|

|

| Crypto still exposed to deeper setbacks |

| LMAX Digital performance |

|

LMAX Digital volumes continue to come off following a record breaking month in May. This is consistent with the drop in volume in the broader market. Weekend total notional volume at LMAX Digital averaged $709 million, down from $784 million the previous weekend. Weekend Bitcoin volume averaged $420 million, down from $460 million in the previous weekend. Ether volume was also off from the previous weekend average volume of $197 million, coming in at $182 million. Total notional volume at LMAX Digital over the past 30 days comes in at $43.6 billion. Average trading size for Bitcoin came in at $7,621 over the weekend. Average trading size for Ether came in at $3,383 over the weekend. The average daily trading range for BTCUSD is $3,074. The average daily trading range for ETHUSD is $256. |

| Latest industry news |

|

News of more Chinese mine closures and additional regulatory scrutiny has been sourced as some of the driver of this latest weakness in crypto markets. While longer-term, the movement out of China should be seen as a positive for decentralization, in the short-term, the drop in the hash rate is causing a disruption for the market. Of course, there are other factors at play when looking at this latest wave of downside pressure. These include technical reasons, with the market in a bearish consolidation and failing to break out to the topside in the latest attempt. Structural concerns are at play as well, with many talking about the failure of a stable coin. Others cite a general slowdown in retail demand for the weakness we’re seeing. But we would also attribute weakness in the crypto space to fallout from the Fed decision in the previous week. When considering the short-term dynamics in markets, there is still a view that Bitcoin is a maturing, emerging asset, which therefore shares correlations with risk correlated assets. As investor sentiment wanes in the aftermath of the more hawkish Fed outlook, so does sentiment towards crypto assets. Of course, we see Bitcoin being very well supported into dips, with setbacks seen very well supported down towards $20,000 as medium and longer-term players are happy to scoop up the asset on it longer term value proposition. |

