|

| 9 December 2025 ETH outperforms on staking ETF optimism |

| LMAX Digital performance |

|

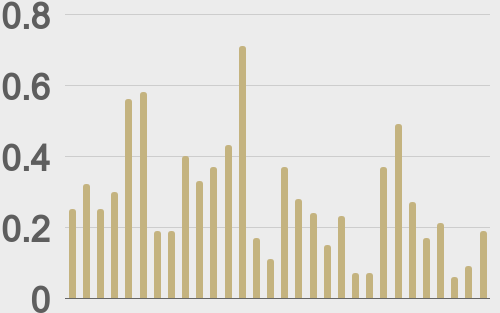

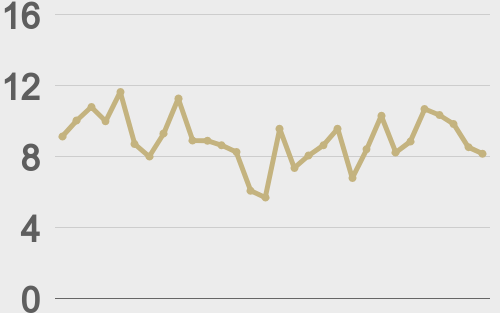

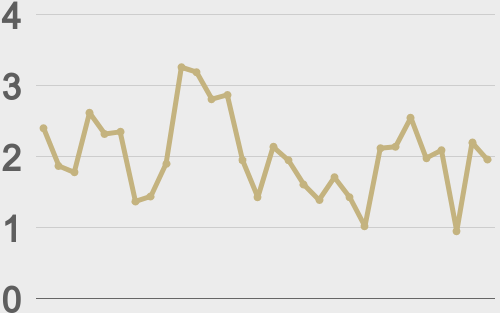

LMAX Digital volumes got off to a slow start this week. Total notional volume for Monday came in at $321 million, 32% below 30-day average volume. Bitcoin volume printed $194 million, 31% below 30-day average volume. Ether volume came in at $64 million, 41% below 30-day average volume. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $8,950 and average position size for ether at $2,109. Bitcoin and ETH volatility have been in cool down mode since peaking in October. We’re looking at average daily ranges in bitcoin and ether of $3,518 and $175 respectively. |

| Latest industry news |

|

Bitcoin has drifted a little lower over the past 24 hours as near-term profit taking caps upside, while ETH has outperformed on the back of improving regulatory expectations and renewed optimism around ETF-related inflows, particularly tied to the prospect of staking-enhanced products attracting incremental institutional demand. BlackRock has moved to file with the SEC to add staking functionality to a proposed Ethereum ETF. The development revives optimism around ETH-focused inflows and the prospect of yield-bearing crypto products reaching a broader investor base. While regulatory timelines remain uncertain, the headline has added more support to ETH’s relative stability versus bitcoin. Institutional flows continue to be a key underpinning for sentiment, even as price action pauses. Michael Saylor’s Strategy disclosed the purchase of an additional 10,624 BTC for roughly $963 million, reinforcing the long-term accumulation narrative among corporate and institutional holders. Such buying has provided a structural bid for bitcoin, helping to limit downside despite a more cautious short-term trading environment. From a macro perspective, crypto assets continue to take cues from traditional markets, where risk appetite has been tempered by lingering uncertainty around global growth, central-bank policy, and geopolitical tensions. Equity markets have been choppy, and higher real yields remain a headwind for speculative assets, encouraging a more selective approach across risk markets, including digital assets. Taken together, the last 24 hours reflect a market digesting strong institutional headlines against an unsettled macro backdrop. While near-term momentum has slowed, the combination of ongoing corporate bitcoin accumulation and incremental progress on crypto ETFs suggests medium-term fundamentals remain supportive. |

| LMAX Digital metrics | ||||

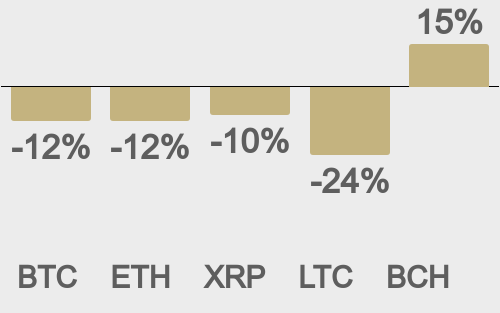

| Price performance last 30 days avg. vs USD (%) |

||||

|

||||

| Total volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD volumes last 30 days ($bn) |

||||

|

||||

| BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

| ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

@TheBlock__ |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||