|

|

24 July 2024 ETH ETFs well received on first day |

| LMAX Digital performance |

|

LMAX Digital volumes saw a big jump on Tuesday. Total notional volume for Tuesday came in at $573 million, 61% above 30-day average volume. Bitcoin volume printed $280 million on Tuesday, 45% above 30-day average volume. Ether volume came in at $204 million, 85% above 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $9,251 and average position size for ether at $4,645. Market volatility is finally showing signs of turning back up after trending lower since March. We’re looking at average daily ranges in bitcoin and ether of $2,314 and $136 respectively. |

| Latest industry news |

|

On balance, the first day of ETH ETF trading in the US proved to be a healthy success. Much like with the bitcoin ETFs, the market was expecting healthy outflows from Grayscale’s costly fund. But this was more than offset by inflows from the other funds to result in net inflows of $110 million. There is also reason to believe the Grayscale outflows will be mitigated by the fact that Grayscale has introduced an Ethereum Mini Trust, offering some of the most competitive rates in the US market. Another notable stat from Tuesday trading was the pickup in overall volume, helped by ETH ETF volume that crossed over $1 billion. Many market participants were worried about appetite for the new ETH ETFs and these same market participants have been relieved to see performance expectations exceeded. Looking ahead, the market will continue to monitor appetite for the ETH ETFs, while getting ready for the Bitcoin Conference, which kicks off tomorrow and runs through the weekend. Donald Trump is expected to deliver an uber crypto friendly address at the conference, with some even speculating the Presidential candidate will talk about the United States putting bitcoin on the Treasury’s balance sheet. The other big news story around the conference is the chatter that Vice President Harris has been in talks to make an appearance. This suggests the Democrats recognize the opportunity in warming up to crypto, which could pave the way for increased appetite for crypto assets overall. |

| LMAX Digital metrics | ||||

|

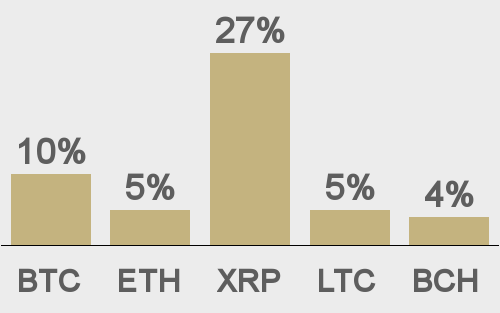

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@BTCTN |

||||

|

@BTCTN |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||