|

|

22 February 2022 Crypto hit on geopolitical tension |

| LMAX Digital performance |

|

LMAX Digital volume got off to a good start after a slow week in the previous week. Total notional volume for Monday came in at $1.1 billion, 30% above 30-day average volume. Bitcoin volume printed $594 million on Monday, 38% above 30-day average volume. Ether volume came in at $402 million, 31% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,966 and average position size for ether at 6,606. Volatility has been trending lower in 2022. We’re now looking at average daily ranges in bitcoin and ether of $1,983 and $193 respectively. |

| Latest industry news |

|

We should expect to see liquidity returning to normal conditions on Tuesday, as the US market comes back from the long weekend. As we come into Tuesday, there is quite a bit of vulnerability in the crypto market, mostly on the back of the downturn in risk assets. The driving force has been the escalation of geopolitical tension around Russia and the Ukraine. All of this on news Russian President Putin has recognized breakaway rebel regions in Ukraine’s east as independent states, effectively ending peace talks there. What’s so interesting about the fallout in bitcoin is that there is a very strong argument to be made for bitcoin demand on this news, given bitcoin’s properties as a store of value asset. We are also living in a world where inflation is rising to multi-year highs, yet another reason to be wanting to diversify into bitcoin. However, shorter-term and right now, there is still a correlation between bitcoin and risk-off flow given the fact that so many out there still consider bitcoin and crypto to be an emerging market. We believe this will set up tremendous opportunity for medium and longer-term players to be stepping in and buying bitcoin into the dip. |

| LMAX Digital metrics | ||||

|

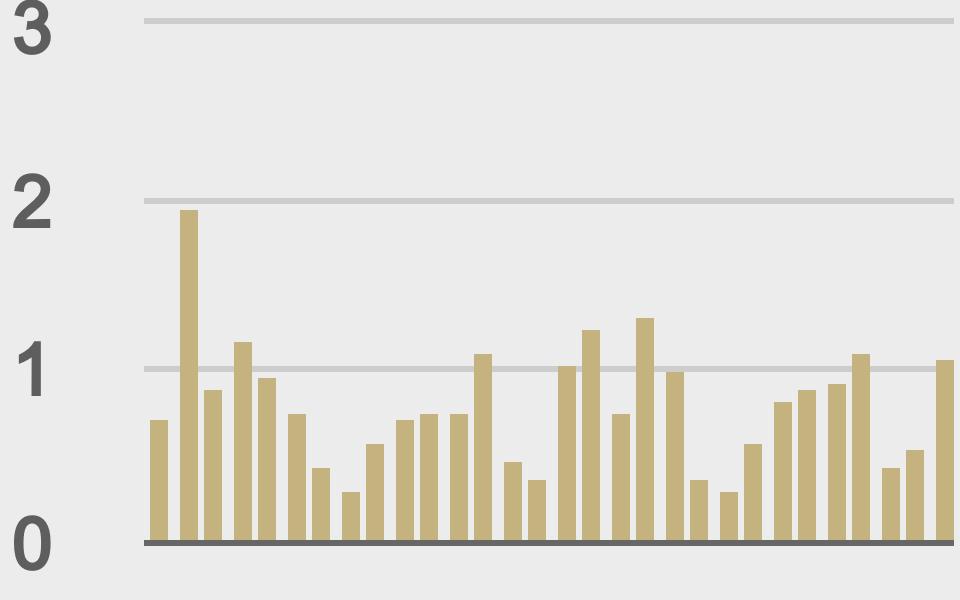

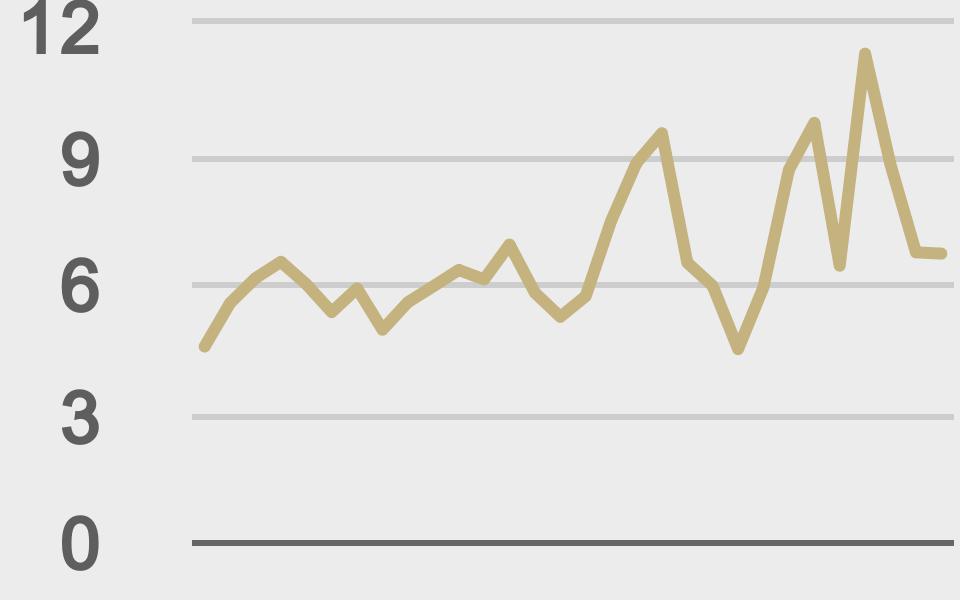

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@KaikoData |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||