|

|

6 January 2022 Crypto can’t escape macro pressures |

| LMAX Digital performance |

|

LMAX Digital volume picked up in a big way on Wednesday after a slow start to the week. The action didn’t come as a surprise given the intense downside pressure on prices. Total notional volume came in at $915 million, 27% above 30-day average volume. Bitcoin volume printed $579 million on Wednesday, 56% above 30-day average volume. Ether volume recovered to $241 million, bang on with 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,199 and average position size for ether at 6,685. Volatility has been trending lower as we come into 2022. We’re now looking at average daily ranges in bitcoin and ether of $2,376 and $220 respectively. |

| Latest industry news |

|

We’ve spent a lot of time highlighting our concerns with respect to the short-term outlook for the crypto space. We’ve highlighted correlations with US equities and global sentiment, and we’ve warned that this could lead to a period of weakness in the days and weeks ahead. In our introductory note of 2022, we also suggested this could result in ether underperformance relative to bitcoin, given ether’s stronger correlation with risk sentiment. And as things stand, this is how things are playing out at the moment. The latest catalyst? A more hawkish leaning, less investor friendly Fed communication in Wednesday’s Minutes. If stocks are selling off, market participants are less inclined to be invested in risk correlated assets. And considering crypto is still an emerging asset class with many unknowns, it should come as no surprise to see price corrections as a consequence. Technically speaking, in this report, we’ve already highlighted key supports to keep on eye as far as bitcoin goes. Those supports come in the form of the December 2021 low and June 2021 low respectively. We think it will be important to keep an eye on those levels for those watching ether and broader cryptocurrencies, as those levels in bitcoin will likely serve as a proxy for the entire market. At some point, we expect bitcoin will be very well supported even if US equities continue to slide, this on bitcoin’s medium and longer term value proposition, which we also believe will support the crypto space on the whole. But we are not there just yet, and at the moment, there is risk we will continue to see these price corrections play out. Again, a lot of this will hinge on the direction in US equities in the days ahead. |

