|

|

6 March 2023 Crypto shaken up on banking woes |

| LMAX Digital performance |

|

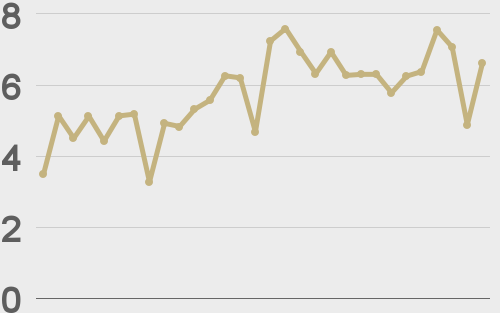

Total notional volume at LMAX Digital cooled off in the previous week. Total notional volume from last Monday through Friday came in at $2 billion, 23% lower than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.1 billion in the previous week, 29% lower than the week earlier. Ether volume came in at $543 million, 17% lower than the week earlier. Total notional volume over the past 30 days comes in at $11.3 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $5,914 and average position size for ether at $3,030. Volatility has come off recent highs but still sits well off multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $773 and $62 respectively. |

| Latest industry news |

|

Last week, crypto markets took a hit on crypto specific fundamentals, and we’ll have to wait and see if there is more spillover in the new week. The big headlines were around Silvergate insolvency concerns, with many exchanges forced to sever operations with the struggling institution. This led to more worry about the future prospects for crypto off ramp solutions in the US. At the same time, there is also plenty of concern around the outlook for Fed rate policy and just how much more rates will need to go higher before finally peaking out. All of this points to the potential for more risk off flow in markets in 2023, which could then spill over into crypto assets. On a positive note, while we did see some spillover from the Silvergate implosion, Signature Bank has stepped in, agreeing to take on clients like LedgerX and Coinbase. Technically speaking, we had also warned, irrespective of the already mentioned fundamentals, that there could be room for a decent pullback in the days and weeks ahead after bitcoin stalled out into critical resistance above $25k. The next big level of support to keep an eye on is the February low at $21,365. A break below there would likely expose a deeper drop back towards a retest of $20k. |

| LMAX Digital metrics | ||||

|

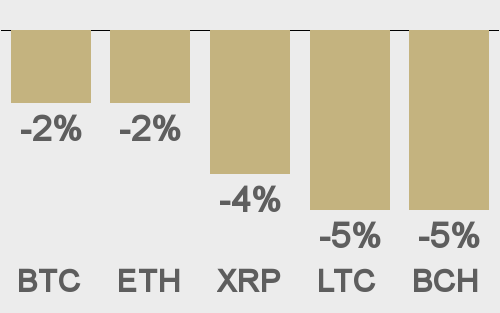

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

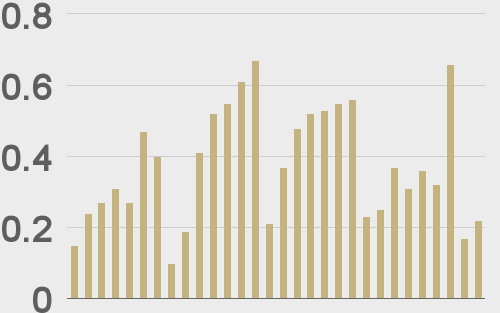

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

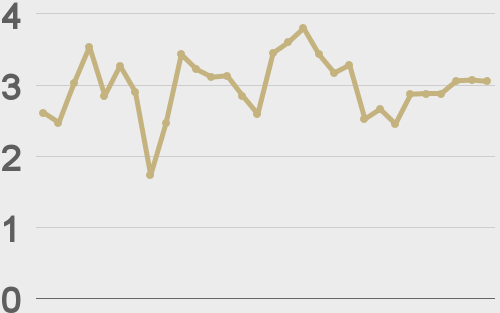

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@CoinDesk |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||