|

| 15 September 2025 Crypto holds firm on soft dollar and rising tokenization buzz |

| LMAX Digital performance |

|

Total notional volume from last Monday through Friday came in at $2.89 billion, relatively unchanged from the week earlier. Breaking it down per coin, bitcoin volume came in at $1.4 billion, 4% higher than the previous week. Ether volume came in at $906 million, 13% lower than the week earlier. Total notional volume over the past 30 days comes in at $15.1 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,686 and average position size for ether at $3,517. Bitcoin volatility continues to consolidate off yearly low levels. ETH volatility has been in cool down mode since mid-August when it traded to its highest level since December 2021. We’re looking at average daily ranges in bitcoin and ether of $2,411 and $184 respectively. |

| Latest industry news |

|

Crypto markets are holding firm, with bitcoin edging higher toward key resistance near recent highs and Ethereum broadly following. The price action has been helped by a modest improvement in risk appetite across equities and a softening dollar. Broader trading volumes have been somewhat light, reflecting a wait-and-see stance ahead of upcoming central bank meetings, but the underlying bid has hinted at continued institutional interest. A major talking point has been fresh reporting that BlackRock is exploring ways to make exchange-traded funds available as tokens on the blockchain. According to Bloomberg, tokenization could allow trading beyond traditional Wall Street hours, simplify global access to US products, and create new forms of collateral for crypto networks. Market participants have interpreted the news as another step toward the normalization of crypto within mainstream finance, reinforcing BlackRock’s pivotal role in bringing digital assets into the asset-management fold and adding a structural prop to bitcoin’s medium-term narrative. This momentum has also been echoed by Nasdaq’s reported request to regulators to permit trading of tokenized versions of stocks on its exchange. Such a move would mark one of the first material tests of blockchain technology within the core of US equity markets and, if approved, could accelerate the convergence of traditional and digital market infrastructures. For crypto traders, this is another sign that tokenization of traditional assets is moving from concept to implementation, potentially enlarging the universe of blockchain-settled instruments and supporting the case for Bitcoin and Ethereum as base-layer collateral. Traditional macro drivers have also shaped sentiment. Global equity indices have gained on hopes of an eventual easing of monetary policy, while the US dollar has eased, lending support to risk assets including crypto. Overall, the confluence of constructive macro signals and structural blockchain adoption stories is helping sustain a positive bias as markets look ahead to key policy meetings and regulatory decisions. |

| LMAX Digital metrics | ||||

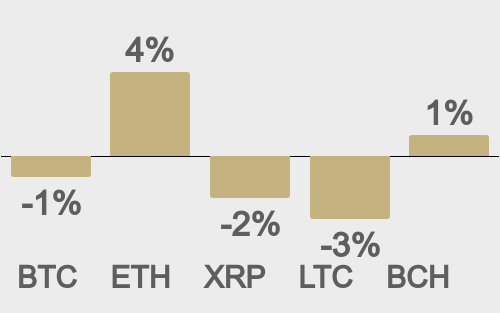

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

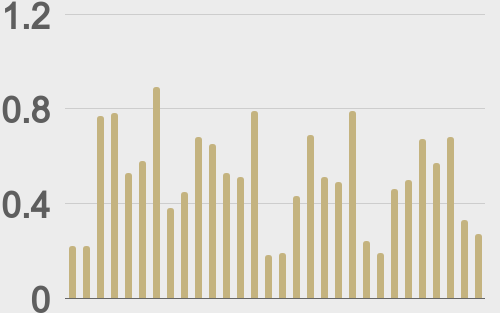

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

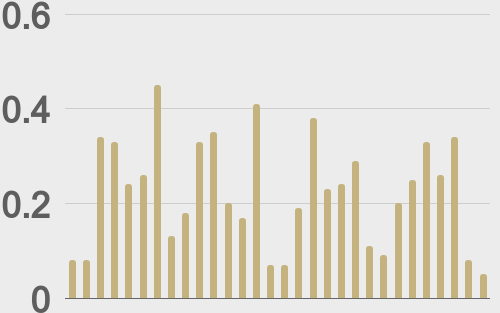

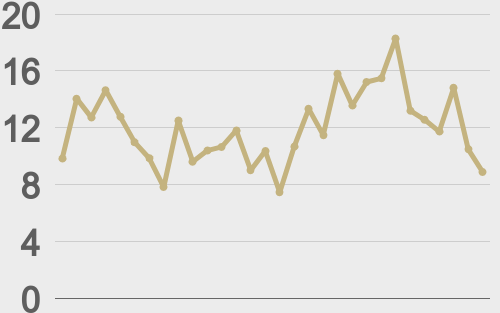

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

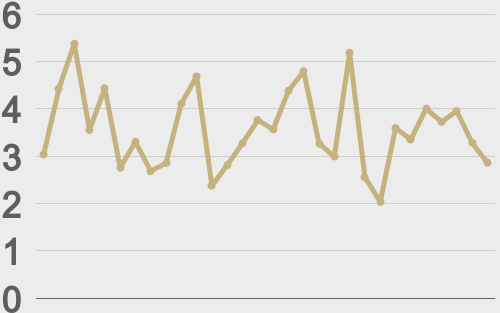

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||