|

|

12 May 2025 Crypto’s second star shining bright again |

| LMAX Digital performance |

|

Total notional volume from last Monday through Friday came in at $2.7 billion, 53% higher than the week earlier. Breaking it down per coin, bitcoin volume came in at $1.4 billion, 59% higher than the previous week. Ether volume came in at $637 million, 62% higher than the week earlier. Total notional volume over the past 30 days comes in at $11.2 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,842 and average position size for ether at $1,777. Bitcoin volatility is tracking at yearly lows, while ETH volatility has picked up about 50% over the past week. We’re looking at average daily ranges in bitcoin and ether of $2,661 and $130 respectively. |

| Latest industry news |

|

While Bitcoin’s ascent beyond $100,000 has captured headlines in recent days, we have been spotlighting a more captivating development deserving greater attention. Our focus has been on the price of ETH, the world’s second-largest cryptocurrency, which endured a punishing Q1, faltering under a cascade of internal and macroeconomic challenges. To recap, ETH’s value plummeted nearly 60% from its 2025 opening, battered by a post-US election crypto correction, internal discord within the Ethereum Foundation, competition from rival blockchains, and a pervasive risk-off sentiment in traditional markets. Yet, we maintained that these setbacks were overstated, anticipating a graceful turnaround in Q2. That revival is now elegantly unfolding, signaling robust appetite for crypto assets beyond Bitcoin and a promising outlook for the broader market. The market is poised to reward ETH as it rises above internal strife, layer-1 rivalries, and Q1’s risk-averse pressures. Last week’s Ethereum Foundation Pectra upgrade, paired with renewed optimism surrounding global trade as the US and China pursue a resolution, should inspire investors to seize ETH at its still-attractive valuation. ETH has reclaimed 85% of its losses from yearly lows, yet remains 23% below its year-to-date peak, offering ample opportunity for further appreciation. Moreover, with institutions like BlackRock placing bold bets on real-world asset tokenization and deepening their commitment to Ethereum, this synergy promises to fuel greater adoption and demand for ETH in the weeks and months ahead. |

| LMAX Digital metrics | ||||

|

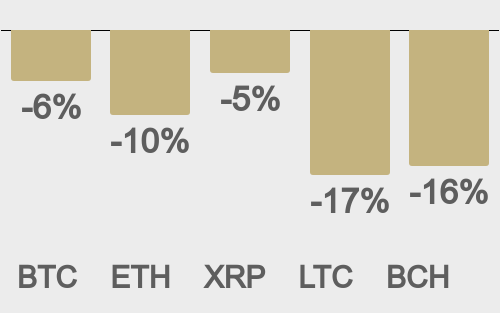

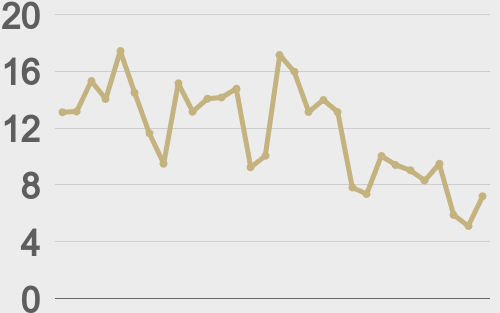

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

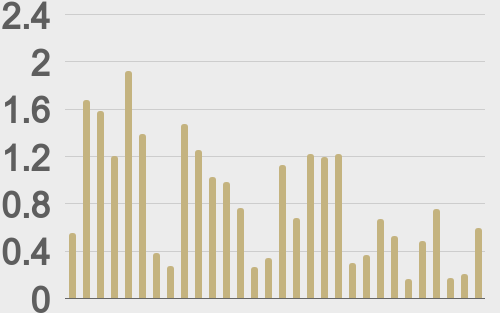

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

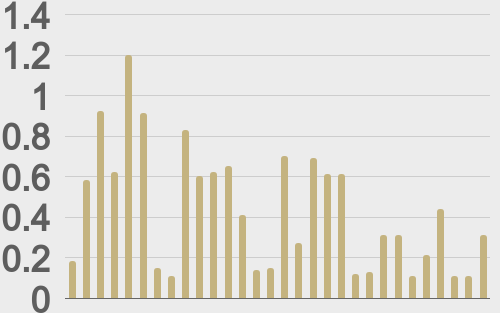

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

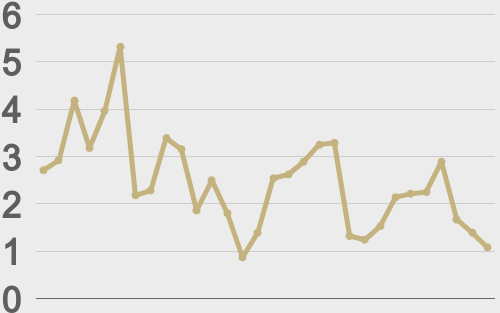

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BitcoinPierre |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||