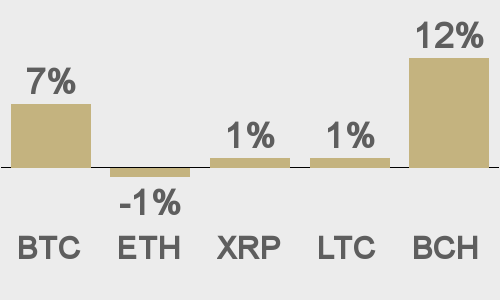

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

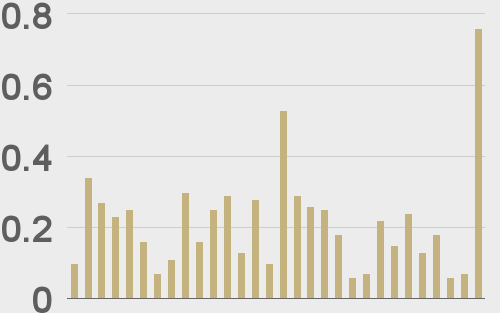

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

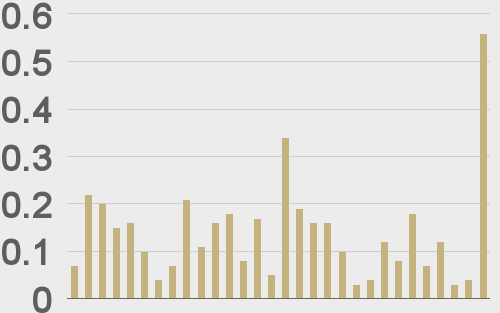

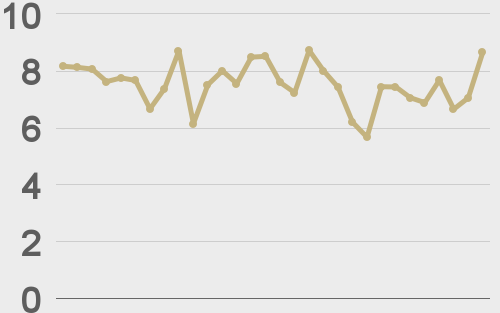

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

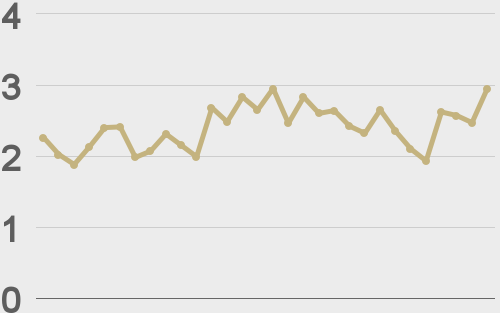

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||