|

| 22 May 2025 Crypto surges as bitcoin defies global headwinds |

| LMAX Digital performance |

|

LMAX Digital volumes for Wednesday came in at $835 million, 84% above 30-day average volume. Bitcoin volume printed $492 million, 121% above 30-day average volume. Ether volume came in at $174 million, 66% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,570 and average position size for ether at $2,330. Bitcoin volatility has turned up but is still tracking just off recent yearly low levels, while ETH volatility has nearly doubled since bottoming out earlier this month. We’re looking at average daily ranges in bitcoin and ether of $3,012 and $156 respectively. |

| Latest industry news |

|

Bitcoin has surged to a new all-time high, surpassing its January 20 record, lifting the broader crypto market, driven by robust institutional interest, advancing regulatory clarity, and strong market fundamentals. Recent supportive factors include Texas passing SB 21 to establish a state bitcoin reserve, Coinbase’s S&P 500 inclusion, and the U.S. Senate advancing the GENIUS Act for stablecoin regulation. Technically, bitcoin’s new record high solidifies this year’s low as the next higher low in a strong uptrend, setting the stage for a projected rally toward a measured move target of $145,000. Bitcoin has also demonstrated strong resilience against global macro headwinds, brushing off Moody’s U.S. credit downgrade, U.S. fiscal deficit worries, rising Treasury yields after a poorly received $16 billion 20-year bond auction, and heightened geopolitical tensions. With a 10-day realized volatility lower than the S&P 500’s, bitcoin showcases stability amid traditional market turbulence. Meanwhile, high stablecoin liquidity on exchanges further reinforces its role as a potential hedge against global uncertainties. On-chain data shows minimal selling pressure, with large holders accumulating, providing a solid price floor for bitcoin. Record ETF inflows in 2025 bolster the market’s strong bullish outlook, sustaining upward momentum. Overall, favorable regulatory progress, rising institutional adoption, and growing recognition of bitcoin’s value proposition should continue to drive optimism, ensuring crypto’s resilience even amidst persistent global macro and geopolitical risks. |

| LMAX Digital metrics | ||||

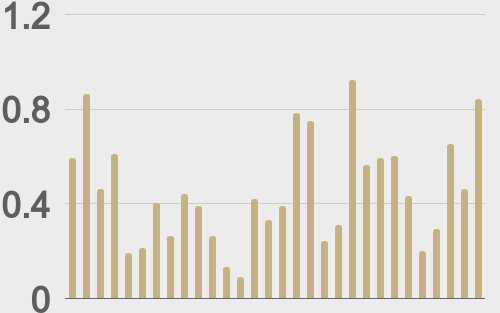

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

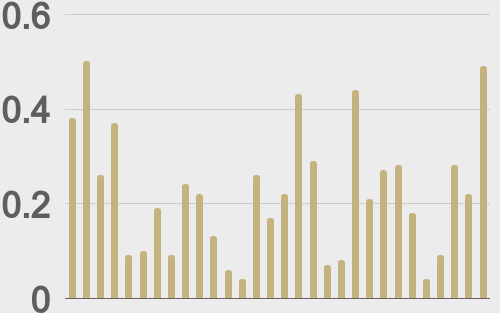

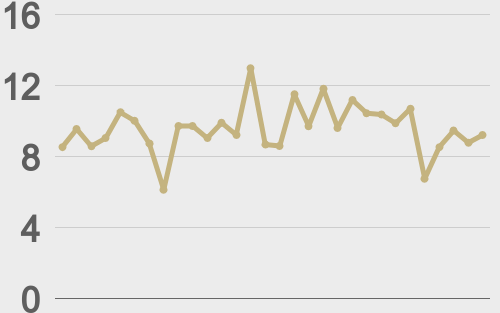

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||