|

|

14 February 2024 Crypto assets turning heads post US CPI |

| LMAX Digital performance |

|

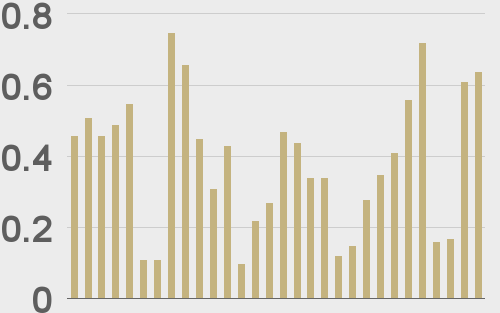

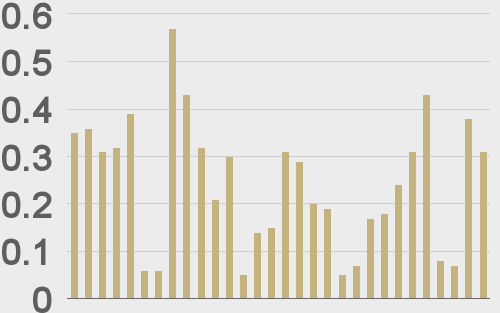

LMAX Digital volumes have been robust this week, with Tuesday volume outpacing an already impressive Monday performance by $30 million. Total notional volume for Tuesday came in at $638 million, 64% above 30-day average volume. Bitcoin volume printed $313 million on Tuesday, 29% above 30-day average volume. Ether volume came in at $243 million, 159% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,268 and average position size for ether at $3,197. Volatility is starting to turn back up after dropping by more than 40% from the January peak. We’re looking at average daily ranges in bitcoin and ether of $1,526 and $85 respectively. |

| Latest industry news |

|

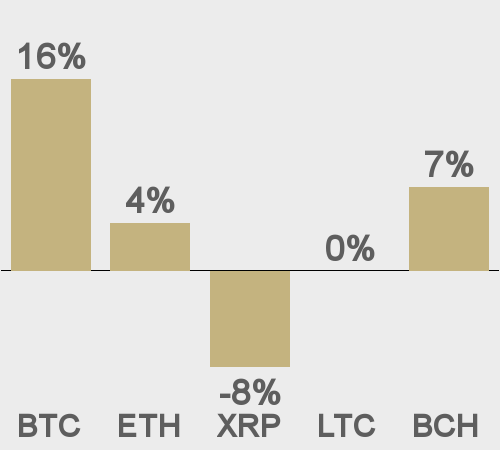

Bitcoin’s performance has been impressive in the aftermath of Tuesday’s US CPI read. The data came out hotter than expected, opening a wave of broad US Dollar demand and risk off flow. And yet, despite the price action, bitcoin and crypto assets have held up well overall, sending a message that correlations with traditional markets aren’t what they used to be. There are a number of factors playing into the relative outperformance that shows both bitcoin and ether well out in front of all other traditional assets over the past 30 days. The launch of the bitcoin spot ETFs has been very well received with inflows only expected to continue to grow. Meanwhile, the market is getting excited about the bitcoin halving event and the approval of ether spot ETFs, which should only encourage additional price appreciation. Throw in the deflationary economics around crypto and the value proposition in times of risk off is also quite compelling, particularly with respect to bitcoin. Technically speaking, the recent push through $50k has bitcoin staring at a push towards a retest and break of the record high from 2021. Ether is also making moves, closing in on a break of the yearly high from January, which will take it to its highest level against the Buck since May 2022. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

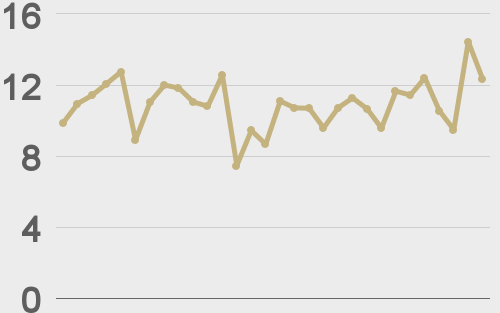

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

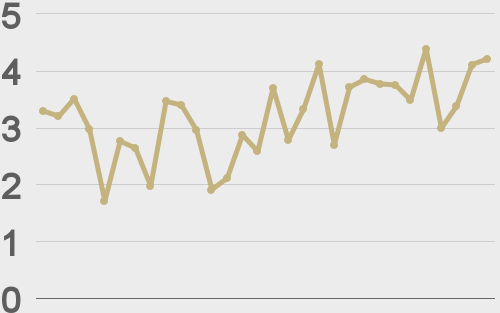

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@LukeGromen |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||