|

|

10 April 2025 Dollar’s dip, bitcoin’s lift – a policy-driven edge |

| LMAX Digital performance |

|

LMAX Digital volumes were impressive on Wednesday. Total notional volume for Wednesday came in at $1.1 billion, 138% above 30-day average volume. Bitcoin volume printed $586 million on Wednesday, 153% above 30-day average volume. Ether volume came in at $173 million, 134% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,179 and average position size for ether at $2,464. Volatility has been trending up over the past few sessions. We’re looking at average daily ranges in bitcoin and ether of $4,010 and $141 respectively. |

| Latest industry news |

|

Bitcoin’s correlation with US equities may have garnered excessive attention, while its ties to Federal Reserve policy and the US dollar’s trajectory deserve greater scrutiny. Market dynamics are shifting as the Fed’s outlook adjusts to pressures from US trade policy, with expectations of steeper rate cuts in 2025 now taking hold. This pivot toward a more accommodative stance is poised to narrow yield differentials, weakening the dollar’s appeal and, in turn, creating a supportive tailwind for bitcoin. The asset’s fundamentals further bolster the bullish outlook. Bitcoin operates as a decentralized, trustless system, facilitating peer-to-peer transactions without intermediaries. Secured by a transparent, immutable blockchain and capped at an extremely limited supply, it naturally draws demand from investors seeking an alternative store of value—an appeal that deepens as adoption grows over time. Though still a young and evolving asset, bitcoin is often lumped with emerging markets and risk-sensitive investments. Yet, as it matures and demonstrates resilience, its linkage to traditional risk assets is likely to fade. This evolution underscores a broader shift in how its value is perceived. Against this backdrop, bitcoin appears well-positioned to trend higher through year-end, even if US equities face further downside. The Fed’s policy path and the dollar’s response could amplify this divergence, casting bitcoin’s unique value proposition into sharper relief. In short, while equity correlations may linger in the narrative, bitcoin’s interplay with monetary policy and its structural strengths suggest a compelling case for sustained upside, independent of broader market turbulence. |

| LMAX Digital metrics | ||||

|

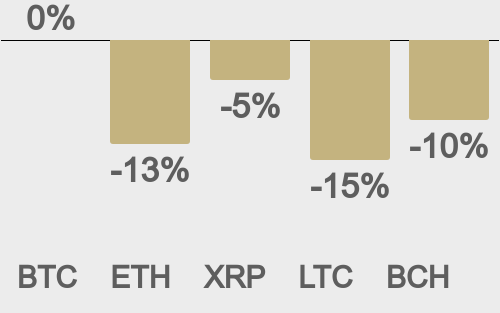

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

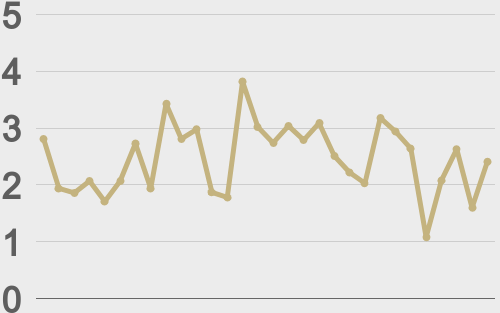

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||