|

| 29 October 2025 Crypto holds ground ahead of Fed decision |

| LMAX Digital performance |

|

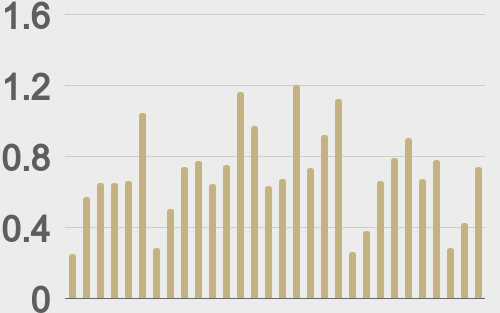

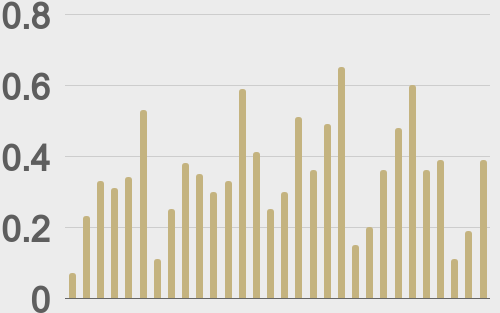

LMAX Digital volumes saw a nice jump on Tuesday. Total notional volume came in at $740 million, 7% above 30-day average volume. Bitcoin volume printed $391 million, 14% above 30-day average volume. Ether volume came in at $179 million, 4% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $12,657 and average position size for ether at $3,308. Bitcoin and ETH volatility have been in cool down mode following the latest surge. We’re looking at average daily ranges in bitcoin and ether of $3,507 and $210 respectively. |

| Latest industry news |

|

The crypto market is holding up well, with bitcoin trading within a tight range despite several intraday pullbacks. While brief bouts of profit-taking pressure prices lower, the broader tone remains constructive as investors position cautiously ahead of the Federal Reserve’s policy decision. ETH mirrors the move, after coming under another bout of minor pressure before stabilizing on the back of steady network activity and sustained staking demand. We’ve also heard calls from many reputable names in the space talking about a significantly undervalued ETH. Macro conditions provide a generally supportive backdrop, with softer U.S. yields and a range-bound dollar helping to temper downside pressure across risk assets. Equities continue to push record highs as moderating inflation expectations reinforce the view the Fed is nearing the end of its tightening cycle. Flows continue to show healthy participation, though we are seeing some caution ahead of today’s Fed meeting. The market is watching the Fed’s tone closely for hints on the timing of eventual rate cuts. A balanced message may keep crypto consolidating at current levels, while a more dovish signal could provide the catalyst for renewed momentum. As a final note, seasonal patterns continue to favor crypto, with October and the broader fourth quarter historically marking periods of strength for Bitcoin and digital assets. With a few trading days left in the month, both bitcoin and ETH remain well positioned to build on this trend and potentially extend gains into the monthly close. |

| LMAX Digital metrics | ||||

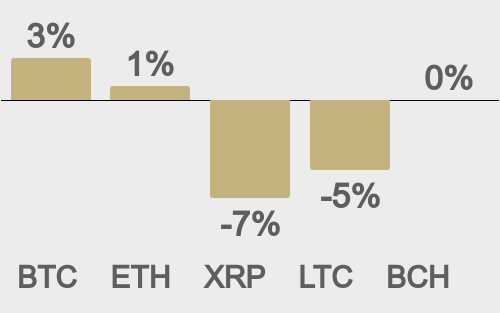

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

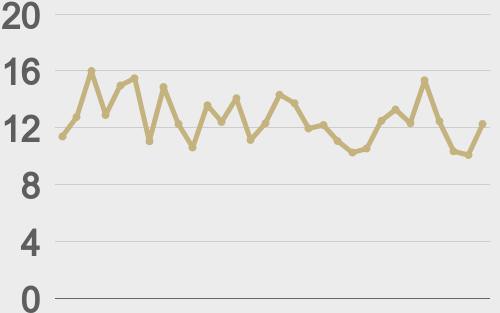

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@iamjosephyoung |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||