| LMAX Digital metrics | ||||

|

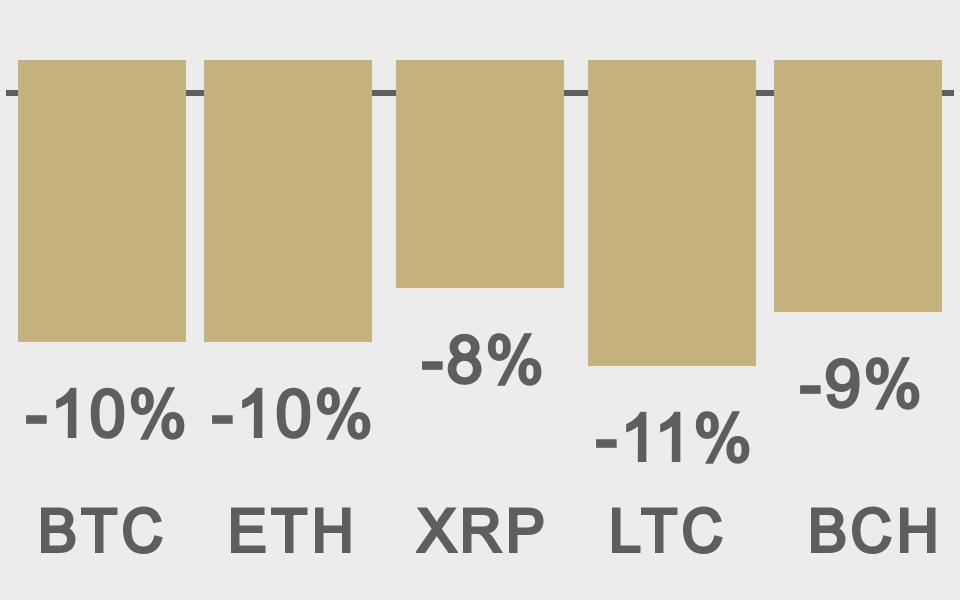

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

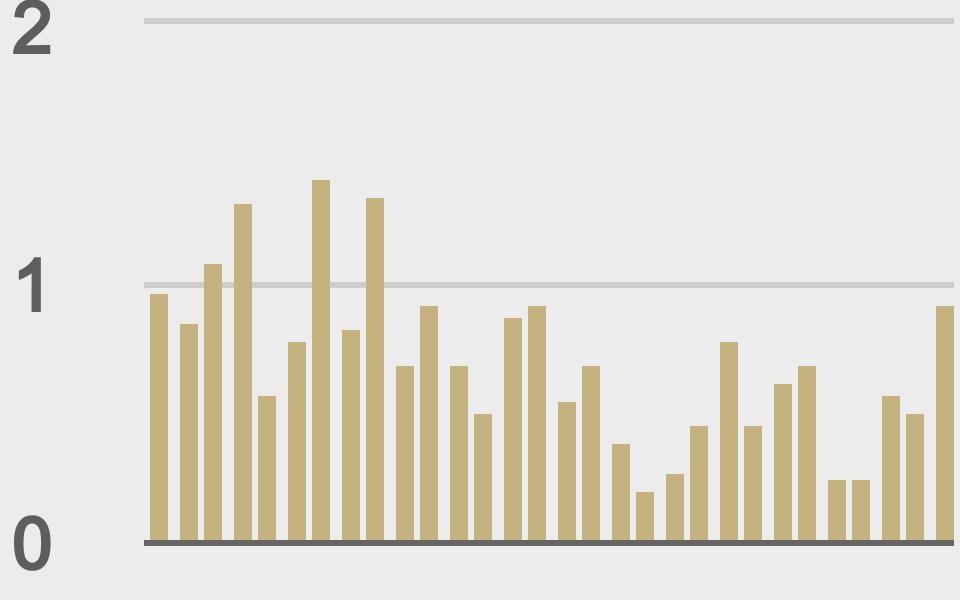

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

