|

|

17 July 2023 Crypto volumes see nice jump in previous week |

| LMAX Digital performance |

|

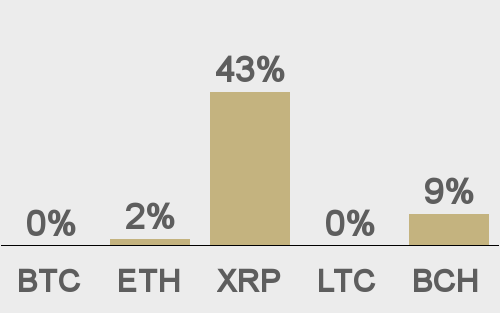

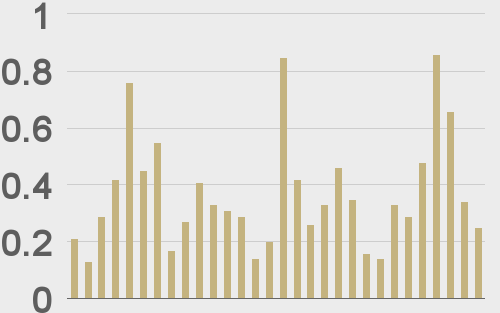

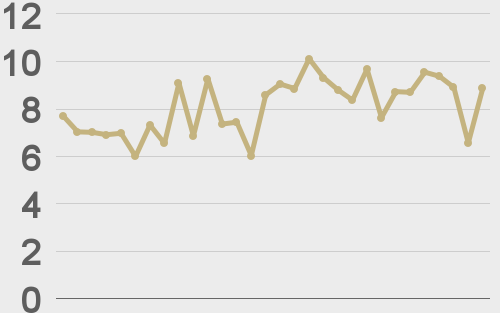

Last week, we saw a healthy pickup in total notional volume at LMAX Digital. Total notional volume from last Monday through Friday came in at $2.6 billion, 43% higher than the week earlier. Breaking it down per coin, Bitcoin volume came in at $1.6 billion in the previous week, 49% higher than the week earlier. Ether volume came in at $613 million, 23% higher than the week earlier. Total notional volume over the past 30 days comes in at $11.1 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,047 and average position size for ether at $2,874. Volatility has been trending lower in July after an impressive surge in June. We’re looking at average daily ranges in bitcoin and ether of $873 and $62 respectively. |

| Latest industry news |

|

All of the positive momentum from last week’s news of the partial victory for Ripple Labs in its case against the SEC has faded away and crypto markets are pretty much back to trading at levels where we were trading ahead of the news. Still, the news was a victory for the space, even if a partial one, which we believe should ultimately prove supportive of the market into dips. Look no further than the price of XRP itself, which has clearly held onto most of the gains seen from the court ruling. Ultimately, the broader crypto market remains confined to a consolidation, and we will be looking for that consolidation to get broken to the topside to open the door for a bullish continuation. We continue to use bitcoin as a proxy for overall direction, and as such, will be looking for a push back through last week’s high (2023 high) at $31,870 to trigger the next big bull run. The focus will quickly shift back to updates from the ETF front, and when exactly we get that approval for a bitcoin ETF. If a BlackRock ETF gets approved, this will likely serve as the fundamental catalyst for a fresh wave of bullish sentiment. Another potentially supportive development comes from the monetary policy outlook at the Fed. Recent economic data has been supportive of the idea that the Fed will soon pause, inviting a more investor friendly environment, something that could be beneficial to crypto assets. As far as today goes, there has been some downside pressure on crypto, perhaps on fallout in global markets from softer China data. Some have also talked about problems over at Binance, though we believe any such fallout should mostly be isolated to Binance itself. Looking ahead, it will be important to monitor price action in US equities, especially if what looks to be an overcooked market starts to show signs of a more aggressive pullback. We’ll also be looking out for any positive updates from the ETF front. |

| LMAX Digital metrics | ||||

|

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

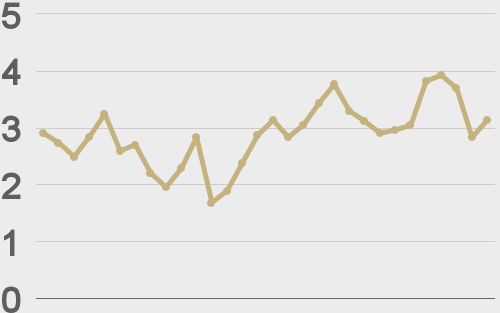

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||