|

|

29 August 2022 Crypto feels the heat of hawkish Powell |

| LMAX Digital performance |

|

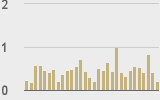

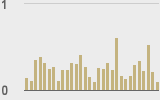

Total notional volume at LMAX Digital turned a little lower in the previous week. Total notional volume from last Monday through Friday came in at $2.8 billion, 8.5% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.6 billion in the previous week, off 8% from a week earlier. Ether volume came in at $1.03 billion, off 9.5% from the week earlier. Total notional volume over the past 30 days comes in at $14.1 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8327 and average position size for ether at $3,161. Volatility is still struggling to show signs of picking back up. We’re looking at average daily ranges in bitcoin and ether of $912 and $110 respectively. |

| Latest industry news |

|

We’ve seen renewed downside price action in the crypto market over the past week, with bitcoin sliding back below the $20k barrier. Most of this can be attributed to all things global macro, this after the Fed Chair rocked markets with his latest speech. On Friday, Jerome Powell was out exceeding already hawkish expectations, with the Fed Chair talking about a commitment to higher for longer policy, while dismissing any impact from one softer inflation print. The net result was a risk off reaction in global markets, with US equities falling sharply and the US Dollar rallying. And as things have been correlating, the risk off reaction has translated to this latest wave of downside in crypto. In our technical note, we highlight the risk of another intense pullback should bitcoin take out the yearly low, with that pullback potentially extending down to a measured move target of $10k. Overall, our biggest concern about the outlook for crypto right now stems from the possible fallout in US equities, which could still be at risk for a much steeper decline in 2022. At the same time, there are regulatory hurdles that continue to be a headache for crypto investors. But on net, we believe any setbacks that take bitcoin down towards $10k will be short-lived, with the longer-term value proposition too compelling to ignore. |

| LMAX Digital metrics | ||||

|

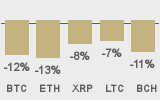

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||