|

|

22 November 2022 Crypto market still assessing fallout risk |

| LMAX Digital performance |

|

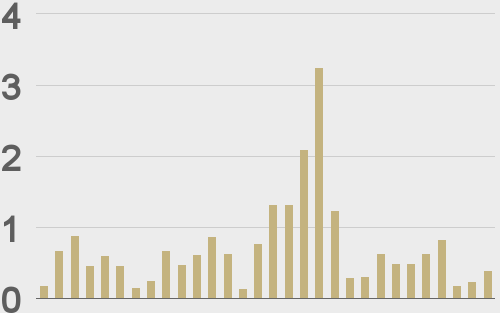

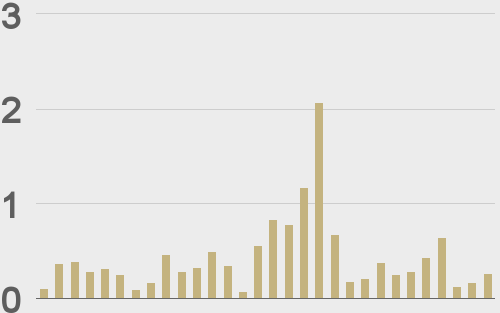

LMAX Digital volumes got off to a slow start this week. Total notional volume for Monday came in at 249 million, 48% below 30-day average volume. Bitcoin volume printed $144 million on Monday, 47% below 30-day average volume. Ether volume came in at $62 million, 60% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,805 and average position size for ether at 2,805. Volatility is showing some signs of life after trading to yearly and multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $803 and $87 respectively. |

| Latest industry news |

|

Crypto assets have been shaken in the aftermath of the FTX implosion and market participants continue to worry about contagion. Adding insult to injury is a wave of hawkish Fed speak, COVID deaths in China, and downside pressure on global equities. At the moment, there is plenty of concern around the status of Digital Currency Group (DCG) and the impact this will have on Genesis, an independent lending desk owned by DCG. Genesis has said it has no plans to file for bankruptcy, but at the same time, clearly there are problems that need to get worked out one way or another. The bigger, systemic risk associated with DCG is that any fallout at subsidiary Genesis could force DCG to liquidate its Grayscale holdings, an event that would likely open more intensified downside pressure on crypto assets. But as of now, this risk is not considered to be a serious threat. Technically speaking, we’ve highlighted the recent breakdown in bitcoin to a fresh yearly low below the previous low at $17,600. This breakdown now opens the door for a measured move downside extension towards $10,000. If this plays out, we would expect to see the price of ether retesting and breaking its yearly low from June at $880. |

| LMAX Digital metrics | ||||

|

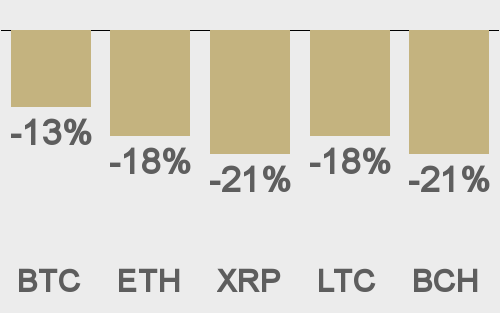

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

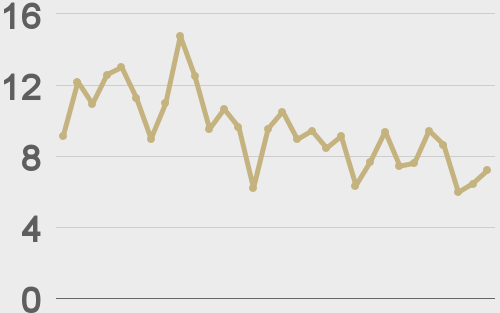

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

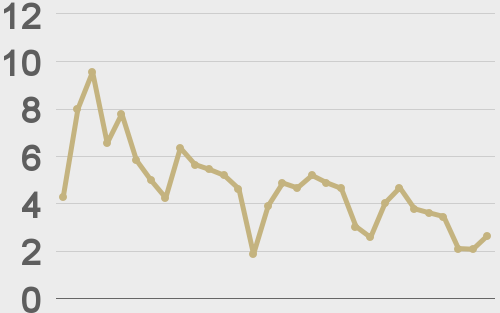

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||