|

|

11 January 2024 Crypto market turns its attention to ETH |

| LMAX Digital performance |

|

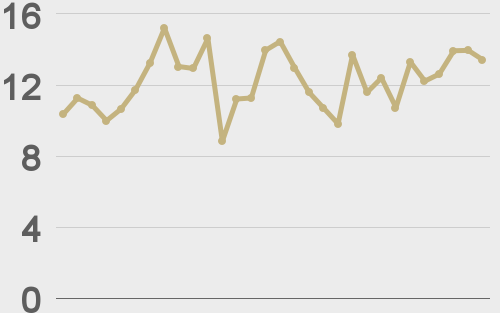

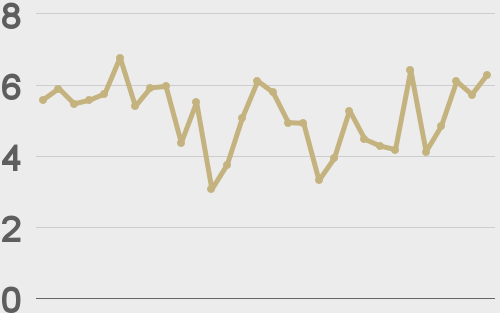

LMAX Digital volumes have been running strong all week. Total notional volume for Wednesday came in at $2.1 billion, 174% above 30-day average volume. Bitcoin volume printed $1.6 billion on Wednesday, 163% above 30-day average volume. Ether volume came in at $405 million, 288% above 30-day average volume. Average position continues to trend up over the past 30 days. We’re seeing average bitcoin position size at $16,978 and average position size for ether at $4,572. Bitcoin and ether volatility have traded up to their highest levels since 2022. We’re looking at average daily ranges in bitcoin and ether of $1,976 and $118 respectively. |

| Latest industry news |

|

Finally, at long last, the SEC has gone ahead and approved the spot bitcoin ETFs. Momentum has however stalled a bit, as a lot of the initial run of gains we were expecting in the immediate aftermath had already come on the back of the SEC’s fake tweet a day earlier. Nevertheless, we don’t expect setbacks to be deep, and we believe the bitcoin market will continue to be exceptionally well supported for additional upside through $50k over the short-term. We do expect there to be a period of multiday consolidation as the market waits for new money to arrive from traditional players. But we don’t believe we’re there just yet and are still looking for that push through the $50k barrier. Technically speaking, as per today’s chart analysis, the rally has stalled out for now just ahead of the March 2022 high. This level guards against the anticipated push through $50k. As per our Wednesday commentary, the primary beneficiary from the news has been ether. Eth has been exceptionally well bid in recent sessions, rallying out from it’s lowest levels against bitcoin since mid-2021. Ether is now up more against the US Dollar than bitcoin over the past 30 days. Clearly the market is looking past this latest round of spot bitcoin ETF approvals, focusing in on all the potential around ETH spot ETF approvals later this year. |

| LMAX Digital metrics | ||||

|

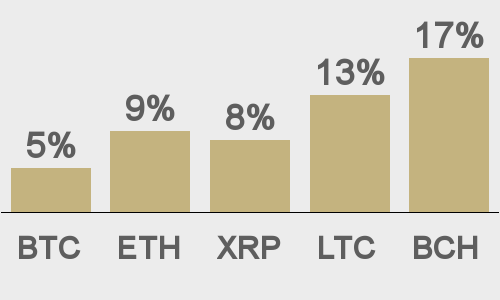

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

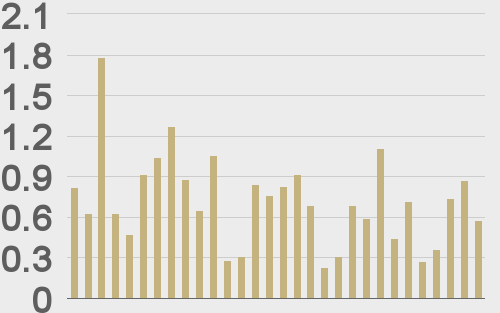

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

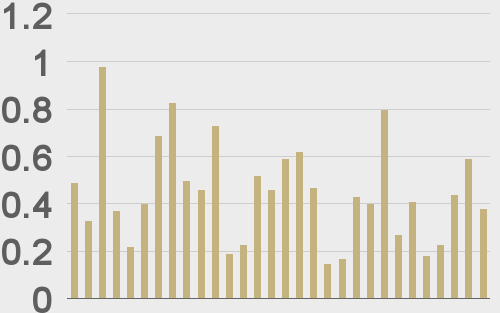

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@CoinDesk |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||