|

|

20 March 2024 Considering Fed event risk |

| LMAX Digital performance |

|

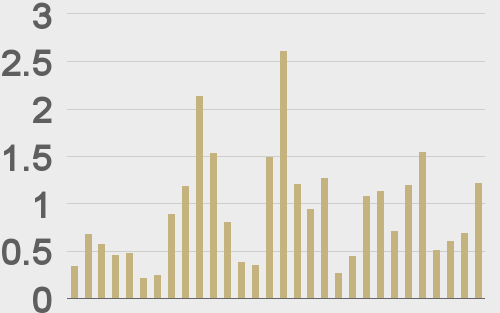

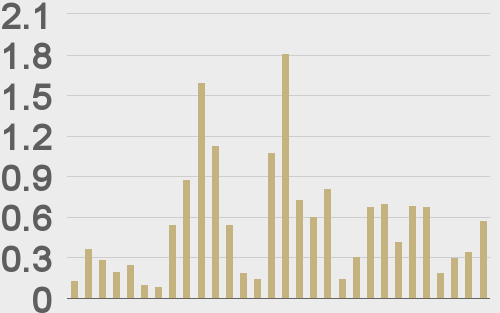

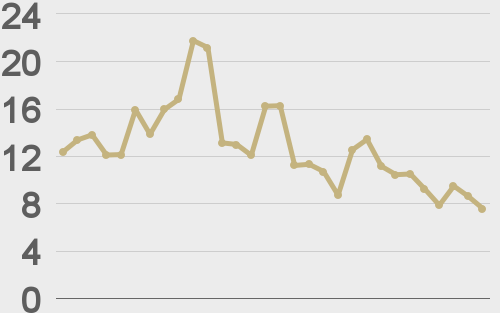

LMAX Digital volumes picked back up on Tuesday after a quiet start to the week. Total notional volume for Tuesday came in at $1.2 billion, 35% above 30-day average volume. Bitcoin volume printed $576 million on Tuesday, 4% above 30-day average volume. Ether volume came in at $432 million, 83% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $13,004 and average position size for ether at $4,345. Market volatility is continues to track at multi-month highs. We’re looking at average daily ranges in bitcoin and ether of $3,746 and $231 respectively. |

| Latest industry news |

|

Now that this overdue bitcoin correction is finally playing out, the question becomes just how deep of a pullback we see before the uptrend resumes. There is definitely more room for setbacks to extend without it doing anything to compromise the uptrend on the daily chart. In our technical overview, we talk about the possibility for setbacks to extend towards $50k and bitcoin still trading within a strong uptrend. The way these corrections usually play out is that first there is some natural profit taking, which then spills over into stop losses getting hit, which then spills over into leveraged longs getting liquidated, which only intensifies the overall move. There has also been chatter of added selling pressure from the news of the largest daily outflows in the bitcoin spot ETFs since inception. Some attribute this to position squaring ahead of today’s major central bank event risk. Later today, we get the always highly anticipated Fed decision. We have talked about downside risk associated with the possibility the Fed scales back rate cut bets. If this happens, global sentiment will head south on the less investor friendly policy communication, all while yield differentials move back to the US Dollar on the repricing of US rates. Crypto assets have been less sensitive to Fed monetary policy and developments on the global macro front, but could be exposed if the post-Fed fallout is extreme. Whatever the case, we expect any weakness in crypto over the coming days to be quickly bought up on account of the attractive value proposition in the emerging asset class. On a positive note, the news of Japan’s pension fund seeking information about bitcoin as a consideration for its portfolio is news that should be very well received. We expect more headlines like these around the globe as adoption in the traditional markets ramps up in 2024. |

| LMAX Digital metrics | ||||

|

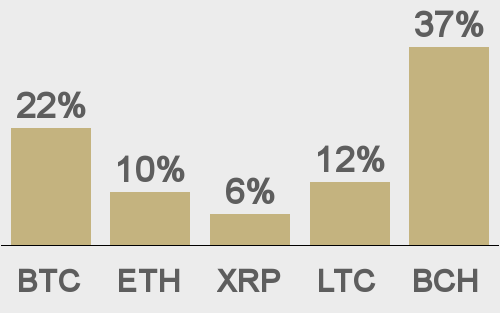

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

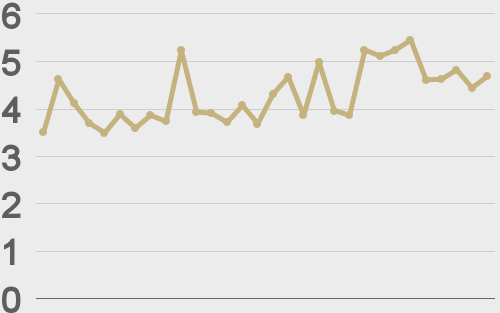

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||