|

|

10 September 2024 Crypto assets and the presidential debate |

| LMAX Digital performance |

|

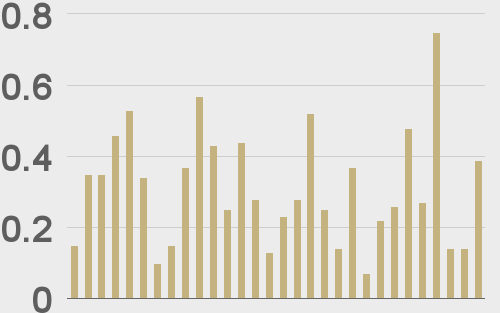

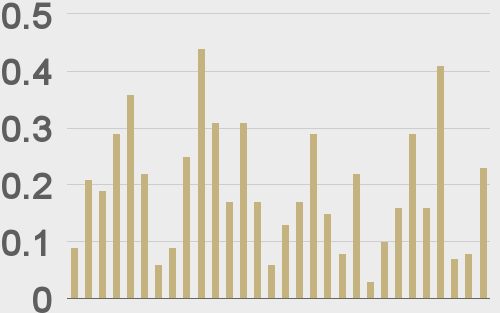

LMAX Digital volumes got off to a healthy start this week. Total notional volume for Monday came in at $387 million, 24% above 30-day average volume. Bitcoin volume printed $227 million on Monday, 18% above 30-day average volume. Ether volume came in at $105 million, 41% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $7,281 and average position size for ether at $2,387. Market volatility has cooled off sharply after an impressive run higher in early August. We’re looking at average daily ranges in bitcoin and ether of $2,457 and $129 respectively. |

| Latest industry news |

|

The market still has its work cut out for it given historical underperformance in September. At the same time, setbacks have already been quite intense this month and we are that much closer to what has historically been a very bright Q4. On Monday, we finally saw an end to a nasty streak of bitcoin ETF outflows, with $28 million coming back in. This update could help to inspire additional demand over the coming sessions. Later today, we get the highly anticipated presidential debate between Donald Trump and Kamala Harris. While we don’t expect there to be too much if any focus on crypto, the market has priced Trump as the more crypto friendly candidate. This suggests a Trump win in the debate would inspire some demand. The market is however expecting a debate victory for Harris, which also means that in the event this does prove to be the case, crypto assets have already priced in the outcome, presumably leaving little downside risk from a Harris debate victory. The key takeaway here is that the balance of risk leaves more room for crypto to benefit from the debate than to be hurt by it. We’d also highlight the fact that the Harris campaign has shown signs of wanting to warm up to crypto in recent weeks. Beyond the debate, there will be plenty of attention around tomorrow’s US inflation data. Anything that leans softer will do a good job increasing odds for more rate cuts than less between now and year and, which should translate to more demand for crypto on account of yield differentials moving out of the Buck’s favor. |

| LMAX Digital metrics | ||||

|

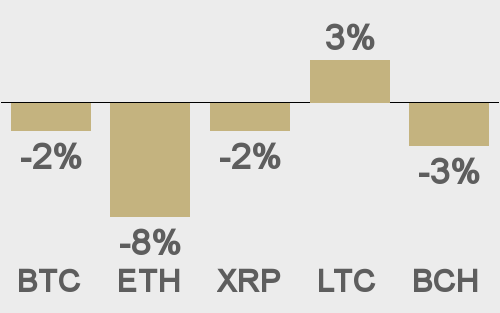

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||