|

|

21 May 2025 Crypto shines as bitcoin defies equity dip |

| LMAX Digital performance |

|

LMAX Digital volumes cooled off from Monday’s robust levels but were still healthy overall. Total notional volume for Tuesday came in at $459 million, 3% above 30-day average volume. Bitcoin volume printed $221 million, 1% above 30-day average volume. Ether volume came in at $113 million, 10% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,528 and average position size for ether at $2,288. Bitcoin volatility continues to be rather subdued, just off recent yearly low levels, while ETH volatility has nearly doubled since bottoming out earlier this month. We’re looking at average daily ranges in bitcoin and ether of $2,834 and $156 respectively. |

| Latest industry news |

|

Bitcoin is powering the crypto market this week, eyeing record highs, undeterred by a pullback in U.S. equities. This resilience highlights bitcoin’s allure as an uncorrelated asset, attracting investors seeking portfolio diversification. Bullish sentiment is reinforced by the U.S. Senate’s advancement of the GENIUS Act for stablecoin regulation, which cleared a procedural hurdle with bipartisan support. A Senate floor debate is imminent, though a final vote may occur after the Memorial Day recess, marking progress toward a robust regulatory framework. Institutional enthusiasm is also propelling the rally, with bitcoin ETF inflows exceeding $40 billion, bolstering market confidence. Many well-regarded analysts in the space believe bitcoin could climb to $210,000–$250,000 by year-end, driven by declining volatility and mainstream adoption, including Coinbase’s S&P 500 inclusion. Meanwhile, the narrative of bitcoin as a hedge against U.S. debt concerns is gaining momentum as it gets attention on CNBC. At the same time, El Salvador’s ongoing bitcoin gains further fuel optimism, positioning the market to absorb short-term volatility with ease. Finally, ongoing pressure from the market for more Fed rate cuts and a pro-crypto stance from the Trump administration further add to the positive outlook. Overall, the dynamic environment underscores bitcoin and the broader crypto asset class potential to sustain its upward trajectory on the back of solid fundamentals. |

| LMAX Digital metrics | ||||

|

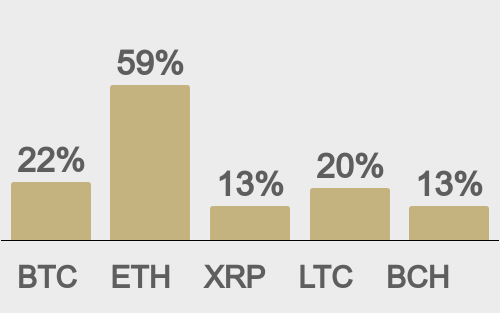

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

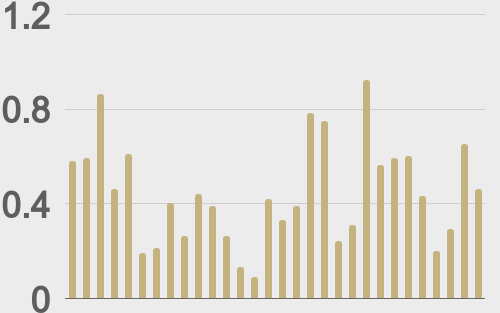

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

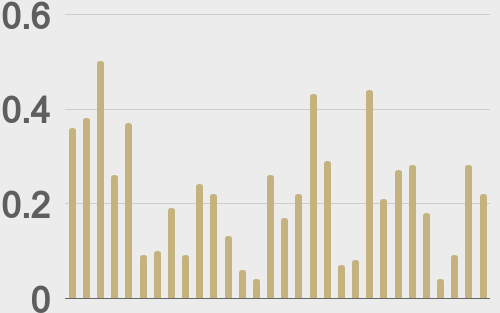

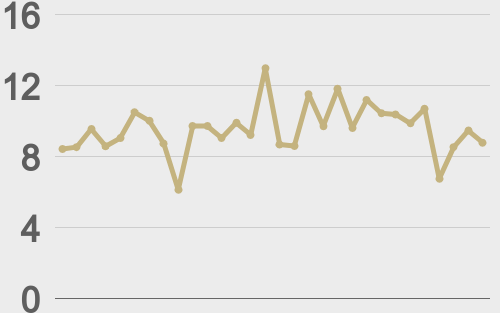

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

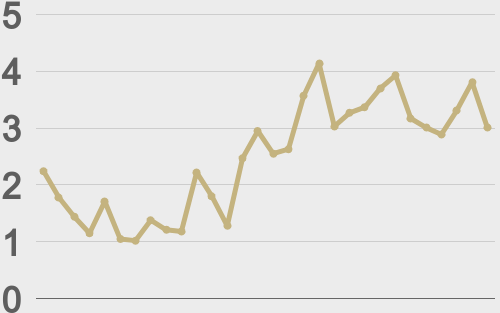

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||