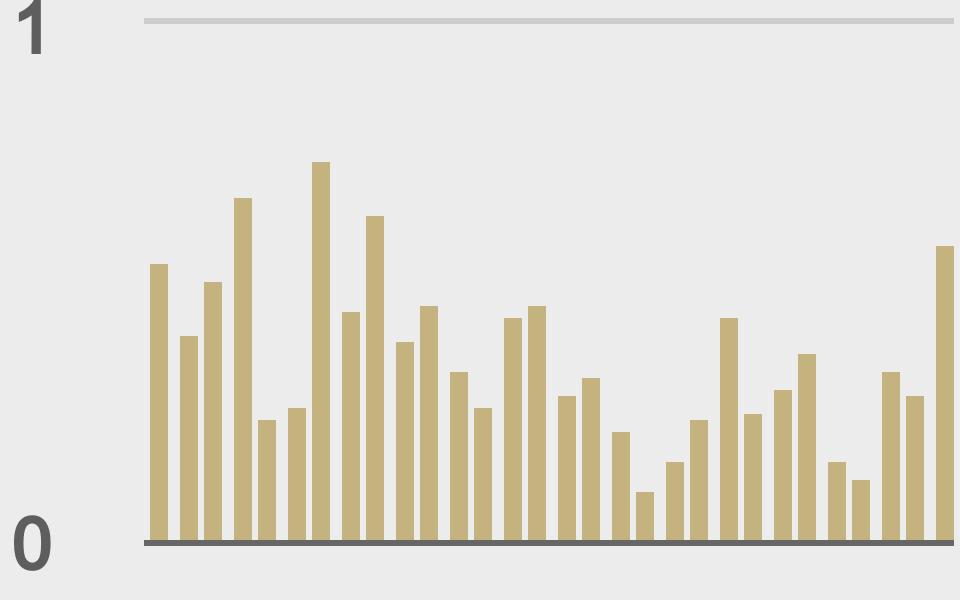

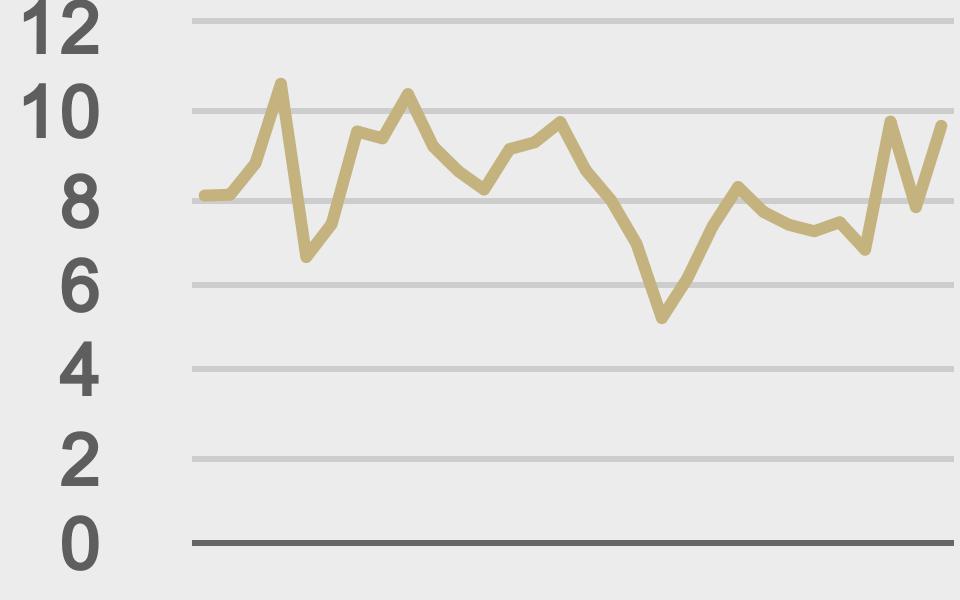

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

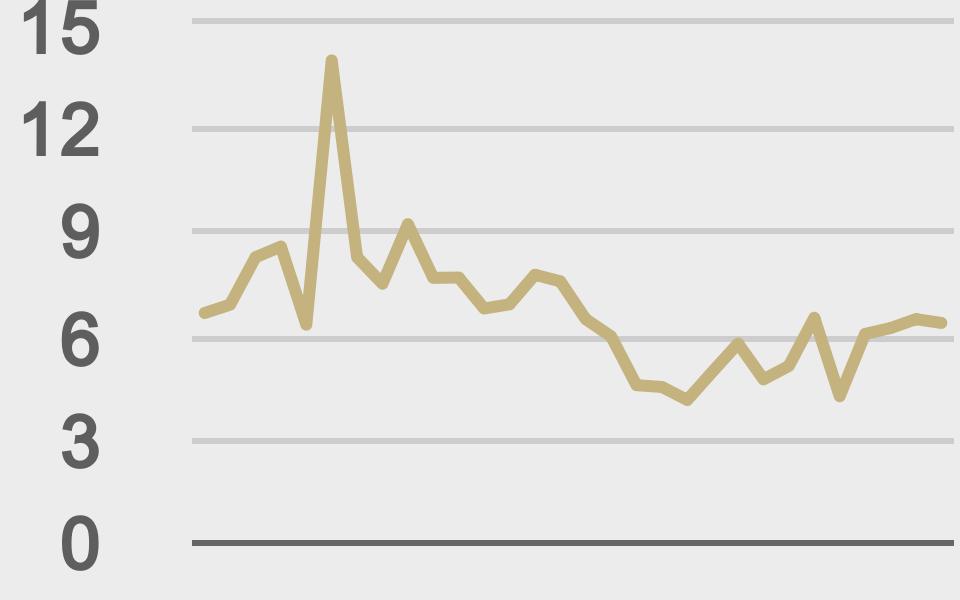

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||