|

|

18 June 2024 Considering the downside |

| LMAX Digital performance |

|

LMAX Digital volumes were healthy on Monday. Total notional volume for Monday came in at $509 million, 26% above 30-day average volume. Bitcoin volume printed $261 million on Monday, 39% above 30-day average volume. Ether volume came in at $189 million, 18% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,405 and average position size for ether at $4,133. Market volatility has been trending lower since March but is finally show some signs of wanting to bottom out. We’re looking at average daily ranges in bitcoin and ether of $2,017 and $149 respectively. |

| Latest industry news |

|

When we look at the crypto market right now, there are three risks – all interrelated, that could open the door to more downside over the coming sessions. That being said, even if we do see a more intense decline in the days ahead, the outlook remains highly constructive over the medium and longer-term. As far as the risks go, the first risk comes from the technicals front. If we zoom out on the bitcoin chart, it looks as though the market could be wanting to put in a double top on the weekly. If this proves to be true, we could see deeper setbacks towards the neckline all the way down at $56,500. And if the neckline is then broken, it would expose an additional setback towards a measured move target all the way down into the $44k area. This would be the extreme downside risk in our view and would translate to additional setbacks of some 30% from current levels. In other words, should we see such a severe decline, any dips into these levels should then be aggressively bought up. At the same time, when the sentiment is feeling overwhelmingly bearish and everyone is looking at the same thing, the technicals have a way of doing the opposite, which of course would be more encouraging of a near-term reversal to the topside and bullish continuation. In our chart overview in today’s report we highlight this possibility if bitcoin can continue to hold up above $65k on a daily close basis. As far as the other risks go, we see downside risk coming from the recent Fed decision which leaned more hawkish than the market would have wanted to see, which translated to yield differentials moving back into the US Dollar. Finally, we are concerned about the ongoing push in US equities to record highs and possible overextension on that front that could lead to a massive correction, which could then open additional downside pressure on crypto assets. On a positive note, we’ve already highlighted why the technical picture might not get as ugly, and we believe recent US CPI data justifies room for more rate cuts in 2024. As far as US equities go, ultimately, the trend is your friend, and despite concerns about an intense correction, there is nothing substantive to suggest we will indeed see such a move, which should continue to keep risk assets well supported. |

| LMAX Digital metrics | ||||

|

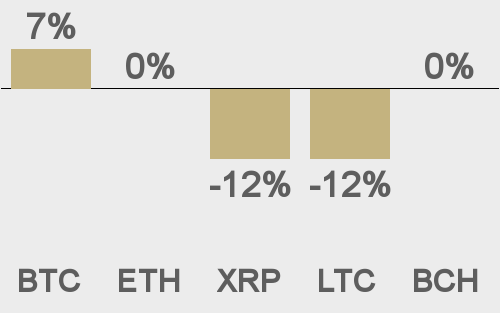

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

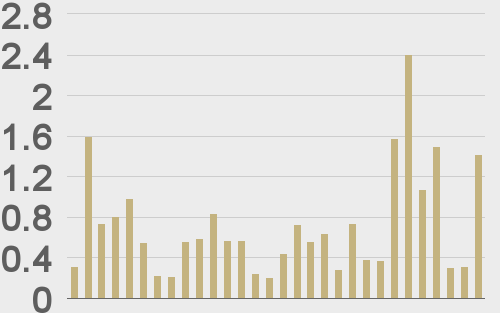

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

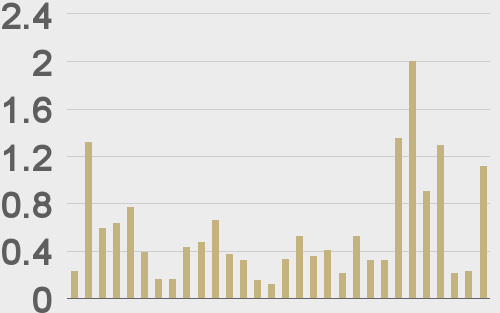

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

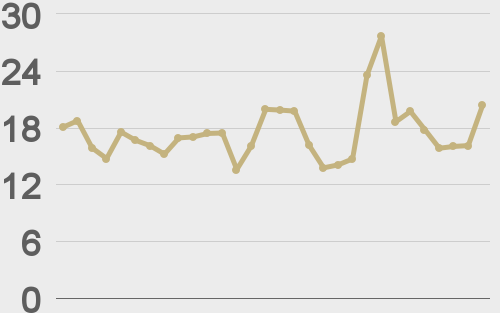

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||