|

|

2 February 2023 BlackRock increases stake in Silvergate |

| LMAX Digital performance |

|

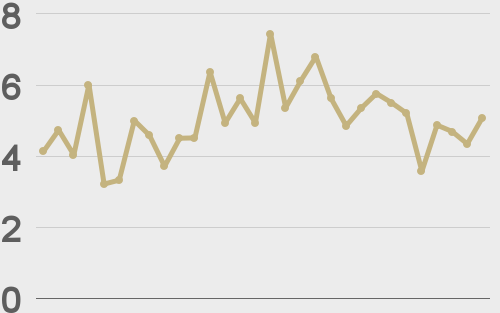

LMAX Digital volumes recovered nicely on Wednesday after a Tuesday lull. Total notional volume for Wednesday came in at $455 million, 27% above 30-day average volume. Bitcoin volume printed $222 million on Wednesday, 16% above 30-day average volume. Ether volume came in at $126 million, 41% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,157 and average position size for ether at 2,806. Volatility is finally showing signs of turning up from multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $781 and $72 respectively. |

| Latest industry news |

|

The Fed decision has come and gone and the reaction hasn’t been all that surprising. There was plenty in the communication for both doves and hawks. Of course, the market has a way of only focusing on the dovish, which led to a post decision risk on rally. This opened the door for additional upside in the prices of both bitcoin and ether, with bitcoin extending up through $24,000 and ether testing $1,700. References from the Fed of soon being able to see the first signs of disinflation is what did the trick, driving this latest wave of risk on flow. However, into Thursday, we’re seeing some signs of the market running out of momentum. It’s possible investors are once again getting worried about overplaying their hand, with data dependency still a factor and the Fed ultimately not fully relenting on hawkish policy. It’s also possible we’re seeing a little bit more caution on the day, with two major central bank meetings still upon us in the form of the BOE and ECB policy decisions due later today. On a positive note for crypto, asset management giant BlackRock was out disclosing an increased stake in Silvergate Capital. This sends a message to the institutional market that major players are very much behind crypto’s value proposition. |

| LMAX Digital metrics | ||||

|

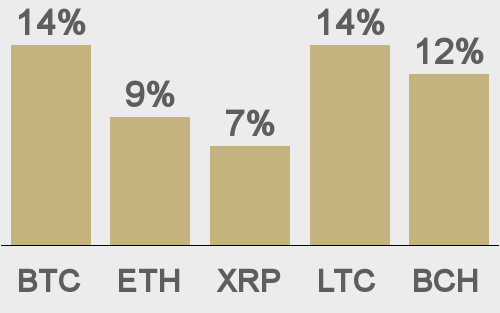

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

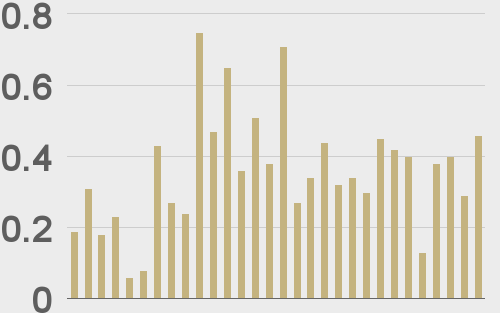

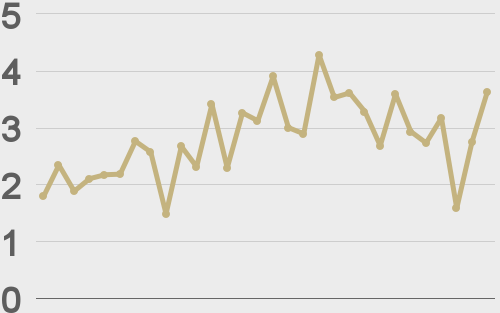

Total volumes last 30 days ($bn) |

||||

|

||||

|

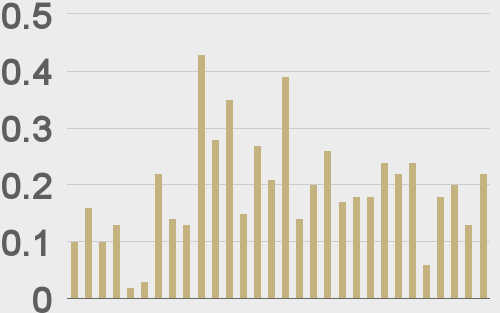

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||