|

|

19 February 2024 Ether at highest level since May 2022 |

| LMAX Digital performance |

|

Total notional volume at LMAX Digital was impressive in the previous week. Total notional volume from last Monday through Friday came in at $3 billion, 32% higher than a week earlier. Breaking it down per coin, bitcoin volume came in at $1.7 billion in the previous week, 30% higher than the week earlier. Ether volume came in at $961 million, 41% higher than the week earlier. Total notional volume over the past 30 days comes in at $11.4 billion. Looking at average position size over the past 30 days, we’re seeing average bitcoin position size at $11,673 and average position size for ether at $3,491. Volatility has been trending back to the topside after cooling off from the January peak. We’re looking at average daily ranges in bitcoin and ether of $1,518 and $97 respectively. |

| Latest industry news |

|

Sentiment in the crypto market is running high in 2024 and we continue to see signs of demand picking up. The approval of the bitcoin ETFs has opened the door for mass adoption and inflow numbers have ramped up. Last week, we saw the largest single day of inflows since the launch in January. Some $10 billion of new money has come to the bitcoin market through these ETF funds since inception in January. There is every expectation that the demand will continue, especially with these funds ramping up education and promotion efforts around bitcoin as an investment. The run in bitcoin has spilled over into optimism throughout the rest of the crypto market as well. Ether has actually been outperforming bitcoin in recent sessions, trading to its highest level against the Buck since May 2022. We believe the market recognizes the value proposition of Ethereum as a hub for innovation in web 3 technology. As the projects on Ethereum become more developed, they will become more user friendly and ultimately will show themselves as providing a more seamless experience than the web 2 experience. Ether is also a more risk correlated investment. This translates to outperformance relative to bitcoin in times of healthy global investor risk appetite. And at the moment, with US equities running at record highs, it makes sense to see added demand for ether. The market is also pricing in the approval of ether spot ETFs later in the year, which will give traditional market investors access to ether exposure. As far as bitcoin goes, now that we’re trading above $50k, the next target is the record high from 2021 up at $69k. Setbacks should be very well supported on dips into the 45k area. |

| LMAX Digital metrics | ||||

|

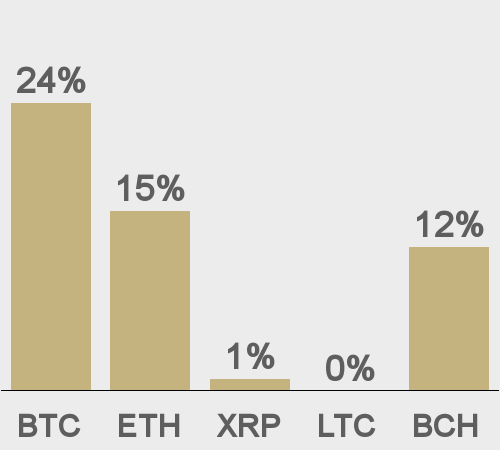

Price performance last 30 days avg. vs USD (%) |

||||

|

||||

|

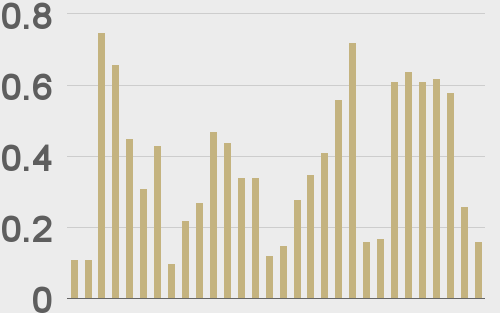

Total volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD volumes last 30 days ($bn) |

||||

|

||||

|

BTCUSD avg. trade size last 30 days ($k) |

||||

|

||||

|

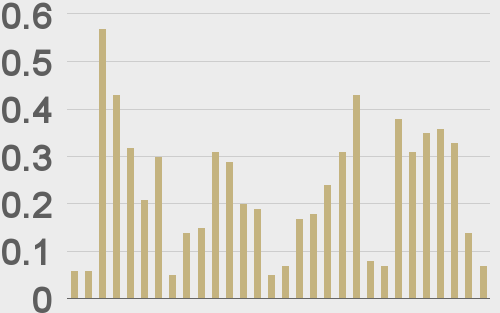

ETHUSD avg. trade size last 30 days ($k) |

||||

|

||||

| Average daily range | ||||

|

||||

|

||||

|

|

||||

|

@crypto |

||||

|

@TheBlock__ |

||||

| Crypto Bulletin sign-up | ||||

| Subscribe | ||||