|

|

26 September 2023 Bitcoin trying to hold up in tough month |

| LMAX Digital performance |

|

LMAX Digital volumes were impressive on Monday, continuing with the trend of rising volume in September. Total notional volume for Monday came in at $297 million, 50% above 30-day average volume. Bitcoin volume printed $213 million on Monday, 64% above 30-day average volume. Ether volume came in at $61 million, 22% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,722 and average position size for ether at $2,315. Volatility is back to trending lower, towards August multi-month low levels. We’re looking at average daily ranges in bitcoin and ether of $589 and $38 respectively. |

| Latest industry news |

|

We’re into the final week of the worst performing month on record for bitcoin. All things considered, things are looking up, with bitcoin tracking mildly in the positive for September as this new week gets going. As per our technical insights, Monday’s recovery and bullish close, could now set the stage for additional upside momentum in the sessions ahead. Of course, we continue to cite $28,200 as the critical resistance level to pay attention to. A break above this level is required to get the market outside of the choppy directionless price action we’ve been seeing in recent weeks, and shift the focus back to the topside. Fundamentally, the market has been given a nice boost on the added vote of confidence out of MicroStrategy. The company made headlines after it was disclosed that it had added 5,445 more bitcoin to its holdings, taking its total holding size to about $4.1 billion at an average cost just under $30k. Looking ahead, global macro fundamentals will be in focus. The notable yield differential advantage to the US Dollar has been influencing markets quite a bit, which in turn has weighed on bitcoin and other crypto assets. This week’s calendar could shake things up some more, with the market focusing on US GDP, core PCE reads, and a Fed Chair Powell speech. Crypto traders will be excited to get done with this week and out of the month of September. October has been one of the best performing months for crypto assets over the past decade. |

| LMAX Digital metrics | ||||

|

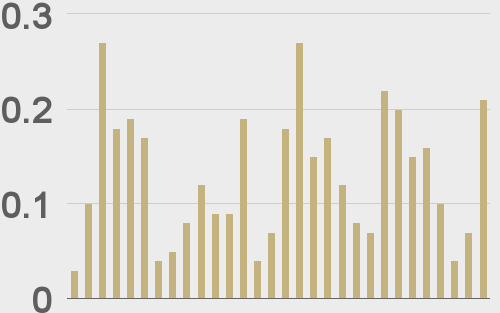

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

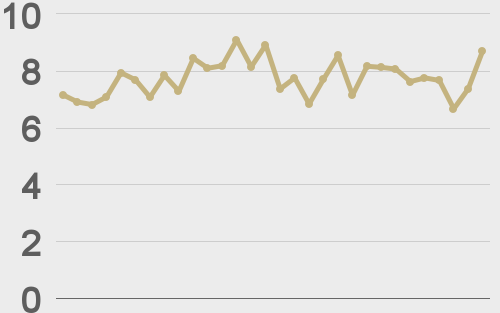

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||