|

LMAX Digital metrics |

||||

|

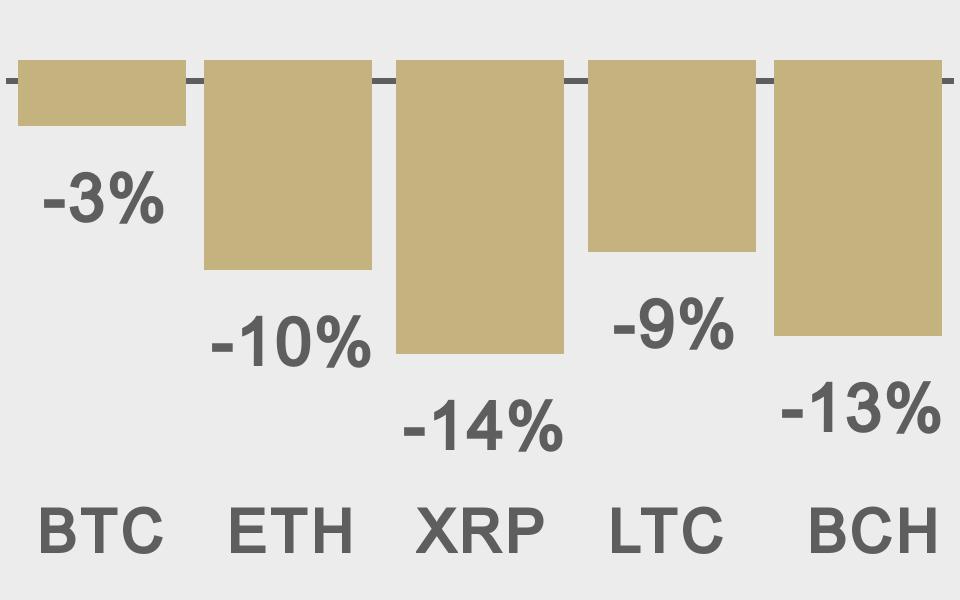

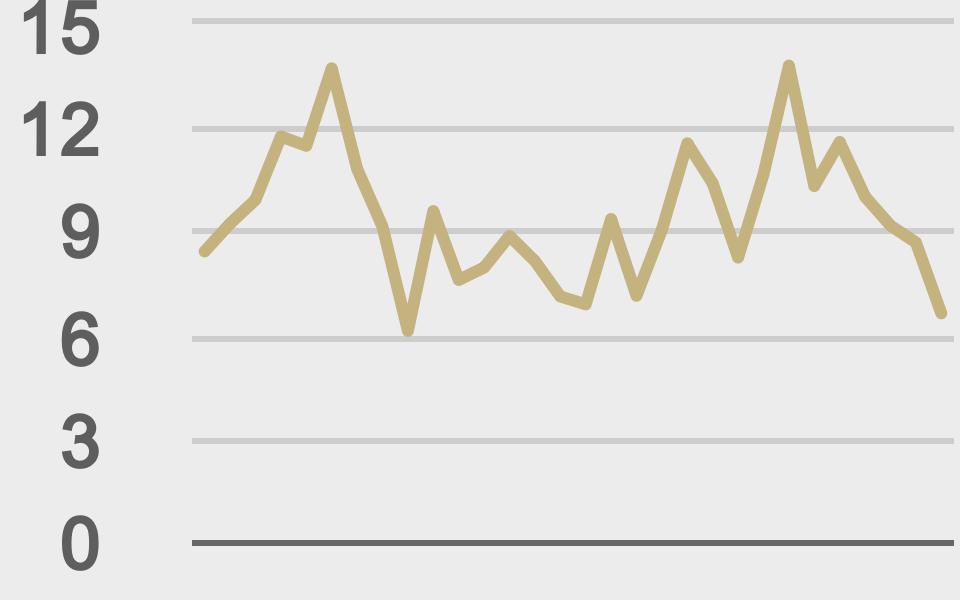

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

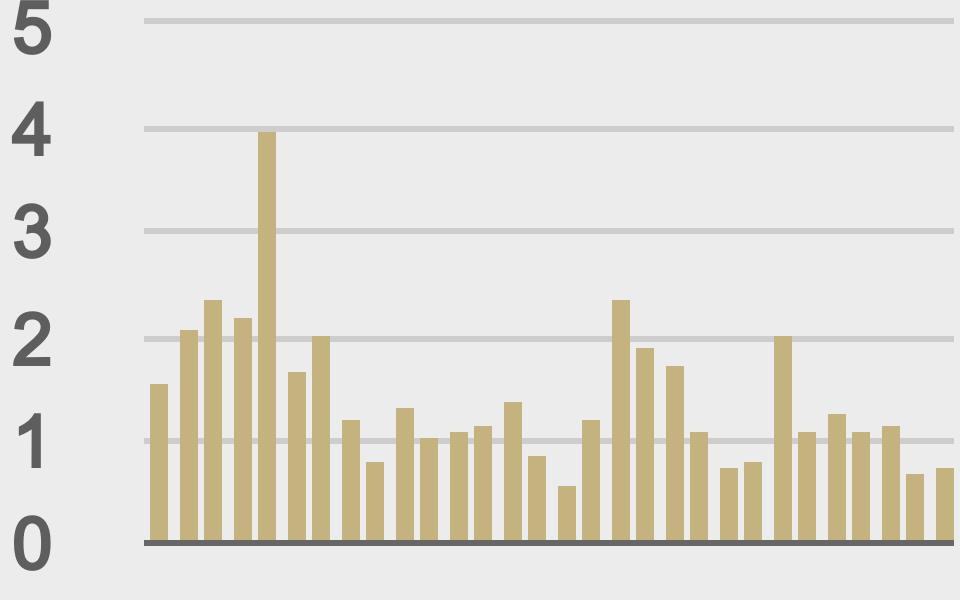

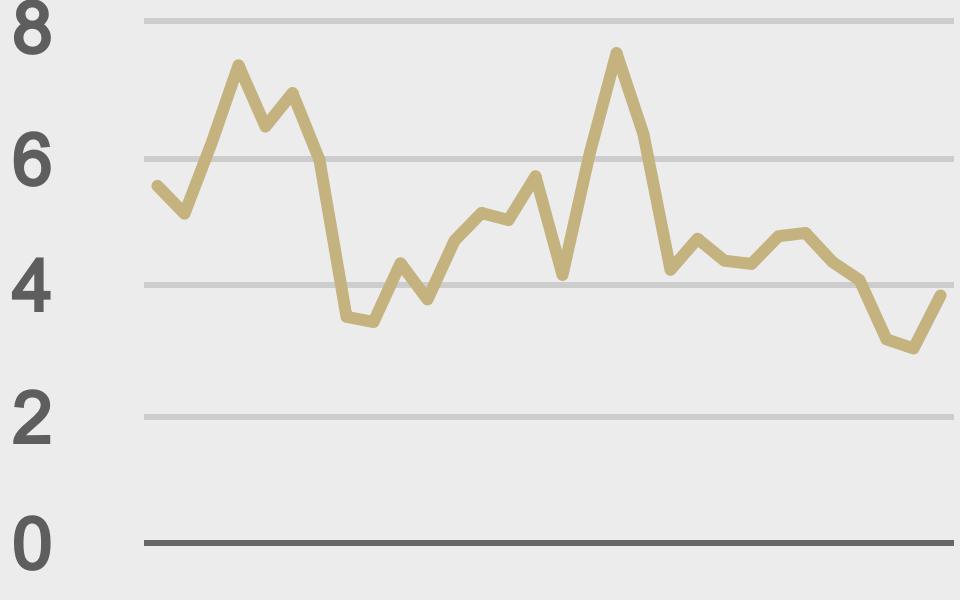

