|

|

1 March 2023 Crypto settles flat in February |

| LMAX Digital performance |

|

LMAX Digital volumes were a little softer to close out February. Total notional volume for Tuesday came in at $310 million, 19% below 30-day average volume. Bitcoin volume printed $160 million on Tuesday, 21% below 30-day average volume. Ether volume printed $93 million, 14% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,597 and average position size for ether at 3,000. Volatility has been running up in 2023 off multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $896 and $69 respectively. |

| Latest industry news |

|

As we look back at performance in the month of February, we view price action as constructive overall. While both bitcoin and ether were unchanged on the month, the fact that gains were able to hold up in the aftermath of a rocketship January run is rather encouraging. Remember, bitcoin closed out January up 40%, and ether put in a very impressive +33% performance. We also need to consider the fact that crypto assets managed to outperform most other major traditional assets in February. Currencies were broadly lower against the US Dollar, and US equities put in a bearish monthly close. This adds to the draw of taking on exposure to an asset class that continues to show promise when it comes to offering up an alternative portfolio diversification option. We believe mostly all of the downside from the 2022 crypto fallout has been priced in, which has also helped to reinvigorate investor enthusiasm towards an emerging asset class that many believe to be grossly undervalued. Moreover, a lot of what has helped to drive outperformance in 2023 has been the ongoing wave of institutional adoption. In February alone, we saw many headlines around giants in traditional financial markets looking to take on or increase exposure to the space. Looking ahead, as per our technical insights, it will be important for bitcoin to establish back above $25,200 to reaffirm bullish prospects. Until then, we do worry there could be downside risk over the short-term on account of global macro fundamentals. That is to say, any additional strain on global markets from a further hawkish repricing of Fed rate expectations will likely weigh on global risk assets and could in turn spillover into crypto. On the other hand, should we see evidence in the weeks ahead of peak inflation, particularly in the United States, this could inspire a great deal of confidence in global risk assets, which would then likely translate to increased demand for crypto assets. As far as crypto specific fundamentals go, it will be important to continue to monitor developments on the regulatory front and to watch to see how updates unfold with respect to upgrades to the technologies around both the Bitcoin and Ethereum blockchains. |

| LMAX Digital metrics | ||||

|

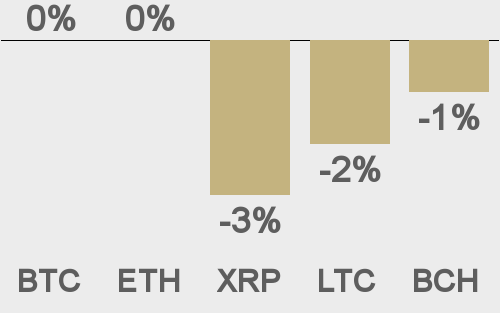

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

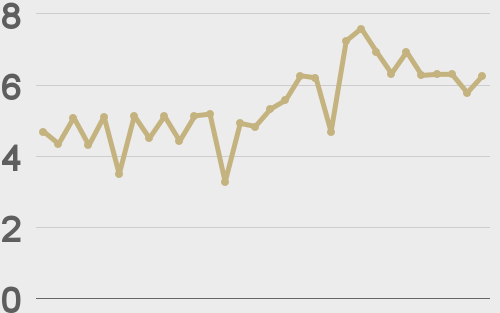

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@crypto |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||