|

|

8 November 2022 Crypto takes hit on industry specific risk |

| LMAX Digital performance |

|

LMAX Digital volumes got off to a decent start this week. Total notional volume for Monday came in at 405 million, 15% above 30-day average volume. Bitcoin volume printed $207 million on Monday, 10% above 30-day average volume. Ether volume came in at $129 million, 1% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $6,704 and average position size for ether at 2,852. Volatility is showing some signs of life after trading to yearly and multi-month lows. We’re looking at average daily ranges in bitcoin and ether of $670 and $81 respectively. |

| Latest industry news |

|

The good news for the crypto market right now is that risk assets have been better bid in recent sessions, which has helped to offset fallout from industry specific risk associated with speculation around FTX solvency. Things heated up over the weekend when Changpeng Zhao, CEO of Binance announced his organization would be selling off all of its holdings of FTX’s FTT token. FTX has since attempted to dispel liquidity concerns, though with the market in a panic, FTT token outflows have persisted. Adding insult to injury is FTX backlash resulting from firm head Sam Bankman-Fried’s proposals around crypto regulation, and a Coindesk story claiming a good portion of FTX capital is tied up in its own token. All of this comes in the aftermath of blowups in the space earlier in the year (Luna, Celsius), leaving many FTX holders unsettled and highly concerned about a similar fate for FTX, thereby resulting in client fund withdrawals from FTX, a run on the token price, and some contagion into the rest of the market. It will be interesting to see how things play out over the coming sessions and market participants will be keeping a close eye on this story, while also contending with US mid-term election risk and US inflation data due later in the week. Technically speaking, the fallout has been well contained, with both bitcoin and ether still confined to familiar ranges, despite this recent downside pressure. |

| LMAX Digital metrics | ||||

|

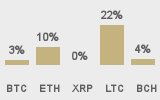

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

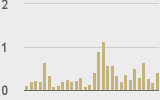

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

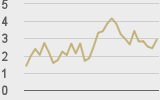

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||