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

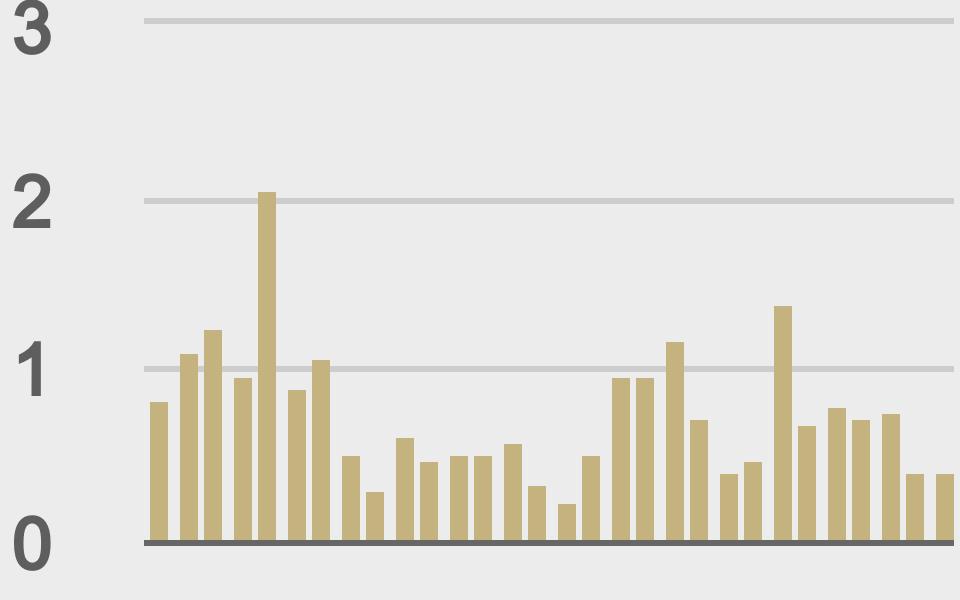

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@DocumentingBTC |

||||

|

@jpurd17 |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||